What will that mean for the economy?

has rested on three pillars: a healthy labour market, falling inflation and robust spending fuelled by savings accumulated during the pandemic. This last pillar may be starting to give way. Research by Hamza Abdelrahman and Luiz Oliveira of the Federal Reserve Bank of San Francisco suggests that Americans have burned through more than 90% of the “excess savings” they amassed in 2020 and 2021. What little remains, the economists estimate, is likely to be gone by the end of September.

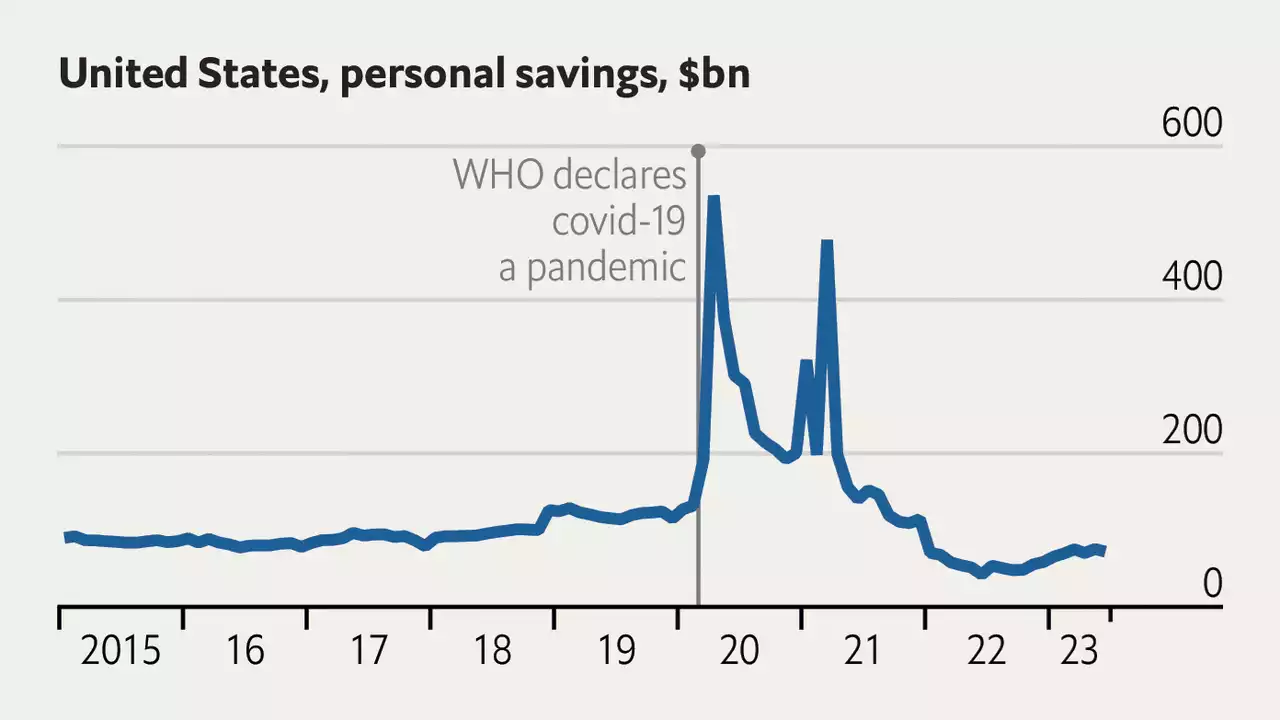

During the pandemic stimulus cheques and other government support boosted personal incomes by more than $1trn, while lockdown restrictions reduced Americans’ spending by another $1trn. As a result, monthly personal savings swelled from around 9% of income in 2019 to more than 30% in the spring of 2020, and 20% during the Alpha and Delta waves of the pandemic the next year.

But data from the Bureau of Economic Analysis, a government agency, show that by June 2022 America’s personal-savings rate had plummeted to just 2.7%. Although the rate has ticked up slightly since then—in June households squirrelled away 4.3% of their incomes—it remains well below pre-pandemic levels. There are signs that a growing number of households are financially stretched.

But when Americans’ pandemic savings will run out is a subject of debate. Although the forecast by Messrs Abdelrahman and Oliveira shows that excess savings could be depleted by the end of next month, economists at the Federal Reserve Board estimate that they were already exhausted in the first quarter of this year. By contrast, analysts at Goldman Sachs, a bank, reckon that there is little reason to think that households will ever get through their excess savings completely .

What is not in question is that Americans have spent down their cash reserves. Messrs Abdelrahman and Oliveira find that this has happened faster than after previous recessions, and the drawdown has taken place across all income groups . At the same time, the stockpile of excess savings may matter less than it used to. For the first time in a few years nominal wage increases for most Americans have started eclipsing the rate of inflation.

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

LEGO just announced the location of its new Boston officesThe LEGO Group on Monday announced the location of its new Boston offices. The company announced in January that it was planning to move its head office in the Americas from Connecticut to Boston. But until now the exact location had remained a mystery. The LEGO Group said 1001 Boylston Street has been chosen as the location of its Americas…

LEGO just announced the location of its new Boston officesThe LEGO Group on Monday announced the location of its new Boston offices. The company announced in January that it was planning to move its head office in the Americas from Connecticut to Boston. But until now the exact location had remained a mystery. The LEGO Group said 1001 Boylston Street has been chosen as the location of its Americas…

Read more »

Get £160 off an iPhone 14 ahead of Apple's iPhone 15 launchThere are big savings to be made on iPhone 14 and iPhone 13s

Get £160 off an iPhone 14 ahead of Apple's iPhone 15 launchThere are big savings to be made on iPhone 14 and iPhone 13s

Read more »

Watch: Crowds flee disturbance at kabaddi eventFootage shows people running as loud bangs are heard at a sports event in Derby.

Watch: Crowds flee disturbance at kabaddi eventFootage shows people running as loud bangs are heard at a sports event in Derby.

Read more »

Unassuming village with abandoned mansion and tower-block free views for milesThere's so much to discover beyond the main road running through, including a historic bridge

Unassuming village with abandoned mansion and tower-block free views for milesThere's so much to discover beyond the main road running through, including a historic bridge

Read more »

Nearly half of pensioners could be missing out on £400 or more a year in savings interestOver-65s are more likely than other age group to have large amounts of cash in savings accounts - and many are not taking advantage of the best rates

Nearly half of pensioners could be missing out on £400 or more a year in savings interestOver-65s are more likely than other age group to have large amounts of cash in savings accounts - and many are not taking advantage of the best rates

Read more »