Its coffers depleted, the Treasury will flood the market with bills

The Treasury general account—the government’s main account at the Federal Reserve, used for official payments—fell to just $23bn at the start of June, far less than the amount of net spending on a typical day. Normally the Treasury tries to maintain a balance of at least $500bn, enough to cover about a week of cash outflows. Thus its task is to rebuild buffers by selling bills and bonds . At the same time, it will have to sell even more paper to finance the government’s deficit.

The concern is where the money will come from and, in particular, if debt sales will drain liquidity from other asset markets. There are two main possible sources of cash, and each poses risks. The first is money-market funds, which are flush at the moment, with more than $5trn invested in them. In principle, these funds could hoover up the bulk of the new bills by simply paring the cash they place at the Federal Reserve via its reverse-repurchase facility.

The second option is less attractive still. Firms, pension funds and other investors may wind up being the biggest buyers of bills, which would mean moving money out of deposits into Treasuries, reducing the level of bank reserves in the financial system. Banks are sitting on excess reserves of about $3trn; it would not take much for these to fall to $2.5trn, a level seen by many as indicating reserve scarcity .

A brief encounter with reserve scarcity would not necessarily spell disaster. The Fed could provide liquidity support if required. And to the extent that money-market funds buy up more bills, pressure on bank reserves would be reduced. Either way, however, the flood of Treasury issuance will almost certainly add to market anxiety and volatility, increasing the risk that something, somewhere breaks. It is one more thing to dislike about America’s perennial debt-ceiling convulsions.

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Two alarming books on the power of America’s Supreme Court“The Shadow Docket” by Stephen Vladeck is the first book to pull back the curtain on a less visible way the court is twisting the constitution

Two alarming books on the power of America’s Supreme Court“The Shadow Docket” by Stephen Vladeck is the first book to pull back the curtain on a less visible way the court is twisting the constitution

Read more »

Britain and America hail new 'special relationship' after signing 'Atlantic declaration' economic agreementThe leaders announced a new economic partnership that will see greater cooperation between the UK and US on matters relating to AI, data protection and civil nuclear power.

Britain and America hail new 'special relationship' after signing 'Atlantic declaration' economic agreementThe leaders announced a new economic partnership that will see greater cooperation between the UK and US on matters relating to AI, data protection and civil nuclear power.

Read more »

Regulators put the future of America’s crypto industry in doubtWhen Taylor Swift was courted to invest in FTX, a now defunct crypto exchange, she reportedly balked: “Can you tell me that these are not unregistered securities?” American regulators are now asking similar questions

Regulators put the future of America’s crypto industry in doubtWhen Taylor Swift was courted to invest in FTX, a now defunct crypto exchange, she reportedly balked: “Can you tell me that these are not unregistered securities?” American regulators are now asking similar questions

Read more »

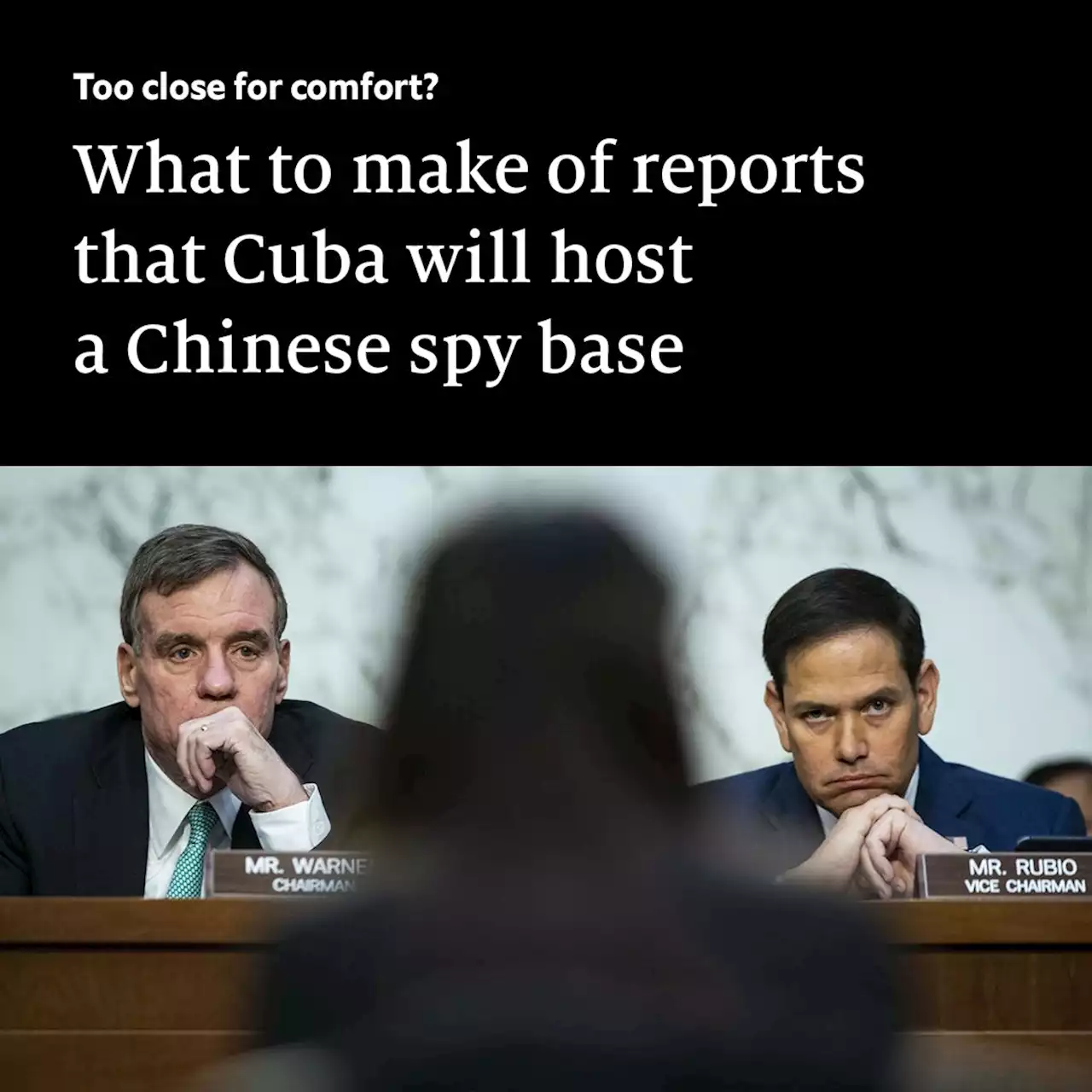

What to make of reports that Cuba will host a Chinese spy baseThe strategic significance of such an agreement remains unclear. But China hawks in America are outraged:

What to make of reports that Cuba will host a Chinese spy baseThe strategic significance of such an agreement remains unclear. But China hawks in America are outraged:

Read more »

GMA star Sam Champion's controversial look goes back over ten years – find out moreThe Good Morning America meteorologist divides fans with his choice of footwear

GMA star Sam Champion's controversial look goes back over ten years – find out moreThe Good Morning America meteorologist divides fans with his choice of footwear

Read more »