EUR/USD trades sideways near 1.0900 in Friday’s European session.

EUR/USD trades back and forth near 1.0900 ahead of US NFP data for May. The US NFP will indicate whether labor market conditions have started normalizing. The ECB commenced its policy easing campaign but refrained from committing to a predefined interest-rate path. The major currency pair remains broadly steady as traders stay on the sidelines ahead of the United States Nonfarm Payrolls data for May, which will be published at 12:30 GMT.

The near-term outlook remains firm due to a golden cross formation, a bullish crossover of the 50-day and 200-day Exponential Moving Averages near 1.0800. The 14-period Relative Strength Index recovers to 60.00. A decisive move above the same would push the momentum towards the upside. Looking up, the major currency pair is expected to extend gains towards the March 21 high at around 1.0950 and the psychological resistance of 1.1000 if it decisively breaks above the round-level resistance of 1.

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

EUR/USD Forecast: EUR/USD steady sub-1.0900 ahead of fresh cluesThe EUR/USD saw little action on Monday, hovering around the 1.0860 mark for most of the day.

EUR/USD Forecast: EUR/USD steady sub-1.0900 ahead of fresh cluesThe EUR/USD saw little action on Monday, hovering around the 1.0860 mark for most of the day.

Read more »

EUR/USD Forecast: EUR/USD holds in range after a disappointing US ADP surveyFinancial markets were mostly quiet throughout the first half of the day, with the US Dollar achieving modest intraday gains amid prevalent caution.

EUR/USD Forecast: EUR/USD holds in range after a disappointing US ADP surveyFinancial markets were mostly quiet throughout the first half of the day, with the US Dollar achieving modest intraday gains amid prevalent caution.

Read more »

EUR/USD Forecast: Further gains now look at US NFPThe US Dollar (USD) saw modest losses on Thursday, encouraging EUR/USD to regain some balance, briefly surpass the 1.0900 barrier, and end the session with decent gains around 1.0880.

EUR/USD Forecast: Further gains now look at US NFPThe US Dollar (USD) saw modest losses on Thursday, encouraging EUR/USD to regain some balance, briefly surpass the 1.0900 barrier, and end the session with decent gains around 1.0880.

Read more »

EUR/USD looks for bullish push ahead of final EU GDP and US NFP data dropsEUR/USD pushed back into near-term highs on Thursday, easing below 1.0870 in early market action before recovering ground and re-pinning into familiar technical levels just below 1.0900 to close out the US market session.

EUR/USD looks for bullish push ahead of final EU GDP and US NFP data dropsEUR/USD pushed back into near-term highs on Thursday, easing below 1.0870 in early market action before recovering ground and re-pinning into familiar technical levels just below 1.0900 to close out the US market session.

Read more »

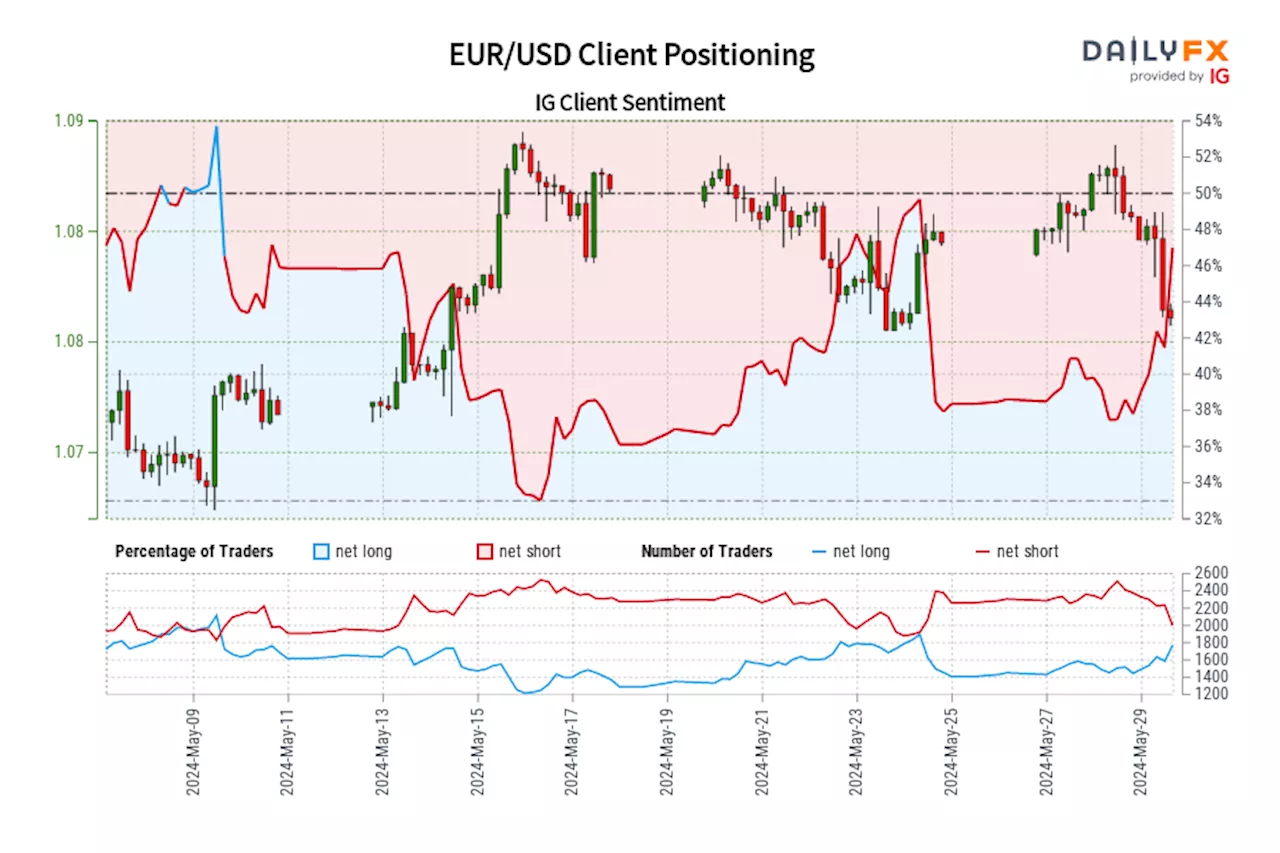

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since May 09, 2024 when EUR/USD traded near 1.08.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since May 09, 2024 when EUR/USD traded near 1.08.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

Read more »

EUR/USD Forecast: Next on the downside comes the 200-day SMAEUR/USD extends its weakness for the third session in a row on Wednesday, this time hovering around the 1.0820 region in a context still favourable to the US Dollar (USD) and the risk-off mood.

EUR/USD Forecast: Next on the downside comes the 200-day SMAEUR/USD extends its weakness for the third session in a row on Wednesday, this time hovering around the 1.0820 region in a context still favourable to the US Dollar (USD) and the risk-off mood.

Read more »