Not everyone is losing out, however. Some traders are reportedly profiting from the country’s distressed debt

, as Russia faced unprecedented economic sanctions in response to its invasion of Ukraine, a sovereign default seemed likely. America and its Western allies had frozen roughly half of the country’s $630bn. Firms such as JPMorgan Chase and MSCI had removed Russian debt from widely tracked bond indices. Investors had begun writing down the value of their assets, which were trading at distressed levels.

Now a default—which would be its first foreign-currency default since 1917—seems all but inevitable. Although Russia’s finance ministry has continued to make payments on its foreign-currency debt, it has only done so thanks to an exemption granted by America’s Treasury Department allowing investors to receive debt payments through American banks until May 25th. On April 4th, in the wake of reported atrocities against civilians in Ukraine, the Treasury said it would start blocking such payments.

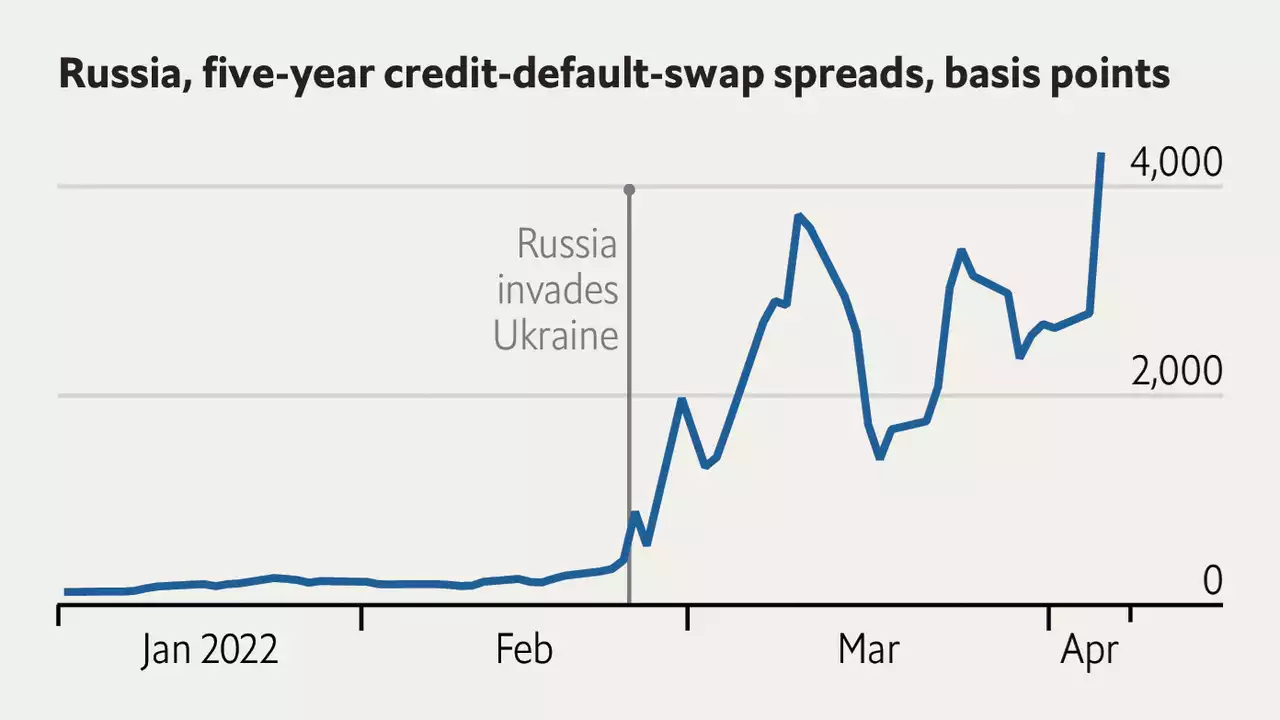

The news sent CDS spreads soaring once more. According to data provided by IHS Markit, a research firm, the cost of insuring Russia’s government debt for five years hit 4,300 basis points on April 5th, up from 2,800 the day before . This means it now costs $4.3m to insure $10m of the country’s securities for five years. Russian bond prices, meanwhile, are tumbling. A bond maturing in 2028 is trading at 34 cents on the dollar; another maturing in 2042 is fetching just 28.

The size of a default would be relatively small, by historical standards . The Russian government owes $40bn in foreign-currency debt, of which around half is held by foreign investors. But as Carmen Reinhart, the chief economist of the World Bank, recently pointed out, the exposure of non-bank institutions—such as hedge funds—to Russia is still unknown.

Bondholders may struggle to recover their money. As Jay Newman, a former hedge-fund manager, has written, Russia has declined to waive its sovereign immunity from lawsuits, limiting their ability to sue in the event of default. Their only recourse may be to ask courts for permission to seize Russian sovereign assets—such as ships or foreign-exchange., a financial-news magazine, reports that Barclays, a bank, has made $50m trading the securities.

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Putin troops 'rape teen sisters' as women cut off hair to look 'less attractive'RUSSIAN troops have raped two teenage sisters in Ivankiv, while women are 'cutting their hair short' to look less attractive to Vladimir Putin's soldiers, a Ukrainian official recounted in tears.

Putin troops 'rape teen sisters' as women cut off hair to look 'less attractive'RUSSIAN troops have raped two teenage sisters in Ivankiv, while women are 'cutting their hair short' to look less attractive to Vladimir Putin's soldiers, a Ukrainian official recounted in tears.

Read more »

Ukraine War: Kremlin spokesman Peskov admits 'significant' Russian lossesKremlin spokesman Dmitry Peskov called the Russian casualty rate a 'huge tragedy' for the country.

Ukraine War: Kremlin spokesman Peskov admits 'significant' Russian lossesKremlin spokesman Dmitry Peskov called the Russian casualty rate a 'huge tragedy' for the country.

Read more »