EUR/USD clings to gains above the crucial support of 1.0800 in Tuesday’s European session.

EUR/USD steadies above 1.0800 as easing US labor market strength weighs on the US Dollar. Fed ’s Powell may refrain from providing a specific timeframe for rate cuts. ECB ’s Knot doesn’t see the central bank delivering subsequent rate cuts in July. The major currency pair holds gains as the US Dollar remains under pressure due to firm market speculation that the Fed eral Reserve will start reducing interest rates in September.

The major currency pair stabilizes above the 20-day and 50-day Exponential Moving Averages , which trade around 1.0750 and 1.0770, respectively. The overall trend of the shared currency pair has also strengthened as it has jumped above the 200-day EMA, which trades around 1.0800. The Symmetrical Triangle formation on the daily timeframe exhibits a sharp volatility contraction, which indicates low volume and narrow ticks. The 14-day Relative Strength Index reaches 60.00.

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

EUR/USD: Topside for EUR/USD is very limited – Societe GeneraleThis morning’s IFO data confirm what the PMIs told us – expectations are down, FX strategist Kit Juckes at Societe Generale notes.

EUR/USD: Topside for EUR/USD is very limited – Societe GeneraleThis morning’s IFO data confirm what the PMIs told us – expectations are down, FX strategist Kit Juckes at Societe Generale notes.

Read more »

EUR/USD clings to gains on firm Fed rate-cut prospectsEUR/USD extends its recovery to 1.0740 in Tuesday’s European session.

EUR/USD clings to gains on firm Fed rate-cut prospectsEUR/USD extends its recovery to 1.0740 in Tuesday’s European session.

Read more »

EUR/USD trims gains and snaps seven-day win streak ahead of Fed policy updateEUR/USD stumbled on Monday after a muddled election outcome in France leaves policy guidance unclear for the Euro bloc.

EUR/USD trims gains and snaps seven-day win streak ahead of Fed policy updateEUR/USD stumbled on Monday after a muddled election outcome in France leaves policy guidance unclear for the Euro bloc.

Read more »

EUR/USD Forecast: Euro remains fragile as focus shifts to US inflation data, FedEUR/USD closed the third consecutive day in negative territory on Tuesday and touched its lowest level in a month at 1.0720.

EUR/USD Forecast: Euro remains fragile as focus shifts to US inflation data, FedEUR/USD closed the third consecutive day in negative territory on Tuesday and touched its lowest level in a month at 1.0720.

Read more »

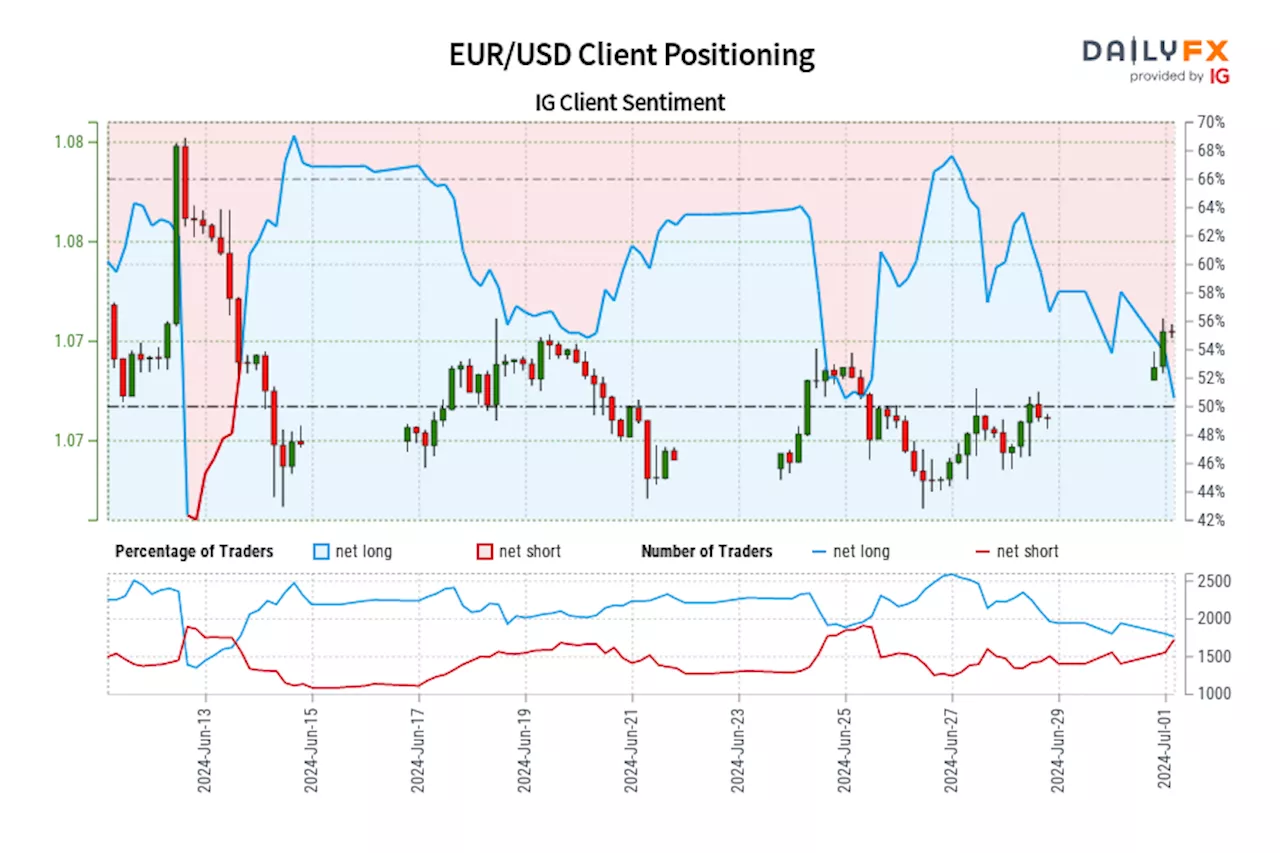

EUR/USD IG Client Sentiment: Our data shows traders are now net-short EUR/USD for the first time since Jun 13, 2024 when EUR/USD traded near 1.07.Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bullish contrarian trading bias.

EUR/USD IG Client Sentiment: Our data shows traders are now net-short EUR/USD for the first time since Jun 13, 2024 when EUR/USD traded near 1.07.Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bullish contrarian trading bias.

Read more »

EUR/USD advances as French elections begin and Fed rate-cut prospects increaseEUR/USD gains 0.50% and jumps to more than a two-week high near 1.0770 in Monday’s European session.

EUR/USD advances as French elections begin and Fed rate-cut prospects increaseEUR/USD gains 0.50% and jumps to more than a two-week high near 1.0770 in Monday’s European session.

Read more »