Across the world, sovereign wealth funds have built roads and filled up national budgets. But experts aren’t so sure the Maharlika fund can do the same for us.

, both home to some of the most renowned SWFs, use profits from their massive funds to finance their budgets, with as much as 20% of their budgets coming from their respective sovereign wealth funds.

“Since its inception, the Infrastructure Fund has financed projects that have electrified 75 percent of Timor-Leste territory, rehabilitated ports, irrigated three regions, and paved many public roads,” the World Bank noted. Over more than a decade of corruption, ex-prime minister Najib Razak managed to exert his political influence on 1MDB even without being designated as the head of the fund. After siphoning away as much as $1 billion for himself, Najib isBefore we start our sovereign wealth fund, we must first answer the big question: where do we get the money from?

The Philippines has neither a budget surplus nor low public debt levels. Experts warn that this places us in a bad situation to start such a fund.“Conceptually, a sovereign wealth fund is good for a country if it is in a position to have one already. Historically, SWF arise from the budget surplus of oil exporting countries. Unfortunately, the Philippines does not currently enjoy that surplus and has no excess funds to invest.

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Budget chief: World Bank, IMF, ADB, Milken Institute all consulted for Maharlika fundBudget Secretary Amenah Pangandaman says that 'we don’t have to be so scared' about establishing the Maharlika fund as the proposal comes with enough safeguards.

Budget chief: World Bank, IMF, ADB, Milken Institute all consulted for Maharlika fundBudget Secretary Amenah Pangandaman says that 'we don’t have to be so scared' about establishing the Maharlika fund as the proposal comes with enough safeguards.

Read more »

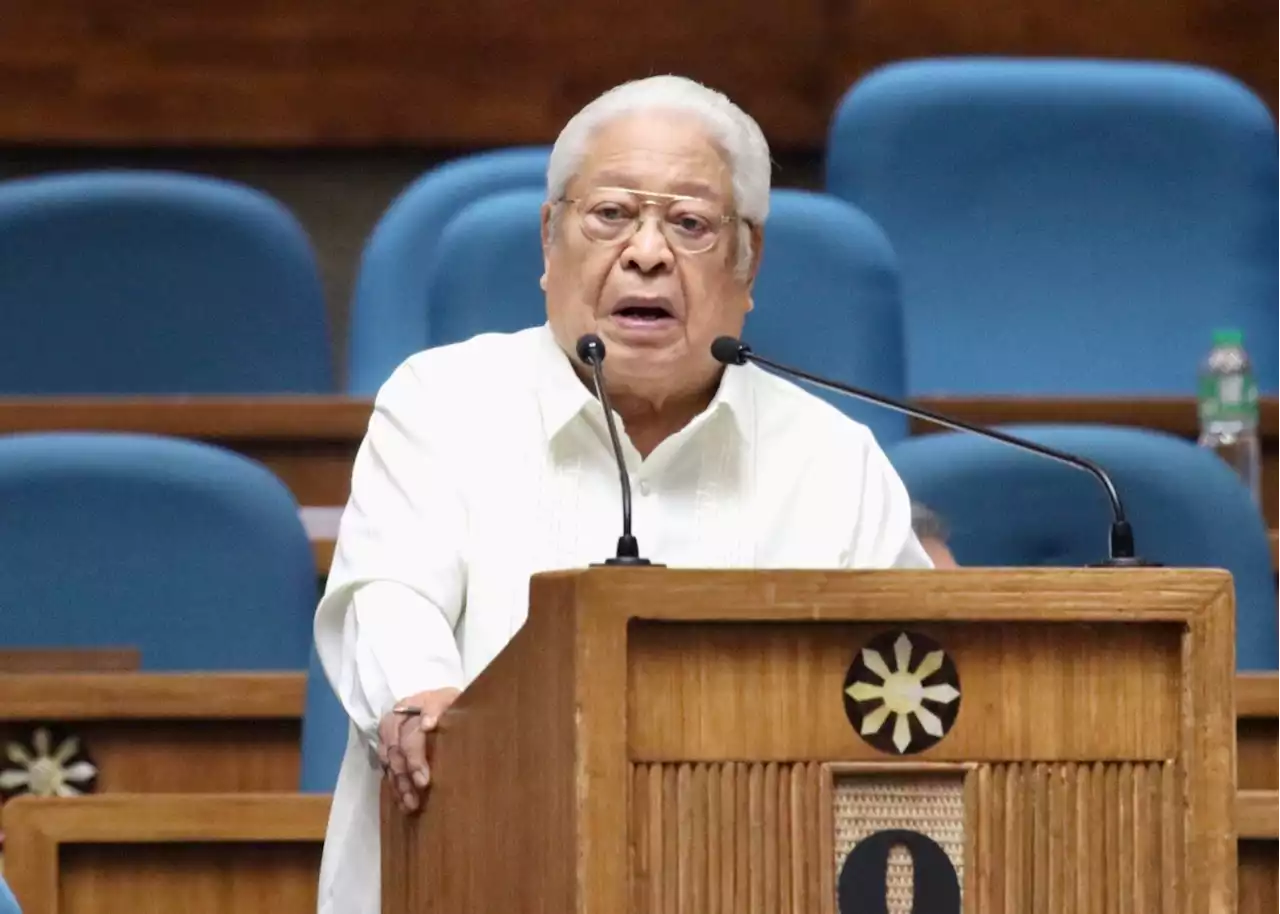

In 2-hour interpellation, Lagman lobbies to delay Maharlika fund's passageThe opposition lawmaker wants the House to wait until 2023 before the bill is passed. There is no doubt that the Maharlika fund proposal will hurdle Congress once a vote is called.

In 2-hour interpellation, Lagman lobbies to delay Maharlika fund's passageThe opposition lawmaker wants the House to wait until 2023 before the bill is passed. There is no doubt that the Maharlika fund proposal will hurdle Congress once a vote is called.

Read more »

Maharlika Wealth Fund: Devil is in the details - BusinessWorld OnlineUnlike the Pharmally fiasco and the P200 million SSS thievery back in the day of then President Erap, there are probably sincere objectives for national progress behind the sponsors of the proposed Maharlika Wealth Fund bill. The fact that otherwise admirable Congresswoman Stella Quimbo is so passionately for it indicates this. However, there are too […]

Maharlika Wealth Fund: Devil is in the details - BusinessWorld OnlineUnlike the Pharmally fiasco and the P200 million SSS thievery back in the day of then President Erap, there are probably sincere objectives for national progress behind the sponsors of the proposed Maharlika Wealth Fund bill. The fact that otherwise admirable Congresswoman Stella Quimbo is so passionately for it indicates this. However, there are too […]

Read more »

NEDA chief advises caution over Maharlika fund: ‘It’s a governance issue’For the Maharlika fund to work, NEDA Secretary Arsenio Balisacan says investments should go towards priority development programs.

NEDA chief advises caution over Maharlika fund: ‘It’s a governance issue’For the Maharlika fund to work, NEDA Secretary Arsenio Balisacan says investments should go towards priority development programs.

Read more »

Finance chief Diokno seeks Marcos urgent seal on Maharlika Fund bill“This is to respectfully request His Excellency to certify as urgent House Bill (HB) No. 6608, establishing the Maharlika Investment Fund (MIF or ‘Fund’), filed as Committee Report No. 237 by the Committees on Bank and Financial Intermediaries, Appropriations, and Way and Means,” Diokno said in a letter to the President dated December 13, 2022.

Finance chief Diokno seeks Marcos urgent seal on Maharlika Fund bill“This is to respectfully request His Excellency to certify as urgent House Bill (HB) No. 6608, establishing the Maharlika Investment Fund (MIF or ‘Fund’), filed as Committee Report No. 237 by the Committees on Bank and Financial Intermediaries, Appropriations, and Way and Means,” Diokno said in a letter to the President dated December 13, 2022.

Read more »

Maharlika mess: Where is the development framework? - BusinessMirrorThe authors of the Maharlika Wealth Fund claim they started on a wrong foot. The truth is that the original proposal was a total disaster. The discerning public could not believe that the proposed bill creating a sovereign wealth fund would have the following features: sequestration of workers’ pension savings as seed capital, wholesale disregard

Maharlika mess: Where is the development framework? - BusinessMirrorThe authors of the Maharlika Wealth Fund claim they started on a wrong foot. The truth is that the original proposal was a total disaster. The discerning public could not believe that the proposed bill creating a sovereign wealth fund would have the following features: sequestration of workers’ pension savings as seed capital, wholesale disregard

Read more »