EUR/USD jostled on Monday, settling near 1.0720 after churning in a tight but lopsided range as markets settle in for the wait to Wednesday’s US Federal Reserve (Fed) outing.

German CPI inflation continues to rise, but below forecasts. Fed rate call, pan-EU GDP and HICP inflation in the mid-week. NFP Friday a key US datapoint this week. EUR/USD jostled on Monday, settling near 1.0720 after churning in a tight but lopsided range as markets settle in for the wait to Wednesday’s US Fed eral Reserve outing. Investors broadly expect US rates to hold steady this week, but traders will be looking for an uptick in Fed guidance for when rate cuts could be coming.

European Gross Domestic Product figures are also due during Tuesday’s European market session, forecast to grind higher to a scant 0.1% in the first quarter compared to the previous quarter’s flat 0.0%. The key headlines this week will be the Fed’s latest rate call on Wednesday, followed by Friday’s NFP labor data, which is expected to show a slight easing from the previous month’s 12-month peak of 303k. Friday’s US NFP is forecast to ease to 243k net additional job growth.

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

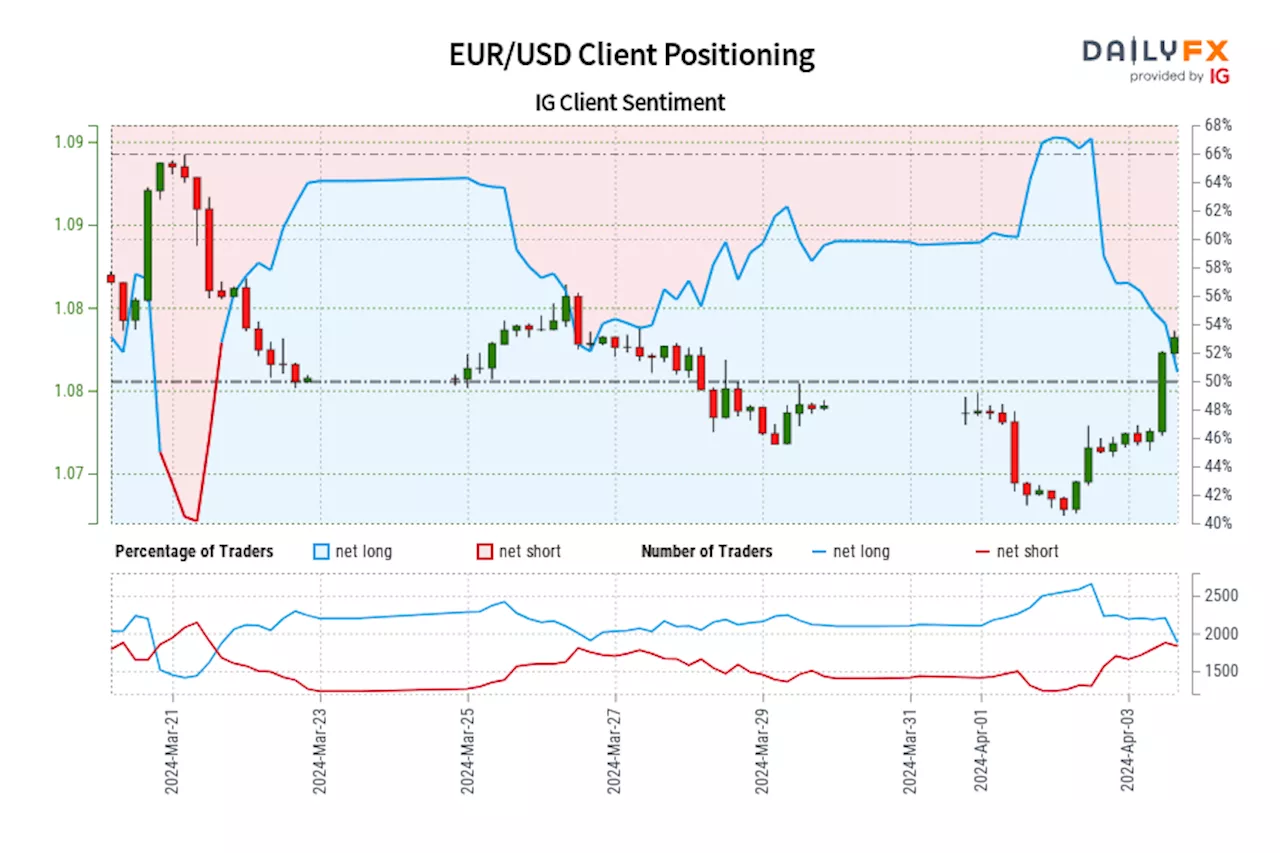

EUR/USD IG Client Sentiment: Our data shows traders are now net-short EUR/USD for the first time since Mar 21, 2024 when EUR/USD traded near 1.09.Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bullish contrarian trading bias.

EUR/USD IG Client Sentiment: Our data shows traders are now net-short EUR/USD for the first time since Mar 21, 2024 when EUR/USD traded near 1.09.Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bullish contrarian trading bias.

Read more »

EUR/USD Forecast: Range-trading to prevail ahead of first-tier eventsThe EUR/USD pair retains modest intraday gains on Monday, trading around the 1.0710 level.

EUR/USD Forecast: Range-trading to prevail ahead of first-tier eventsThe EUR/USD pair retains modest intraday gains on Monday, trading around the 1.0710 level.

Read more »

EUR/USD Forecast: Bears looking to test the 1.0700 regionThe EUR/USD pair fell on Monday to 1.0730, its lowest since mid-February.

EUR/USD Forecast: Bears looking to test the 1.0700 regionThe EUR/USD pair fell on Monday to 1.0730, its lowest since mid-February.

Read more »

EUR/USD Price Analysis: Maintains position below the psychological level of 1.0800EUR/USD pares intraday gains, trading higher around 1.0780 during the Asian session on Monday.

EUR/USD Price Analysis: Maintains position below the psychological level of 1.0800EUR/USD pares intraday gains, trading higher around 1.0780 during the Asian session on Monday.

Read more »

US Dollar Tanks Ahead of Fed Verdict, NFP Data - EUR/USD, GBP/USD, USD/CADThis article explores the fundamental and the technical outlook for the U.S. dollar, zeroing in on three popular and very liquid pairs: EUR/USD, GBP/USD and USD/CAD.

US Dollar Tanks Ahead of Fed Verdict, NFP Data - EUR/USD, GBP/USD, USD/CADThis article explores the fundamental and the technical outlook for the U.S. dollar, zeroing in on three popular and very liquid pairs: EUR/USD, GBP/USD and USD/CAD.

Read more »

EUR/USD Forecast: The next up-barrier comes at 1.0750The resurfacing downward pressure on the US Dollar (USD) on Monday triggered a marked response in EUR/USD, pushing the ongoing recovery to the 1.0730 area.

EUR/USD Forecast: The next up-barrier comes at 1.0750The resurfacing downward pressure on the US Dollar (USD) on Monday triggered a marked response in EUR/USD, pushing the ongoing recovery to the 1.0730 area.

Read more »