EUR/USD consolidates in a tight range above the round-level support of 1.0700 in Wednesday’s European session.

EUR/USD trades sideways above 1.0700 as investors look for fresh cues on the Fed and the ECB interest-rate outlook. ECB policymakers remain concerned over stubborn service inflation. Investors see the Fed reducing interest rates twice this year. The major currency pair trades sideways as investors look for fresh cues about when the European Central Bank will deliver its second rate cut this year.

0636, near the upward-sloping order of the chart pattern plotted from 3 October 2023 low at 1.0448 and the horizontal cushion plotted from April 16 low around 1.0600. The long-term outlook of the shared currency pair has also turned negative as prices dropped below the 200-day Exponential Moving Average , which trades around 1.0800. The 14-period Relative Strength Index falls below 40.00. Momentum could turn bearish if the RSI sustains below this level.

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

EUR/USD Forecast: EUR/USD steady sub-1.0900 ahead of fresh cluesThe EUR/USD saw little action on Monday, hovering around the 1.0860 mark for most of the day.

EUR/USD Forecast: EUR/USD steady sub-1.0900 ahead of fresh cluesThe EUR/USD saw little action on Monday, hovering around the 1.0860 mark for most of the day.

Read more »

EUR/USD Forecast: EUR/USD holds in range after a disappointing US ADP surveyFinancial markets were mostly quiet throughout the first half of the day, with the US Dollar achieving modest intraday gains amid prevalent caution.

EUR/USD Forecast: EUR/USD holds in range after a disappointing US ADP surveyFinancial markets were mostly quiet throughout the first half of the day, with the US Dollar achieving modest intraday gains amid prevalent caution.

Read more »

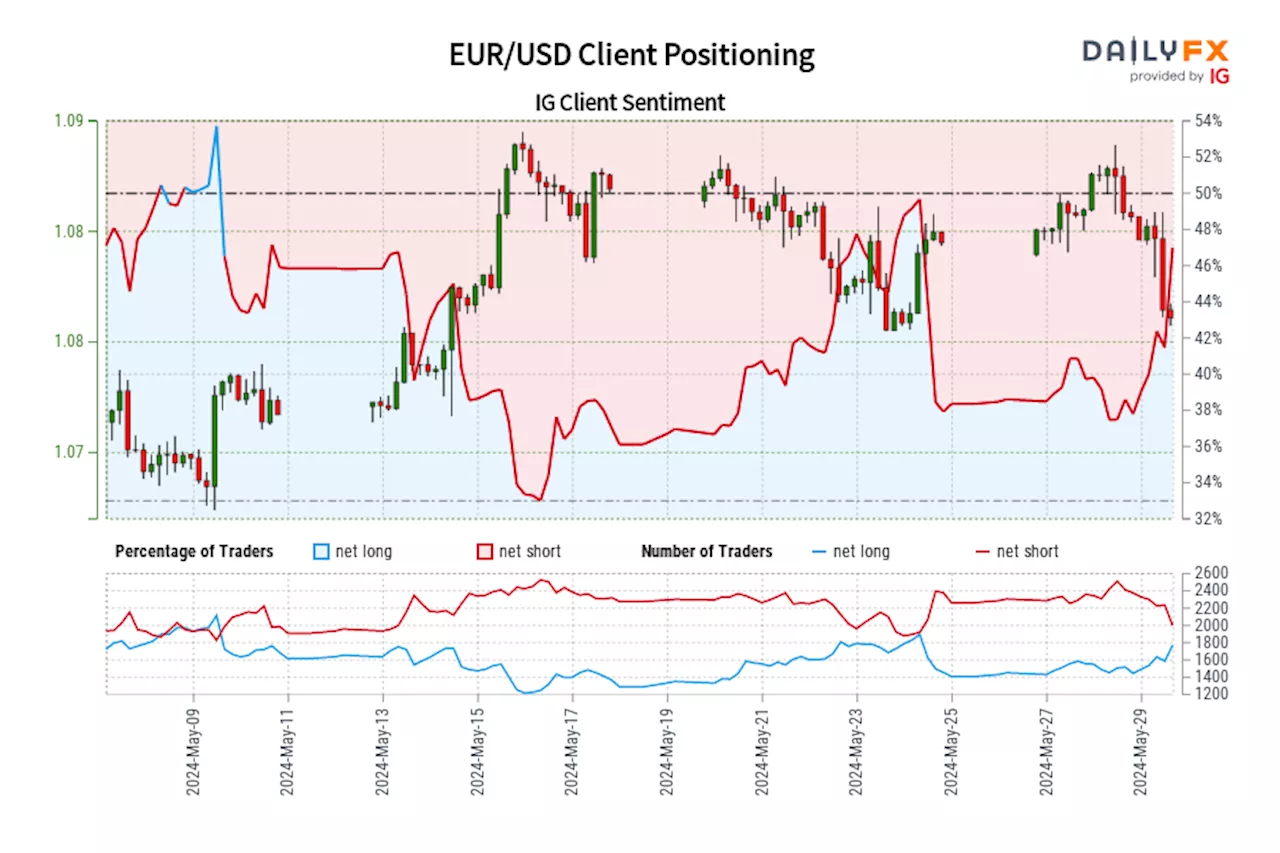

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since May 09, 2024 when EUR/USD traded near 1.08.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since May 09, 2024 when EUR/USD traded near 1.08.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

Read more »

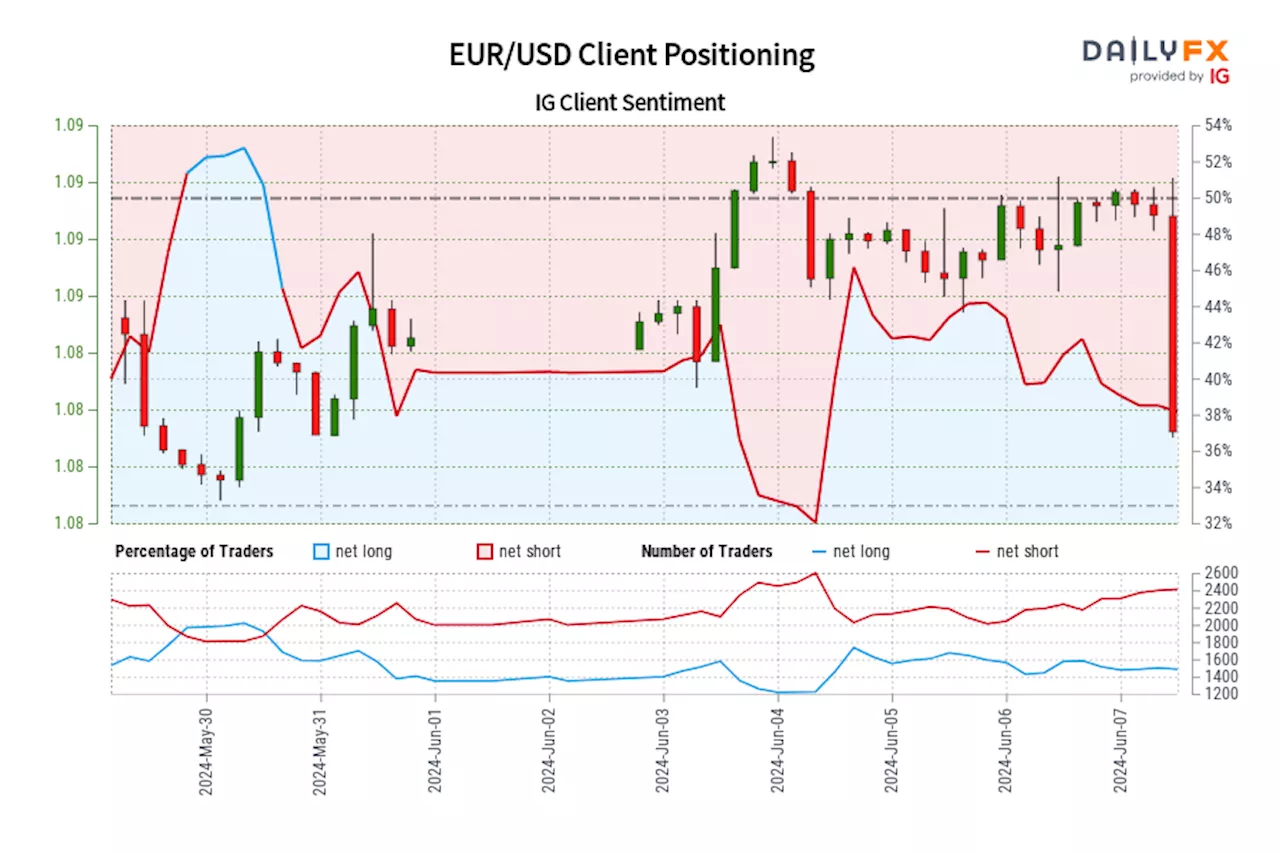

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since May 30, 2024 13:00 GMT when EUR/USD traded near 1.08.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since May 30, 2024 13:00 GMT when EUR/USD traded near 1.08.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

Read more »

EUR/USD tumbles due to Eurozone’s political uncertainty and Fed rate-cut hopes waneEUR/USD extends its decline to 1.0750 on Monday. The major currency pair weakens as political uncertainty in the Eurozone after French President Emmanuel Macron call for a snap election weighed heavily on the Euro.

EUR/USD tumbles due to Eurozone’s political uncertainty and Fed rate-cut hopes waneEUR/USD extends its decline to 1.0750 on Monday. The major currency pair weakens as political uncertainty in the Eurozone after French President Emmanuel Macron call for a snap election weighed heavily on the Euro.

Read more »

EUR/USD looks for balance after off-kilter wobble, US CPI and Fed projections loom aheadEUR/USD trimmed into the low side after a steep correction extended from Friday through Monday, dragging the pair down -1.57% peak-to-trough and the Fiber is once again testing bids near 1.0750.

EUR/USD looks for balance after off-kilter wobble, US CPI and Fed projections loom aheadEUR/USD trimmed into the low side after a steep correction extended from Friday through Monday, dragging the pair down -1.57% peak-to-trough and the Fiber is once again testing bids near 1.0750.

Read more »