The need to borrow in order to cover buybacks isn't necessarily a problem for US oil majors whose debt-to-capital ratios are well below historical averages.

Big Oil Needs to Borrow to Finance Own Share Buybacks - Oil majors have been reporting lower Q3 profits, suggesting that the era of windfall revenues is coming to an end, with the average quarter-on-quarter dip for the five leading companies averaging 12%. - ExxonMobil, Chevron, Shell, TotalEnergies, and BP will earn a combined $24.4 billion in Q3, which leaves all companies except Shell unable to cover their dividends and share buybacks with free cash flow.

- At the same time, expectations for an improving supply and demand balance in 2025 are being pushed back further down the road amidst LNG project delays, with summer 2025 TTF contracts surging to a rare premium over winter 2025-2026. - Hedge funds have benefitted from Europe’s gas volatility, first by ramping up their net long positions to a record high of 268 TWh in early September, then selling it off over the upcoming weeks.

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

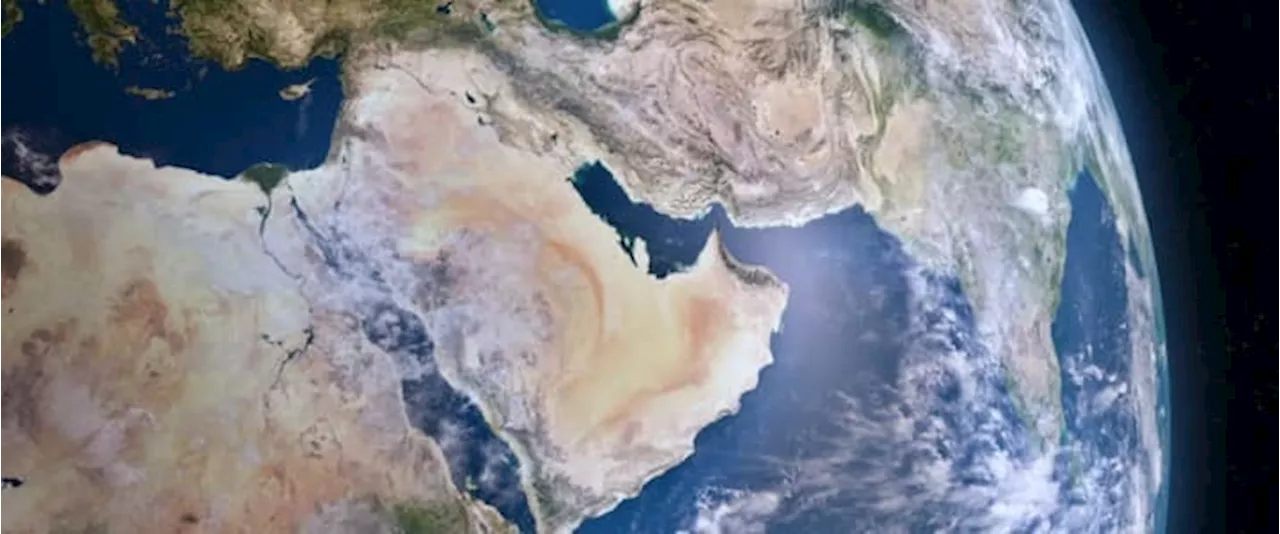

Big Oil Set to Bid in Algeria's New Oil and Gas Licensing RoundAlgeria is launching a new licensing round for its oil and gas sector, attracting interest from major international energy companies.

Big Oil Set to Bid in Algeria's New Oil and Gas Licensing RoundAlgeria is launching a new licensing round for its oil and gas sector, attracting interest from major international energy companies.

Read more »

Scots oil executive demands urgent review Grangemouth oil refinery closure plansSUNDAY MAIL EXCLUSIVE: Gulfsands Petroleum CEO John Bell and former Grangemouth apprentice has joined leading industry figures in calling for government action to save vital national asset.

Scots oil executive demands urgent review Grangemouth oil refinery closure plansSUNDAY MAIL EXCLUSIVE: Gulfsands Petroleum CEO John Bell and former Grangemouth apprentice has joined leading industry figures in calling for government action to save vital national asset.

Read more »

Oil Explodes 4% Amid Talk of Israel Attacking Iranian Oil & GasBenchmark crude oil prices surged well over 4% on Thursday on fears of an Israeli strike that could target Iran's oil and gas infrastructure

Oil Explodes 4% Amid Talk of Israel Attacking Iranian Oil & GasBenchmark crude oil prices surged well over 4% on Thursday on fears of an Israeli strike that could target Iran's oil and gas infrastructure

Read more »

Oil Rises Israel Hints At Attack on Iran's Oil & Gas InfrastructureCrude oil prices rose on continued geopolitical tensions following Iran's 200-missile barrage on Israel.

Oil Rises Israel Hints At Attack on Iran's Oil & Gas InfrastructureCrude oil prices rose on continued geopolitical tensions following Iran's 200-missile barrage on Israel.

Read more »

EIA Slashes Forecasts of Oil Demand Growth and Oil Prices in 2025The U.S. Energy Information Administration lowered its forecast for global oil demand growth in 2025 due to weaker economic outlooks in developed nations, causing a decrease in predicted Brent crude oil prices.

EIA Slashes Forecasts of Oil Demand Growth and Oil Prices in 2025The U.S. Energy Information Administration lowered its forecast for global oil demand growth in 2025 due to weaker economic outlooks in developed nations, causing a decrease in predicted Brent crude oil prices.

Read more »

Australia Tax Overhaul Brings in Billions From Big OilAustralia collected record-high tax revenues from the oil and gas industry in 2022-23 after implementing legislative changes that closed tax loopholes.

Australia Tax Overhaul Brings in Billions From Big OilAustralia collected record-high tax revenues from the oil and gas industry in 2022-23 after implementing legislative changes that closed tax loopholes.

Read more »