EUR/USD is trading back up in the 1.0900s on Thursday, after surging higher following the Federal Reserve (Fed) meeting.

EUR/USD rallies after a dovish hold by the Fed weakens the US Dollar. The Fed continues to expect to make three 0.25% interest rate cuts in 2024, same as December. Eurozone PMI data to give the latest assessment of the region’s economic well being. EUR/USD is trading back up in the 1.0900s on Thursday, after surging higher following the Federal Reserve meeting.

Composite PMI for the Eurozone is expected to show a rise to 49.7 in March from 49.2 in February, the Services PMI is forecast to come out at 50.5 from 50.2, and Manufacturing at 47.0 from 46.5 previously, A higher-than-expected result would likely be bullish for EUR/USD and vice versa for a lower-than-expected result. Technical Analysis: EUR/USD returns to the 1.0900s EUR/USD reversed on a dime at around the level of the 200-day Simple Moving Average in the 1.

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

EUR/USD Price Analysis: Holds below the mid-1.0900s, bullish outlook remains intactThe EUR/USD pair trades on a weaker note below the mid-1.0900s during the early European session on Thursday.

EUR/USD Price Analysis: Holds below the mid-1.0900s, bullish outlook remains intactThe EUR/USD pair trades on a weaker note below the mid-1.0900s during the early European session on Thursday.

Read more »

EUR/USD Forecast: Technicals turn bearish following Thursday slideEUR/USD came under heavy bearish pressure and closed below 1.0900 on Thursday.

EUR/USD Forecast: Technicals turn bearish following Thursday slideEUR/USD came under heavy bearish pressure and closed below 1.0900 on Thursday.

Read more »

EUR/USD trades at make-or-break level after Thursday’s sell-offEUR/USD is trading in the 1.0800s on the last day of the week after taking a step down from its previous range in the 1.0900s.

EUR/USD trades at make-or-break level after Thursday’s sell-offEUR/USD is trading in the 1.0800s on the last day of the week after taking a step down from its previous range in the 1.0900s.

Read more »

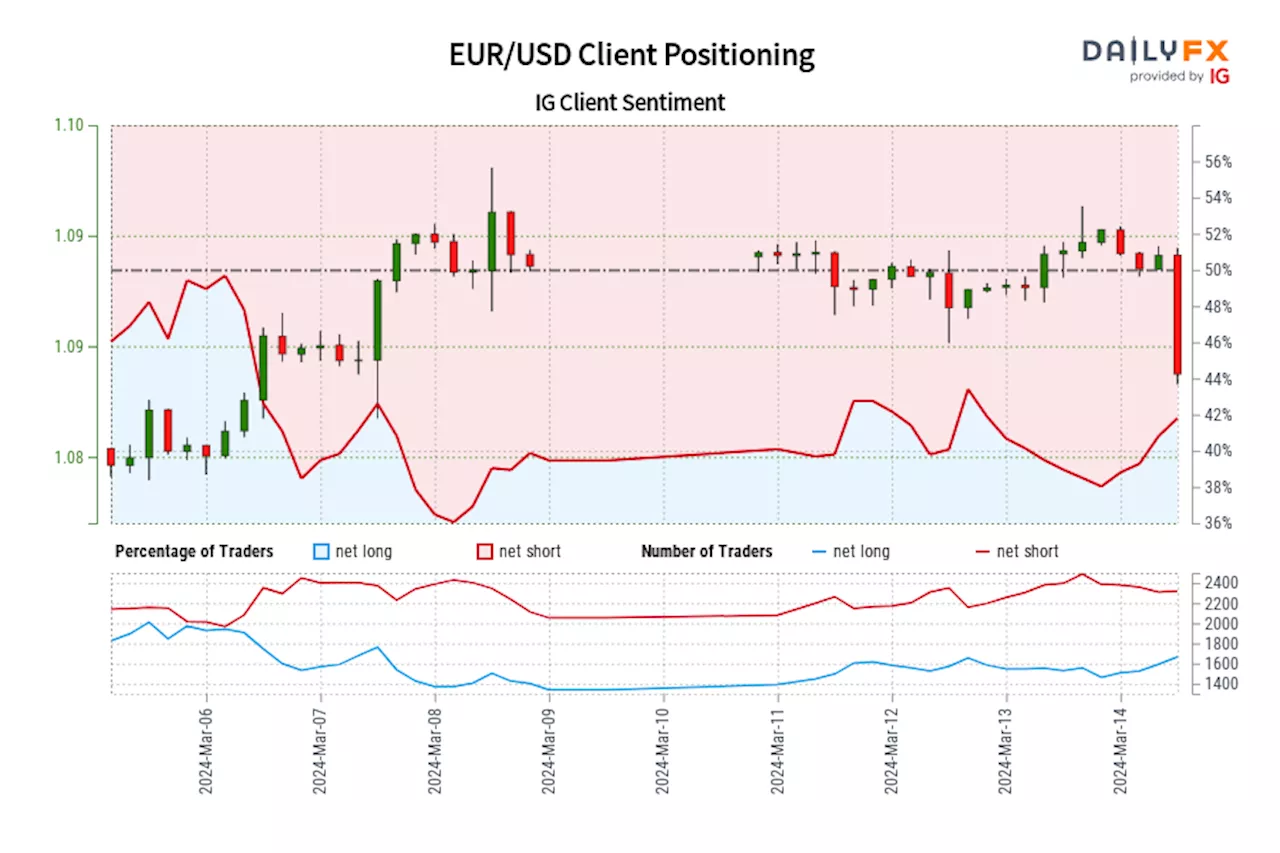

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since Mar 06, 2024 03:00 GMT when EUR/USD traded near 1.09.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since Mar 06, 2024 03:00 GMT when EUR/USD traded near 1.09.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

Read more »

US Dollar Seeks Fed Signals in PPI, Retail Sales Data - EUR/USD, USD/JPY SetupsThe release of U.S. PPI and retail sales data on Thursday is poised to capture the market's focus and potentially ignite volatility, as both macroeconomic reports may influence the Fed’s monetary policy outlook.

US Dollar Seeks Fed Signals in PPI, Retail Sales Data - EUR/USD, USD/JPY SetupsThe release of U.S. PPI and retail sales data on Thursday is poised to capture the market's focus and potentially ignite volatility, as both macroeconomic reports may influence the Fed’s monetary policy outlook.

Read more »

US Dollar Subdued Ahead of Fed Minutes; Setups on EUR/USD, USD/JPY, USD/CADThis article focuses on the technical outlook for three popular U.S. dollar pairs: EUR/USD, USD/JPY, and USD/CAD. Throughout the piece, we scrutinize potential scenarios and examine key price levels worth watching in the coming days.

US Dollar Subdued Ahead of Fed Minutes; Setups on EUR/USD, USD/JPY, USD/CADThis article focuses on the technical outlook for three popular U.S. dollar pairs: EUR/USD, USD/JPY, and USD/CAD. Throughout the piece, we scrutinize potential scenarios and examine key price levels worth watching in the coming days.

Read more »