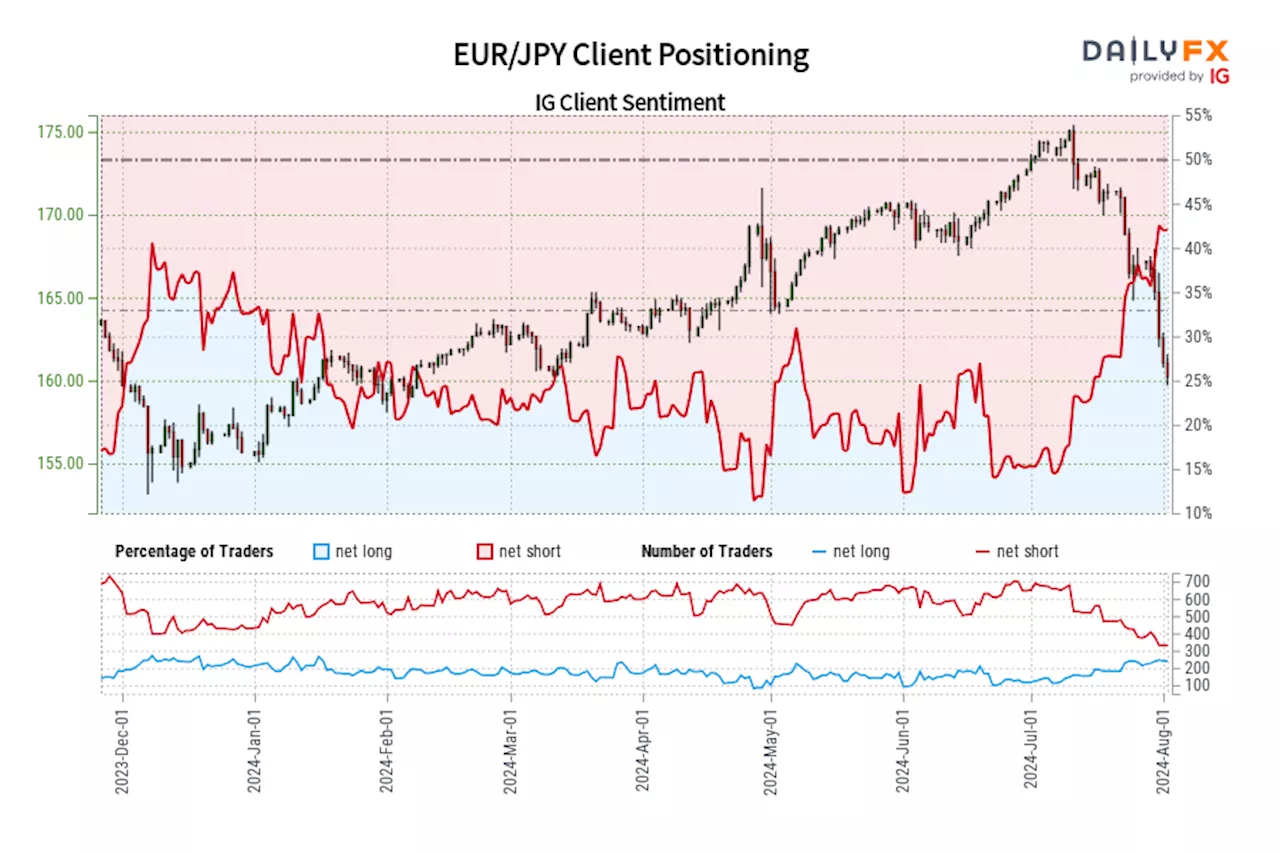

Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/JPY price trend may soon reverse lower despite the fact traders remain net-short.

EUR/JPY IG Client Sentiment: Our data shows traders are now at their most net-long EUR/JPY since Dec 18 when EUR/JPY traded near 155.86.Retail trader data shows 43.36% of traders are net-long with the ratio of traders short to long at 1.31 to 1.since Dec 18 when EUR/JPY traded near 155.86. The number of traders net-long is 1.69% lower than yesterday and 2.52% lower from last week, while the number of traders net-short is 9.82% lower than yesterday and 20.05% lower from last week.

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since Jul 03, 2024 when EUR/USD traded near 1.08.Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Forex trading involves risk. Losses can exceed deposits.

We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Information presented by DailyFX Limited should be construed as market commentary, merely observing economical, political and market conditions. This information is made available for informational purposes only. It is not a solicitation or a recommendation to trade derivatives contracts or securities and should not be construed or interpreted as financial advice.

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Trading on Sentiment: Using IG Client Sentiment DataIG Client Sentiment shows where traders are positioned in the markets. Learn how to use IG CS to spot opportunities based on trader positioning and sentiment.

Trading on Sentiment: Using IG Client Sentiment DataIG Client Sentiment shows where traders are positioned in the markets. Learn how to use IG CS to spot opportunities based on trader positioning and sentiment.

Read more »

Retail Trader Sentiment Analysis – USD/JPY, EUR/JPY, and AUD/JPYThe Japanese yen outperforms the Aussie dollar in early trading as the AUD selloff continues. What does retail positioning suggest about future price movements?

Retail Trader Sentiment Analysis – USD/JPY, EUR/JPY, and AUD/JPYThe Japanese yen outperforms the Aussie dollar in early trading as the AUD selloff continues. What does retail positioning suggest about future price movements?

Read more »

Japanese Yen Sentiment Analysis – USD/JPY, GBP/JPY, EUR/JPY LatestJapanese Yen trader data shows some sizeable shifts in Yen positioning against USD, GBP, and EUR.

Japanese Yen Sentiment Analysis – USD/JPY, GBP/JPY, EUR/JPY LatestJapanese Yen trader data shows some sizeable shifts in Yen positioning against USD, GBP, and EUR.

Read more »

Retail Sentiment Analysis: AUD/USD, Oil, S&P 500 PositioningWhat does IG client sentiment suggest about the recent risk off moves seen in financial markets?

Retail Sentiment Analysis: AUD/USD, Oil, S&P 500 PositioningWhat does IG client sentiment suggest about the recent risk off moves seen in financial markets?

Read more »

EUR/JPY Price Analysis: Remains under selling pressure below 162.50, oversold RSI condition eyedThe EUR/JPY cross trades in negative territory for the fourth consecutive day around 162.25 on Thursday during the early European session.

EUR/JPY Price Analysis: Remains under selling pressure below 162.50, oversold RSI condition eyedThe EUR/JPY cross trades in negative territory for the fourth consecutive day around 162.25 on Thursday during the early European session.

Read more »

EUR/JPY slumps to multi-month lows below 163.00 on hawkish BoJ actionEUR/JPY came under heavy bearish pressure on Wednesday and dropped to its weakest level since mid-April at 162.20.

EUR/JPY slumps to multi-month lows below 163.00 on hawkish BoJ actionEUR/JPY came under heavy bearish pressure on Wednesday and dropped to its weakest level since mid-April at 162.20.

Read more »