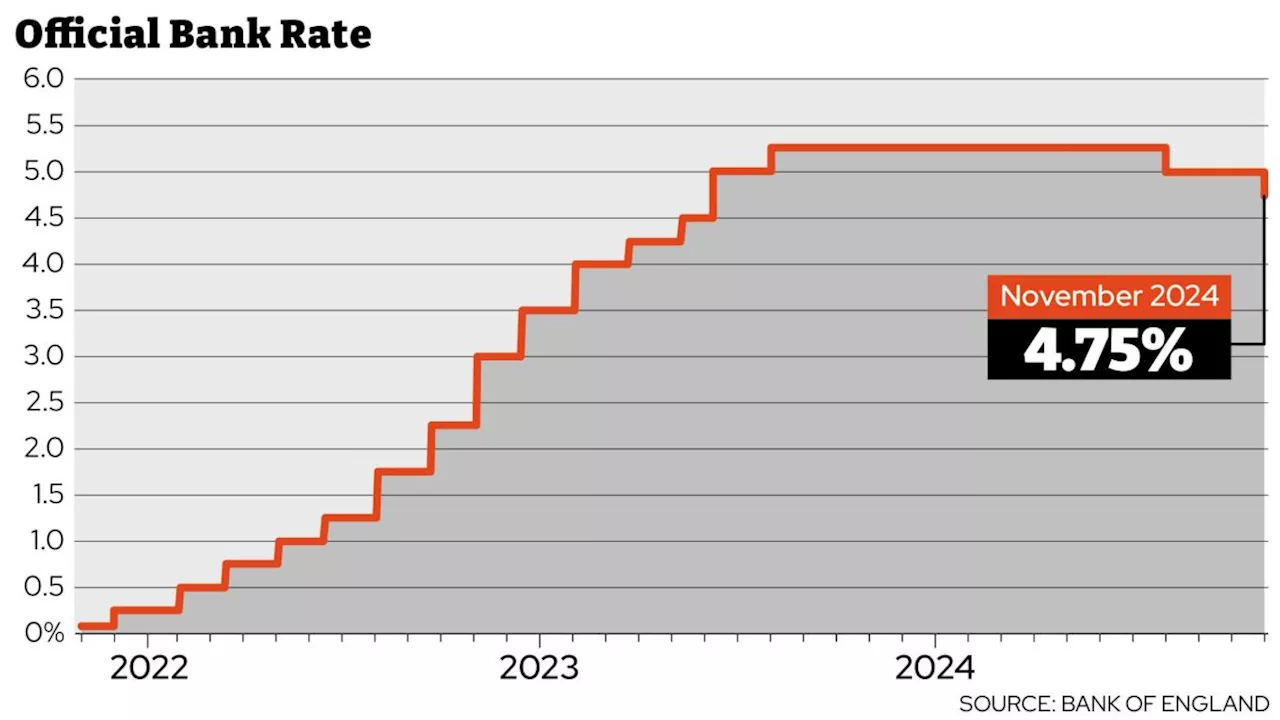

The Bank of England's Monetary Policy Committee has opted to maintain interest rates, defying expectations of a cut. This decision follows a surge in inflation to 2.6% in November, exceeding the Bank's 2% target. The Bank anticipates that inflation will likely persist at elevated levels in the near term.

Interest rates Its Monetary Policy Committee (MPC) decided not to cut the base rate again, a move widely expected by economists.It comes after an inflation reading yesterday showed it rose to 2.6 per cent in November, up from 2.3 per cent, and higher than the Bank’s two per cent target. Chancellor Rachel Reeves said: “I know families are still struggling with high costs.

We want to put more money in the pockets of working people, but that is only possible if inflation is stable and I fully back the Bank of England to achieve that. “Improving living standards across the country is our number one focus, and is why I chose to protect working people’s pay slips from tax rises, froze fuel duty and increased the national living wage for three million people.”Higher inflation means prices are rising quicker than otherwise, and this can prompt the Bank of England to keep interest rates higher for longer.Previously, it was widely thought the next rate cut would come at the first MPC meeting of 2025 in February., three expected four interest rate cuts in 2025, two thought there would be three whilst one more considered there to be two or three. Capital Economics has said it forecasts that rates will continue to be cut gradually, and that they will fall to 3.5 per cent in early 2026. Pantheon Macroeconomics expects interest rate cuts in February, May and November, taking rates to 4 per cent by the end of 2025.Inflation is expected to increase from its current level of 2.6 per cent, experts have said. Paul Dales, chief UK economist at Capital Economics, predicted that inflation would rise to around 2.8 per cent in January. He said: “We do think that by the end of 2025, CPI inflation will have fallen back close to 2 per cent. But in the first half of the year, we suspect it will be a bit higher than most expect.” Thomas Pugh, economist at RSM UK, said: “The rebound in inflation to

Inflation Interest Rates Bank Of England Monetary Policy UK Economy

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Bank of England issues mortgage rate warning to 4.4 million homes and sounds Trump trade alarmThe Bank of England's latest financial stability report - released twice a year - shows 4.4 million homes are set to refinance at higher rates though others will benefit from cuts.

Bank of England issues mortgage rate warning to 4.4 million homes and sounds Trump trade alarmThe Bank of England's latest financial stability report - released twice a year - shows 4.4 million homes are set to refinance at higher rates though others will benefit from cuts.

Read more »

Bank of England Expected to Hold Base RateEconomists predict the Bank of England will keep interest rates steady this week, influenced by the recent Budget and Donald Trump's re-election. While inflation concerns exist, the Budget's stimulative effect and potential future rate cuts are also factors.

Bank of England Expected to Hold Base RateEconomists predict the Bank of England will keep interest rates steady this week, influenced by the recent Budget and Donald Trump's re-election. While inflation concerns exist, the Budget's stimulative effect and potential future rate cuts are also factors.

Read more »

Money blog: Bank of England warns millions of borrowers over mortgage ratesThe Bank of England has warned millions of borrowers they face higher mortgage rates for longer in a report - watch live below as governor Andrew Bailey holds a news conference on the findings.

Money blog: Bank of England warns millions of borrowers over mortgage ratesThe Bank of England has warned millions of borrowers they face higher mortgage rates for longer in a report - watch live below as governor Andrew Bailey holds a news conference on the findings.

Read more »

Bank of England governor backs British Retail Consortium on jobs warning over budgetThere is a 'risk' of unemployment rising due to increases in employers' national insurance contributions and minimum wage rises, according to Andrew Bailey.

Bank of England governor backs British Retail Consortium on jobs warning over budgetThere is a 'risk' of unemployment rising due to increases in employers' national insurance contributions and minimum wage rises, according to Andrew Bailey.

Read more »

Bank of England warns of risks from non-banks in future markets crisisFire sales of assets by pension funds, hedge funds and other investors would amplify impact, says study

Bank of England warns of risks from non-banks in future markets crisisFire sales of assets by pension funds, hedge funds and other investors would amplify impact, says study

Read more »

Bank of England interest rate cut 'unlikely' as expert makes 2025 predictionEconomists are predicting that interest rates will be held next week

Bank of England interest rate cut 'unlikely' as expert makes 2025 predictionEconomists are predicting that interest rates will be held next week

Read more »