The Euro (EUR) is likely to trade with a downward bias. Tentative buildup in momentum suggests downside risk; any further decline in EUR is unlikely to break clearly below 1.0815, UOB Group FX analysts Quek Ser Leang and Lee Sue Ann.

The Euro is likely to trade with a downward bias. Tentative buildup in momentum suggests downside risk; any further decline in EUR is unlikely to break clearly below 1.0815, UOB Group FX analysts Quek Ser Leang and Lee Sue Ann. EUR is unlikely to break clearly below 1.0815 24-HOUR VIEW: “We expected EUR to trade in a sideways range of 1.0875/1.0910 yesterday. Our view was incorrect, as EUR fell, reaching a low of 1.0842. EUR closed on a soft note at 1.0851 .

0870; a breach of 1.0885 would mean that the momentum buildup has faded.” 1-3 WEEKS VIEW: “Two days ago , we highlighted that ‘the recent EUR strength that started two weeks ago has come to an end.’ We added, ‘the current price action is likely part of a range trading phase,’ and we expected EUR to trade between 1.0845 and 1.0945. Yesterday, EUR fell slightly below the bottom of our expected range, reaching a low of 1.0842.

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

EUR/USD: Topside for EUR/USD is very limited – Societe GeneraleThis morning’s IFO data confirm what the PMIs told us – expectations are down, FX strategist Kit Juckes at Societe Generale notes.

EUR/USD: Topside for EUR/USD is very limited – Societe GeneraleThis morning’s IFO data confirm what the PMIs told us – expectations are down, FX strategist Kit Juckes at Societe Generale notes.

Read more »

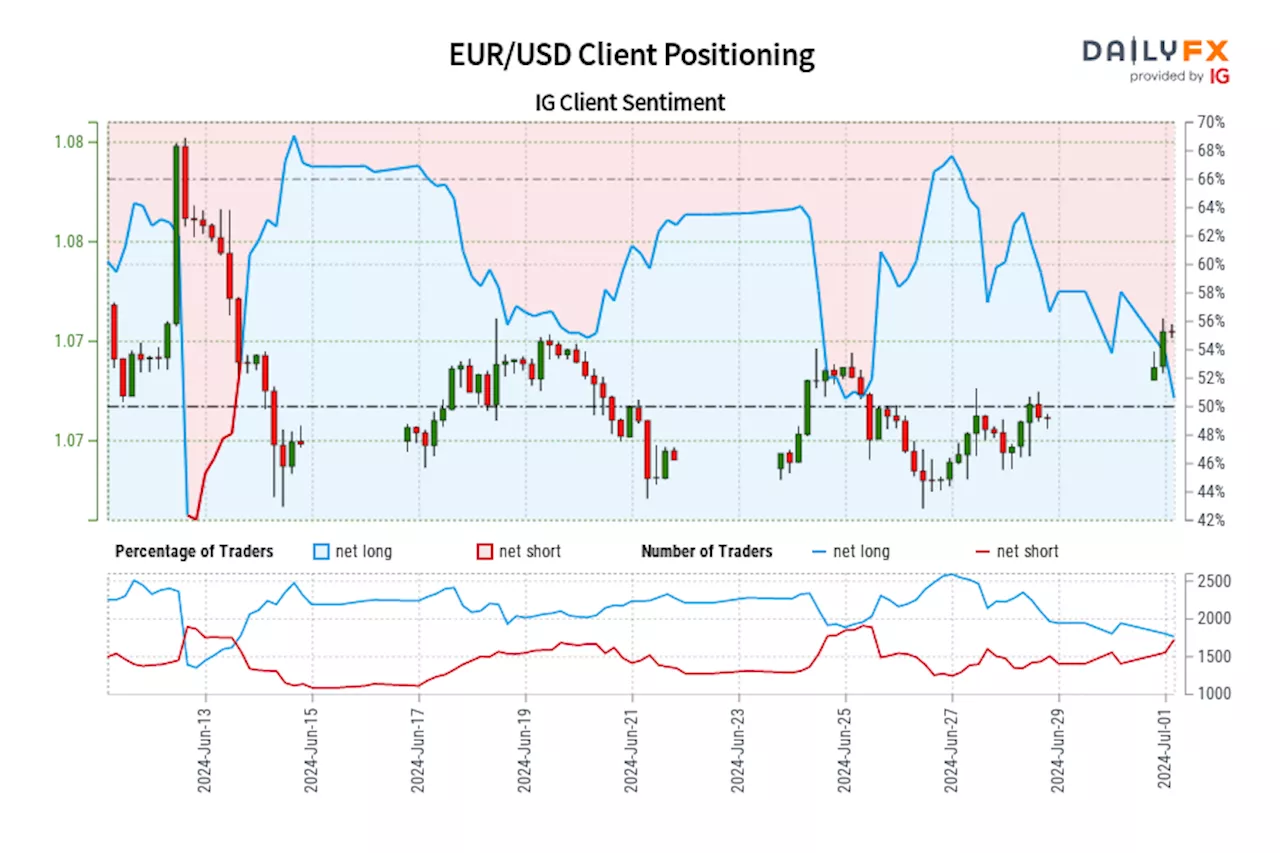

EUR/USD IG Client Sentiment: Our data shows traders are now net-short EUR/USD for the first time since Jun 13, 2024 when EUR/USD traded near 1.07.Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bullish contrarian trading bias.

EUR/USD IG Client Sentiment: Our data shows traders are now net-short EUR/USD for the first time since Jun 13, 2024 when EUR/USD traded near 1.07.Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bullish contrarian trading bias.

Read more »

EUR/USD: Risk of EUR breaking above 1.0850 increasesThe Euro (EUR) is expected to trade in a 1.0795/1.0845 range.

EUR/USD: Risk of EUR breaking above 1.0850 increasesThe Euro (EUR) is expected to trade in a 1.0795/1.0845 range.

Read more »

EUR: French election and US PCE to guide the EUR/USDEUR/USD is trading close to 1.07 following a soft session for risk sentiment on Tuesday, ING’s analyst Francesco Pesole notes.

EUR: French election and US PCE to guide the EUR/USDEUR/USD is trading close to 1.07 following a soft session for risk sentiment on Tuesday, ING’s analyst Francesco Pesole notes.

Read more »

EUR/USD Forecast: Further upside looks likely above 1.0900Another auspicious week saw EUR/USD trade with decent gains and extend its positive streak for the third consecutive week, including a visit to the key 1.0900 region for the first time since early June.

EUR/USD Forecast: Further upside looks likely above 1.0900Another auspicious week saw EUR/USD trade with decent gains and extend its positive streak for the third consecutive week, including a visit to the key 1.0900 region for the first time since early June.

Read more »

EUR/USD strengthens as ECB likely keep interest rates steady, US Dollar tumblesEUR/USD jumps above 1.0900 and reaches a new four-month high in Wednesday’s European session.

EUR/USD strengthens as ECB likely keep interest rates steady, US Dollar tumblesEUR/USD jumps above 1.0900 and reaches a new four-month high in Wednesday’s European session.

Read more »