Bank of England hints economic pain felt by many to be a long, drawn-out affair | EdConwaySky

The Bank of England may have lifted interest rates by less than a lot of people had been expecting up until recently -- but for those with mortgages, the most striking thing from the trove of analysis they've published today isn't about today but about tomorrow.

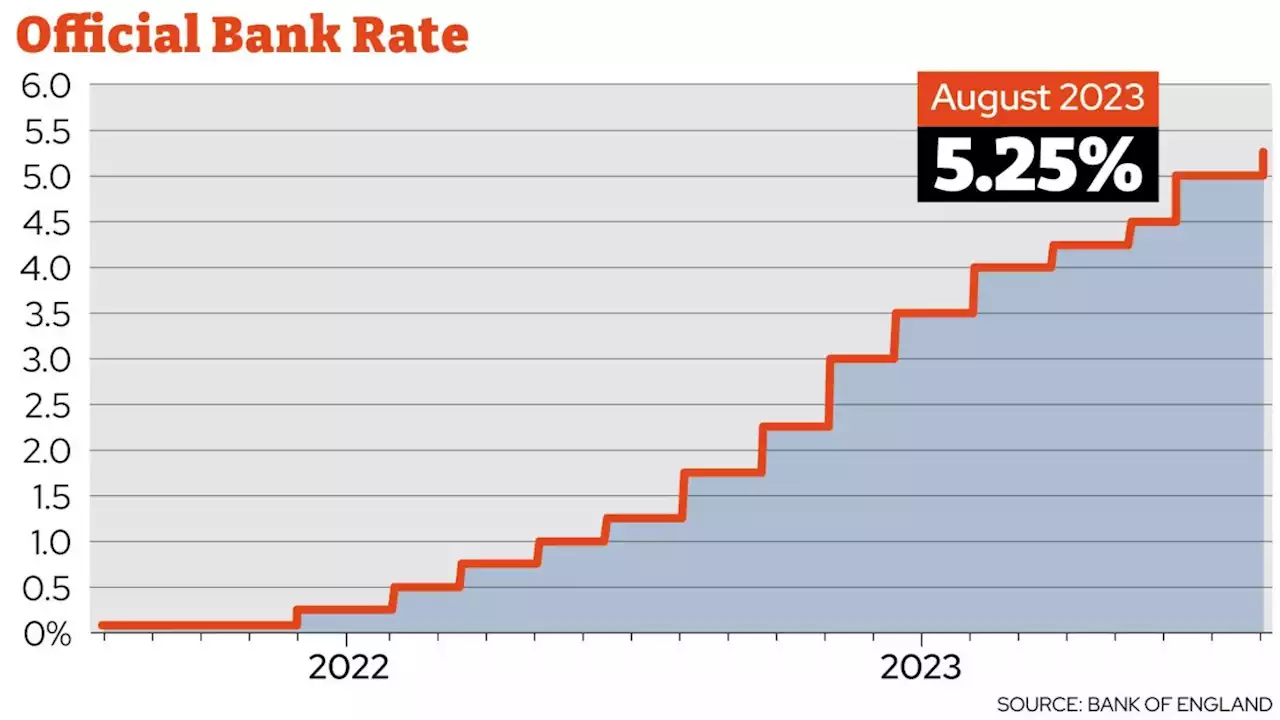

Because there are heavy hints dropped throughout the Bank's Monetary Policy Report that it expects borrowing costs to stay high for a lot longer than many had anticipated.- the official borrowing level set at Threadneedle Street - would be down to 4% by 2024 and 3.7% by 2025. Far higher than the post-financial crisis period but a fall all the same.

Now, those same markets think rates will still be at 5.9% in 2024 and at 5% by 2025. And rather than challenging those assumptions, the Bank has come as close as possible to reinforcing them. This institution doesn't provide explicit guidance about where it's expecting interest rates to go; it prefers to drop hints. And the hint in the minutes alongside the decision today was about as heavy as you could get.

"The [Monetary Policy Committee] would ensure that Bank Rate was sufficiently restrictive for sufficiently long to return inflation to the 2% target sustainably in the medium term, in line with its remit."Why? Another clue is to be found elsewhere in the Bank's forecasts today. It's worth quoting at length:"Sharp increases in energy food and other import prices over the past two years have had second-round effects on domestic prices and wages.

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Sarah Breeden appointed deputy Bank of England governor\n\t\t\tGet local insights from Lisbon to Moscow with an unrivalled network of journalists across Europe,\n\t\t\texpert analysis, our dedicated ‘Brussels Briefing’ newsletter. Customise your myFT page to track\n\t\t\tthe countries of your choice.\n\t\t

Read more »

Bank of England expected to hike interest rate for 14th time in a rowEconomists think a 0.25 percentage point rise to 5.25% is the most likely outcome on Thursday. But there are concerns about the impact of rising rates on many households.

Bank of England expected to hike interest rate for 14th time in a rowEconomists think a 0.25 percentage point rise to 5.25% is the most likely outcome on Thursday. But there are concerns about the impact of rising rates on many households.

Read more »

What time is the Bank of England's August interest rate announcement today?Economists are widely predicting the Bank will raise the base by 0.25 percentage points

What time is the Bank of England's August interest rate announcement today?Economists are widely predicting the Bank will raise the base by 0.25 percentage points

Read more »

Bank of England increases interest rates to 5.25% - what it means for mortgages and savingsThe Bank of England has increased the base rate from 5% to 5.25% this lunchtime, the 14th consecutive rise since December 2021, when rates were just 0.1% Here, CallumCMason examines what a 0.25 percentage point rise means for your money ⬇️

Bank of England increases interest rates to 5.25% - what it means for mortgages and savingsThe Bank of England has increased the base rate from 5% to 5.25% this lunchtime, the 14th consecutive rise since December 2021, when rates were just 0.1% Here, CallumCMason examines what a 0.25 percentage point rise means for your money ⬇️

Read more »

Bank of England increases interest rate for 14th time in a row to 5.25%BREAKING: The Bank of England has increased the base interest rate from 5% to 5.25% in the 14th consecutive hike 📺 Sky 501, Virgin 602, Freeview 233 and YouTube

Bank of England increases interest rate for 14th time in a row to 5.25%BREAKING: The Bank of England has increased the base interest rate from 5% to 5.25% in the 14th consecutive hike 📺 Sky 501, Virgin 602, Freeview 233 and YouTube

Read more »

Mortgage warning for millions as Bank of England hikes interest rates againMILLIONS of homeowners are braced for more mortgage misery as the Bank of England has hiked interest rates to a new 15-year high. The Bank’s Monetary Policy Committee (MPC) has lifted the…

Mortgage warning for millions as Bank of England hikes interest rates againMILLIONS of homeowners are braced for more mortgage misery as the Bank of England has hiked interest rates to a new 15-year high. The Bank’s Monetary Policy Committee (MPC) has lifted the…

Read more »