The Bank of England should avoid cutting interest rates too quickly or risk another inflation spike, Chancellor Jeremy Hunt has warned.

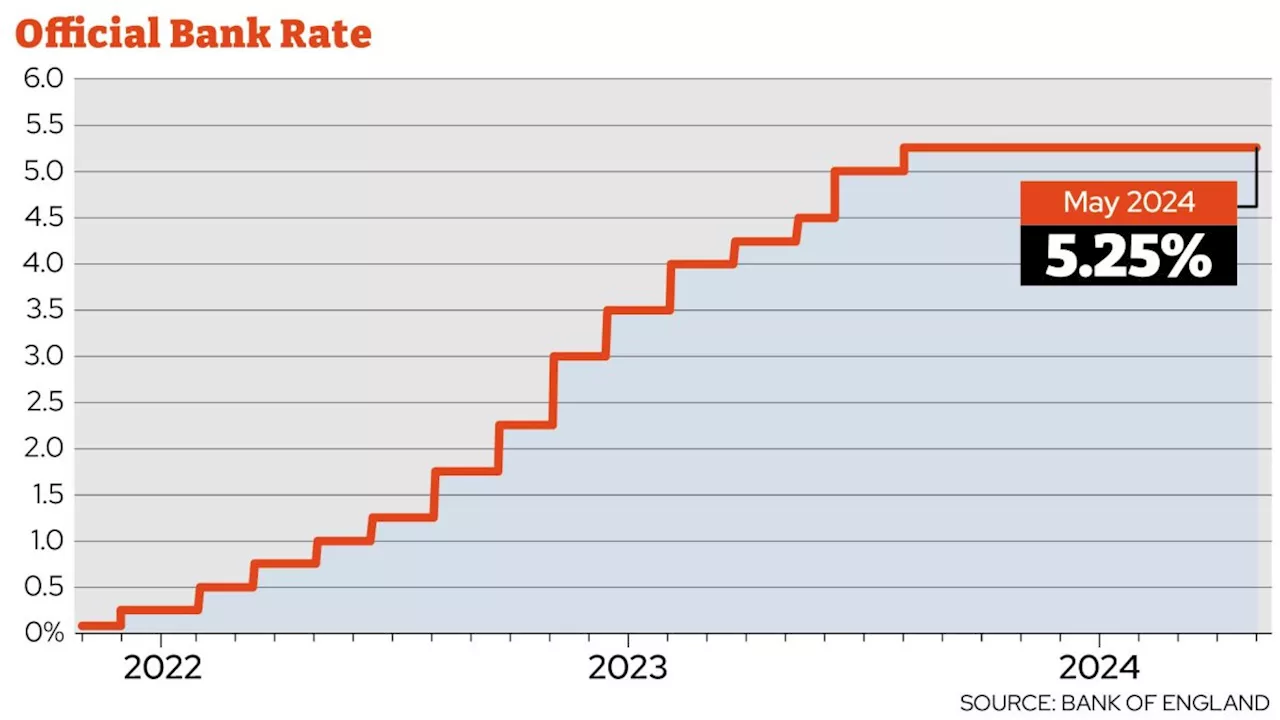

It comes after the Bank announced it is keeping the base rate of interest on hold at a 16-year-high of 5.25%.The Bank of England maintained interest rates at 5.25% at its May Monetary Policy Committee meeting. However, governor Andrew Bailey has signalled optimism that it may soon be able to cut rates, possibly in June. Mr Hunt has warned against moving too quickly, saying he would “much rather they waited until they’re absolutely sure inflation is on a downward trajectory”.

"We need to see more evidence that inflation will stay low before we can cut interest rates. I'm optimistic that things are moving in the right direction." The MPC indicated it is still looking for more progress on factors including services inflation and wage growth, which have remained persistently high at about 6%, before cutting rates.

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Bank of England locks in interest rates as new homeowners pay extra £3480 a yearInterest rates are locked in at a 16-year high

Bank of England locks in interest rates as new homeowners pay extra £3480 a yearInterest rates are locked in at a 16-year high

Read more »

Interest rates held at 5.25% but Bank of England ‘optimistic’ about cutsThe central bank has again voted to freeze rates.

Interest rates held at 5.25% but Bank of England ‘optimistic’ about cutsThe central bank has again voted to freeze rates.

Read more »

The four key reasons why the Bank of England still won’t cut interest ratesDespite the Bank hinting rate cuts are to come, there are several key reasons why it won't do so yet

The four key reasons why the Bank of England still won’t cut interest ratesDespite the Bank hinting rate cuts are to come, there are several key reasons why it won't do so yet

Read more »

Bank of England holds interest rates at 16-year high of 5.25%The Bank of England has announced it is keeping the base rate of interest on hold at a 16-year-high of 5.25%.

Bank of England holds interest rates at 16-year high of 5.25%The Bank of England has announced it is keeping the base rate of interest on hold at a 16-year-high of 5.25%.

Read more »

Bank of England holds interest rates at 5.25% again – what it means for your moneyThe base rate has been held six times now since reaching its peak last year

Bank of England holds interest rates at 5.25% again – what it means for your moneyThe base rate has been held six times now since reaching its peak last year

Read more »

Bank of England not ready to cut interest rates, experts sayThe Bank of England’s Monetary Policy Committee (MPC), which sets the level of UK interest rates, will announce its latest decision on Tuesday

Read more »