The average long-term U.S. mortgage rate fell slightly this week, welcome news for home shoppers facing rising prices and a stubbornly low inventory of properties on the market this spring homebuying season.

A for sale is displayed in front of home in Prospect Heights, Ill., Monday, March 18, 2024. On Thursday, March 28, 2024, Freddie Mac issues its weekly report on long-term U.S. mortgage rates. LOS ANGELES — said Thursday. A year ago, the rate averaged 6.32%. The average rate is now at its lowest level in a couple of weeks.

“Mortgage rates moved slightly lower this week, providing a bit more room in the budgets of some prospective homebuyers,” said Sam Khater,’s chief economist. “Regardless, rates remain elevated near 7% as markets watch for signs of cooling inflation, hoping that rates will come down further.” Many economists expect that mortgage rates will ultimately ease moderately this year, but that’s not likely to happen before the Fed begins cutting its benchmark interest rate. Last week, the central bank kept its rate unchanged and signaled again that it expects to make three rate cuts this year, but not before it sees more evidence that inflation is slowing.

The rise in mortgage rates most of last month pushed up monthly payments for prospective homebuyers. The national median payment on home loan applications in February was $2,184, an increase of 6% from a year earlier, the Mortgage Bankers Association said Thursday.The U.S. housing market is coming off a deep, 2-year sales slump triggered by a sharp rise in mortgage rates and a dearth of homes on the market.

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

ECB's Knot: Leaning toward June to begin lowering borrowing costsThe European Central Bank (ECB) Governing Council member Klaas Knot said on the weekend that he expects to begin lowering borrowing costs in June, even though it’s premature to say inflation has been defeated.

ECB's Knot: Leaning toward June to begin lowering borrowing costsThe European Central Bank (ECB) Governing Council member Klaas Knot said on the weekend that he expects to begin lowering borrowing costs in June, even though it’s premature to say inflation has been defeated.

Read more »

'The Voice' Sneak Peek: An Impressive Battle Has Reba McEntire Borrowing Chance the Rapper's Slang!Check out ET's exclusive first look at the Battle team-up Reba dubbed 'dope!'

'The Voice' Sneak Peek: An Impressive Battle Has Reba McEntire Borrowing Chance the Rapper's Slang!Check out ET's exclusive first look at the Battle team-up Reba dubbed 'dope!'

Read more »

The Federal Reserve holds interest rates steady, with no immediate relief for consumers from sky-high borrowing costsAs the Federal Reserve postpones rate cutting, here's what that means for your credit card, mortgage rate, auto loan and savings account.

The Federal Reserve holds interest rates steady, with no immediate relief for consumers from sky-high borrowing costsAs the Federal Reserve postpones rate cutting, here's what that means for your credit card, mortgage rate, auto loan and savings account.

Read more »

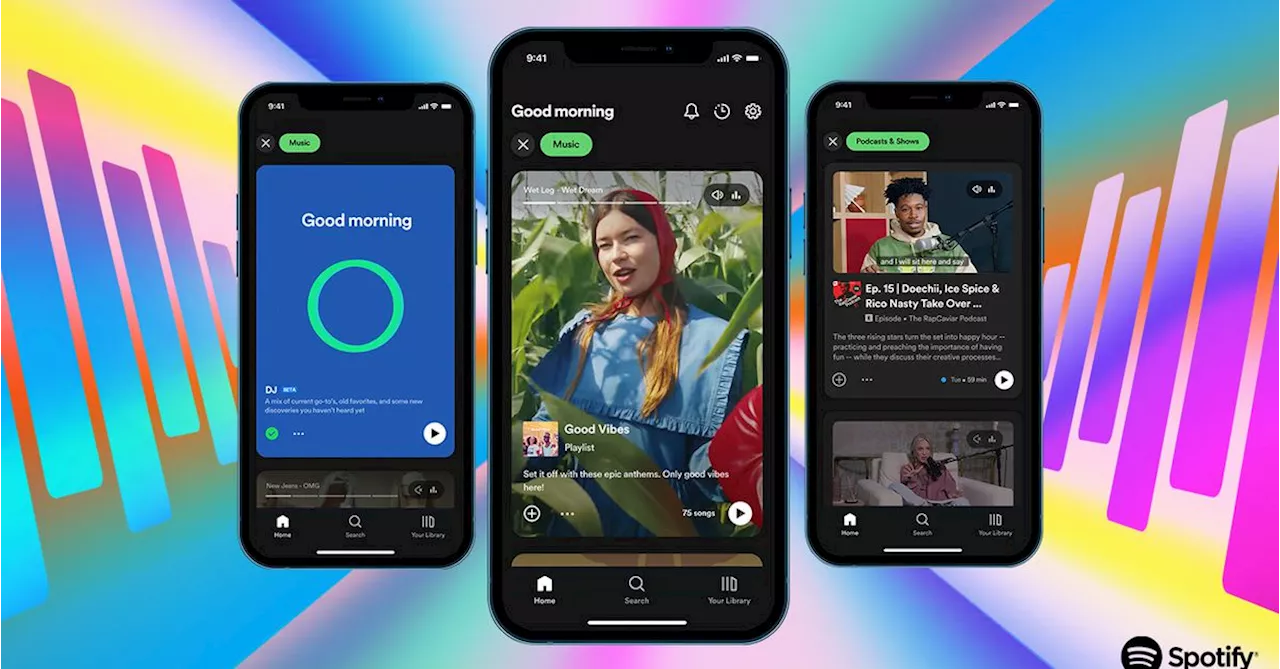

Spotify’s new design turns your music and podcasts into a TikTok feedSpotify is rolling out a new version of its homescreen, which aims to improve discovery of music, podcasts, and audiobooks by borrowing UI tricks from TikTok and Instagram.

Spotify’s new design turns your music and podcasts into a TikTok feedSpotify is rolling out a new version of its homescreen, which aims to improve discovery of music, podcasts, and audiobooks by borrowing UI tricks from TikTok and Instagram.

Read more »

Prisma price tanks 25% after nearly $9 million exploitPrisma Finance (PRISMA) is being exploited, and the attacker has so far pulled $9 million in Ethereum from the borrowing protocol.

Prisma price tanks 25% after nearly $9 million exploitPrisma Finance (PRISMA) is being exploited, and the attacker has so far pulled $9 million in Ethereum from the borrowing protocol.

Read more »

Bank of Japan hikes interest rates for first time in 17 yearsThe move still keeps rates stuck around zero as a fragile economic recovery forces the central bank to go slow on further rises in borrowing costs, analysts say.

Bank of Japan hikes interest rates for first time in 17 yearsThe move still keeps rates stuck around zero as a fragile economic recovery forces the central bank to go slow on further rises in borrowing costs, analysts say.

Read more »