Weaker mining stocks weighed on the Australian sharemarket during the early trading hours on Wednesday as investors started to price in at least one more interest rate hike in April.

The S&P/ASX 200 dipped by as much as 0.9 per cent throughout the morning, and was trading 0.7 per cent lower at 7,310 just after midday.The mining and energy sector was the biggest decliner, with Woodside shares losing 7.5 per cent to $34.79, while market heavyweight BHP declined by 0.5 per cent to $47.71.

CBA Economics said its base case scenario still sees one more interest rate hike in April, taking the cash rate to 3.85 per cent.Citi analysts are also tipping one further rate hike in April, though analyst Josh Williamson noted there was a possibility of additional increases beyond this. That would be a sharp turnaround after it had just slowed its pace of increases to 0.25 percentage points last month from earlier hikes of 0.50 and 0.75 points.

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Whitehaven Coal, New Hope weigh on ASX gainsAustralian shares jumped on Monday, but Whitehaven and Rio Tinto shares came under pressure after China set a modest growth target.

Whitehaven Coal, New Hope weigh on ASX gainsAustralian shares jumped on Monday, but Whitehaven and Rio Tinto shares came under pressure after China set a modest growth target.

Read more »

ASX LIVE: Coal prices sink; Whitehaven falls, Lynas tumbles on Tesla worriesLynas shares sink on demand worries. Shares add 0.7pc. Bond yields, US dollar retreat. Gold climbs. RBA tipped to lift rates Tuesday. Follow updates here.

ASX LIVE: Coal prices sink; Whitehaven falls, Lynas tumbles on Tesla worriesLynas shares sink on demand worries. Shares add 0.7pc. Bond yields, US dollar retreat. Gold climbs. RBA tipped to lift rates Tuesday. Follow updates here.

Read more »

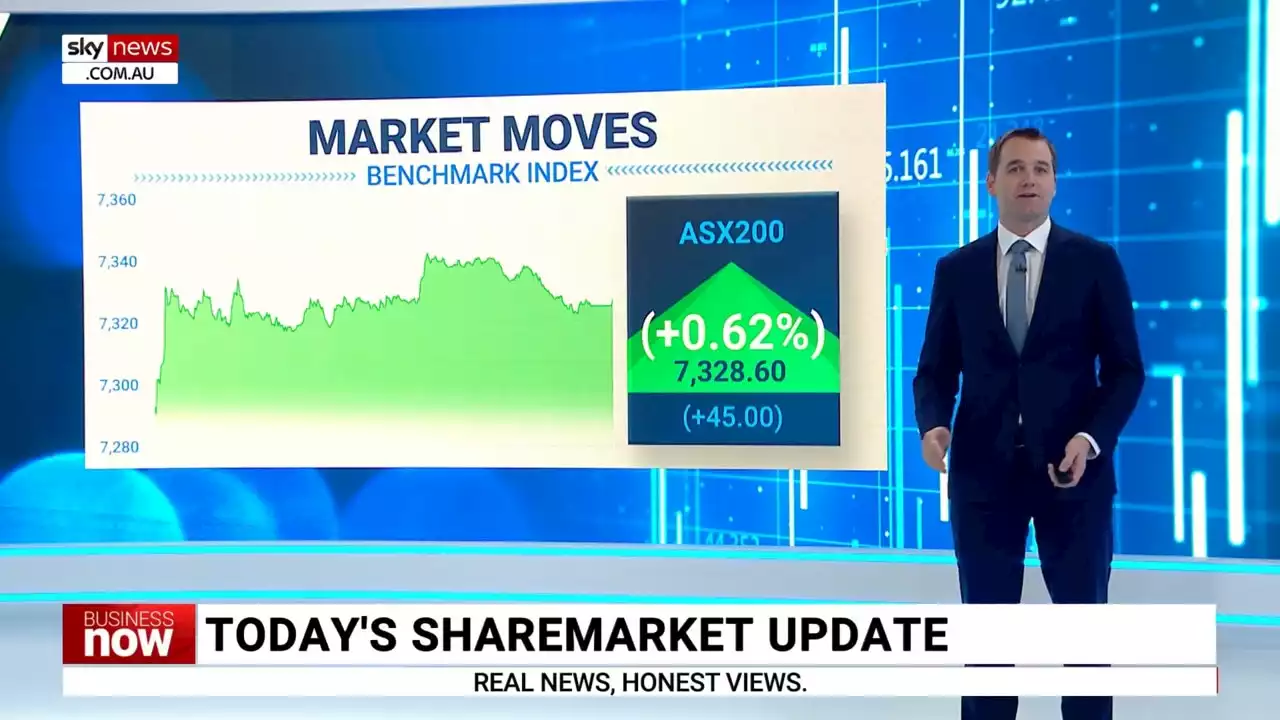

ASX finished the day up by 0.62 per cent on MondayThe ASX finished the day up on Monday rising by 0.62 per cent. The top performers included data centre and cloud computing company Megaport, Xero and HUB24. Monday’s worst performers include Lynas, PolyNovo and Whitehaven coal.

ASX finished the day up by 0.62 per cent on MondayThe ASX finished the day up on Monday rising by 0.62 per cent. The top performers included data centre and cloud computing company Megaport, Xero and HUB24. Monday’s worst performers include Lynas, PolyNovo and Whitehaven coal.

Read more »

ASX rallies 0.5pc after RBA raises ratesThe benchmark Australian share index rose 0.5 per cent to 7364.7 after the Reserve Bank of Australia pulled the trigger on its tenth consecutive rate increase.

ASX rallies 0.5pc after RBA raises ratesThe benchmark Australian share index rose 0.5 per cent to 7364.7 after the Reserve Bank of Australia pulled the trigger on its tenth consecutive rate increase.

Read more »

ASX LIVE: Australian shares slip; Megaport sinks 11pc on CEO resignationAustralian shares are up 0.5pc; RBA lifts cash rate by 0.25pc to 3.6pc; Megaport, ALS CEOs resign; InvoCare soars on TPG bid; Australia trade surplus misses expectations. Follow updates here.

ASX LIVE: Australian shares slip; Megaport sinks 11pc on CEO resignationAustralian shares are up 0.5pc; RBA lifts cash rate by 0.25pc to 3.6pc; Megaport, ALS CEOs resign; InvoCare soars on TPG bid; Australia trade surplus misses expectations. Follow updates here.

Read more »