The Philippine central bank will likely end its monetary tightening with one or two more rate increases this quarter that will bring the key rate to around 6 percent, according to its governor. Know more:

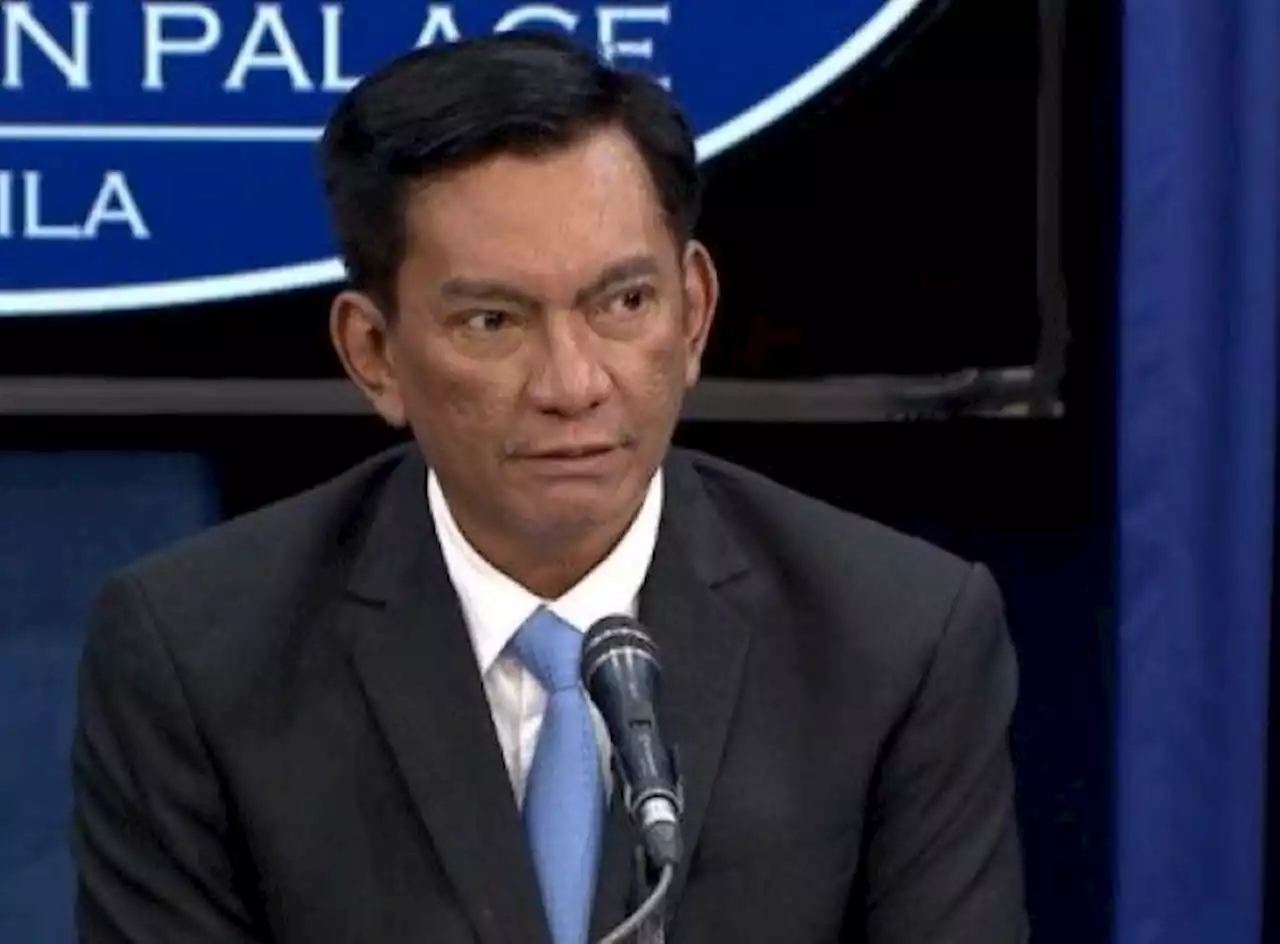

The Philippine central bank will likely end its monetary tightening with one or two more rate increases this quarter that will bring the key rate to around 6 percent, according to its governor.

BSP will likely continue raising at its February 16 and March 23 meetings as “inflationary expectations are still high,” Medalla said. Unlike neighbors that used subsidies to fight price pressures, the Philippines leaned heavily on monetary policy, he said. Once the central bank is done increasing rates, a 200-basis-point cut in the reserve requirement ratio from the current 12 percent is on the table, he said. “The moment it’s clear we’re not raising anymore and therefore we will not be confusing the market, then we’ll cut” RRR, most likely before his term ends in the middle of the year.

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

BSP’s relief measures boost lending growth - BusinessWorld OnlineTHE targeted relief measures of the Bangko Sentral ng Pilipinas (BSP) for lenders has helped sustain credit growth amid the recovery of the economy from the coronavirus pandemic, an official said. BSP Supervisory Policy and Research Department Director Maria Cynthia M. Sison said the relief measures were meant to encourage banks to continue to lend […]

BSP’s relief measures boost lending growth - BusinessWorld OnlineTHE targeted relief measures of the Bangko Sentral ng Pilipinas (BSP) for lenders has helped sustain credit growth amid the recovery of the economy from the coronavirus pandemic, an official said. BSP Supervisory Policy and Research Department Director Maria Cynthia M. Sison said the relief measures were meant to encourage banks to continue to lend […]

Read more »

BSP squeezes out only ₧334.785B from system | Cai U. OrdinarioTHE Bangko Sentral ng Pilipinas (BSP) partially awarded Term Deposit Facilities (TDFs) as investors preferred shorter tenors during the auction on Wednesday. The BSP lowered the volume offering for the TDF auction to P350 billion from P390 billion last week. The total offer volume was also reallocated between the 7-day…

BSP squeezes out only ₧334.785B from system | Cai U. OrdinarioTHE Bangko Sentral ng Pilipinas (BSP) partially awarded Term Deposit Facilities (TDFs) as investors preferred shorter tenors during the auction on Wednesday. The BSP lowered the volume offering for the TDF auction to P350 billion from P390 billion last week. The total offer volume was also reallocated between the 7-day…

Read more »

BSP: PH balance of payments hits P7.263-billion deficit in 2022The central bank reported a BOP surplus of $612 million in December 2022, which compares with the $756-million deficit in November and the $991-million surplus in the same year of 2021. This was, however, not enough to offset the deficits recorded in the previous months as the full-year BOP position stood at a deficit of $7.263 billion, reversing the $1.345-billion surplus recorded in 2021.

BSP: PH balance of payments hits P7.263-billion deficit in 2022The central bank reported a BOP surplus of $612 million in December 2022, which compares with the $756-million deficit in November and the $991-million surplus in the same year of 2021. This was, however, not enough to offset the deficits recorded in the previous months as the full-year BOP position stood at a deficit of $7.263 billion, reversing the $1.345-billion surplus recorded in 2021.

Read more »

BSP dividends dropped as Maharlika fund source in 'reengineered' version, says SalcedaThe proposed Maharlika Investment Fund (MIF) approved by the House of Representatives underwent revision during the Christmas break, Albay Representative Joey Salceda said Friday.

BSP dividends dropped as Maharlika fund source in 'reengineered' version, says SalcedaThe proposed Maharlika Investment Fund (MIF) approved by the House of Representatives underwent revision during the Christmas break, Albay Representative Joey Salceda said Friday.

Read more »

BSP adjusts cap on credit card interest rate to 3% per monthThe BSP said this adjustment will increase the maximum interest rate or finance charge imposed on a cardholder’s unpaid outstanding credit card balance by 100 basis points (bps) or from 2% to 3% per month. The existing ceiling on the monthly add-on rate that credit card issuers can charge on installment loans is maintained at a maximum rate of 1%, the BSP said.

BSP adjusts cap on credit card interest rate to 3% per monthThe BSP said this adjustment will increase the maximum interest rate or finance charge imposed on a cardholder’s unpaid outstanding credit card balance by 100 basis points (bps) or from 2% to 3% per month. The existing ceiling on the monthly add-on rate that credit card issuers can charge on installment loans is maintained at a maximum rate of 1%, the BSP said.

Read more »

BSP, DBP Dropped As Maharlika Fund Source – Salceda | OneNews.PHAlbay Rep. Joey Salceda said they decided to limit the fund sources to dividends from government-owned and controlled corporations only.

BSP, DBP Dropped As Maharlika Fund Source – Salceda | OneNews.PHAlbay Rep. Joey Salceda said they decided to limit the fund sources to dividends from government-owned and controlled corporations only.

Read more »