The EUR/USD pair trades on a weaker note near 1.0787 on the renewed US dollar (USD) demand during the early Asian session on Monday.

EUR/USD trades in negative territory around 1.0787 on the firmer USD. The US Core PCE was up 0.3% MoM and 2.8% YoY, matching the market estimation. ECB’s Stournaras said that a total of four interest rate cuts are possible in 2024. The EUR/USD pair trades on a weaker note near 1.0787 on the renewed US dollar demand during the early Asian session on Monday. The higher-for-longer stance from the Federal Reserve provides some support to the Greenback and weighs on the EUR/USD pair.

On Friday, Fed Chairman Jerome Powell said that recent US inflation data was in line with expectations and that the Fed's goal for the interest rate this year remained unchanged. On the other hand, European Central Bank Governing Council member Yannis Stournaras said on Sunday that a total of four interest rate cuts is possible in 2024, with a total rate reduction of 100 basis points by year-end.

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

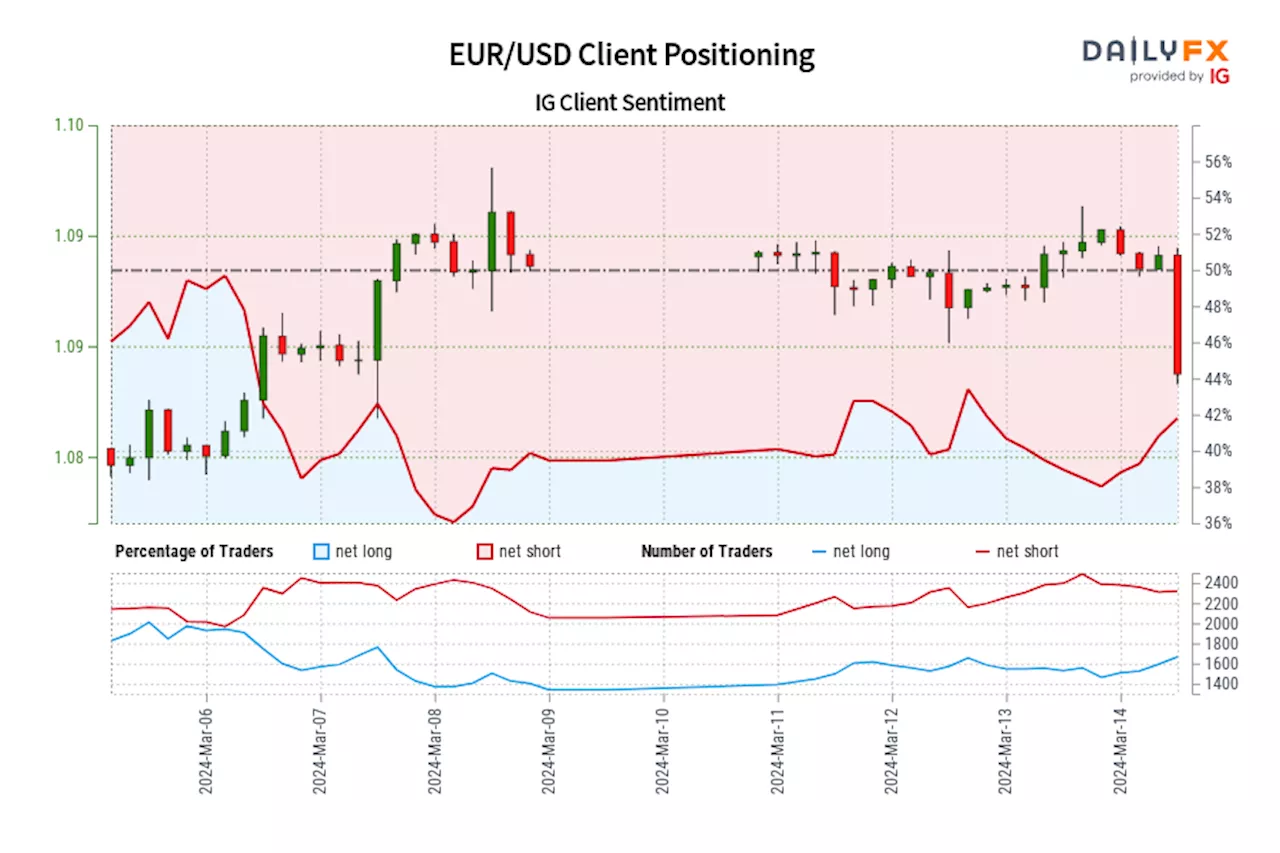

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since Mar 06, 2024 03:00 GMT when EUR/USD traded near 1.09.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since Mar 06, 2024 03:00 GMT when EUR/USD traded near 1.09.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

Read more »

Euro’s Outlook Hinges on ECB Guidance; Trade Setups on EUR/USD, EUR/GBP, EUR/JPYThis article discusses the upcoming ECB decision and its potential ramifications for the euro's outlook. In the piece, we also explore the technical profile for EUR/USD, EUR/GBP, and EUR/JPY, assessing price action dynamics and market sentiment.

Euro’s Outlook Hinges on ECB Guidance; Trade Setups on EUR/USD, EUR/GBP, EUR/JPYThis article discusses the upcoming ECB decision and its potential ramifications for the euro's outlook. In the piece, we also explore the technical profile for EUR/USD, EUR/GBP, and EUR/JPY, assessing price action dynamics and market sentiment.

Read more »

Euro Trade Setups Ahead of ECB Decision – EUR/USD, EUR/GBP and EUR/JPYNext week’s ECB meeting is unlikely to see any change in monetary policy but post-decision commentary may give traders a better view when the first rate cut is set to be announced

Euro Trade Setups Ahead of ECB Decision – EUR/USD, EUR/GBP and EUR/JPYNext week’s ECB meeting is unlikely to see any change in monetary policy but post-decision commentary may give traders a better view when the first rate cut is set to be announced

Read more »

US S&P Global manufacturing PMI improves to 52.5, Services PMI declines to 51.7 in MarchBusiness activity in the US private sector continued to expand at a healthy pace in early March, with the S&P Global Composite PMI coming in at 52.2.

US S&P Global manufacturing PMI improves to 52.5, Services PMI declines to 51.7 in MarchBusiness activity in the US private sector continued to expand at a healthy pace in early March, with the S&P Global Composite PMI coming in at 52.2.

Read more »

Australia's Judo Bank PMIs come in mixed as Services PMI rises, Manufacturing PMI easesAustralia's Judo Bank Purchasing Managers Index (PMI) came in mixed in the early Thursday market session, with a lift in the Services component mixing with an easing in the Manufacturing PMI.

Australia's Judo Bank PMIs come in mixed as Services PMI rises, Manufacturing PMI easesAustralia's Judo Bank Purchasing Managers Index (PMI) came in mixed in the early Thursday market session, with a lift in the Services component mixing with an easing in the Manufacturing PMI.

Read more »

China NBS Manufacturing PMI improves to 50.8 in March, Services PMI climbs to 53.0China’s official Manufacturing Purchasing Managers' Index (PMI) improved to 50.8 in March from the previous reading of 49.1, the latest data published by the country’s National Bureau of Statistics (NBS) showed on Sunday.

China NBS Manufacturing PMI improves to 50.8 in March, Services PMI climbs to 53.0China’s official Manufacturing Purchasing Managers' Index (PMI) improved to 50.8 in March from the previous reading of 49.1, the latest data published by the country’s National Bureau of Statistics (NBS) showed on Sunday.

Read more »