GBP/USD holds ground in the positive territory, hovering around 1.2650 during the Asian session on Tuesday. The pair gained ground on improved risk appetite ahead of Consumer Price Index data scheduled on Wednesday.

GBP/USD gained ground on risk-on sentiment ahead of US consumer prices. CME FedWatch Tool suggests the likelihood of a Fed rate cut in June has decreased to 51.1%. BRC Like-For-Like Retail Sales grew by 3.2% YoY in March, marking the strongest growth since August 2023. The US Dollar faces challenges amid market fluctuations, influenced by the cautious stance of the Federal Reserve .

This boost was largely attributed to an early Easter period, which led to increased food sales ahead of the extended weekend. Moving forward, the Pound Sterling could be influenced by the release of monthly Gross Domestic Product and factory data for February, scheduled for publication on Friday.Bank of England Governor Andrew Bailey is expected to appear on Tuesday. However, he may not delve much into discussions regarding the economy or policy during this session.

GBP/USD Risk-On Sentiment US Consumer Prices CME Fedwatch Tool Rate Cut BRC Like-For-Like Retail Sales Federal Reserve Inflation

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

GBP/USD gains ground near the 1.2800 barrier, BoE rate decision eyedThe GBP/USD pair gains momentum during the early Asian trading hours on Thursday.

GBP/USD gains ground near the 1.2800 barrier, BoE rate decision eyedThe GBP/USD pair gains momentum during the early Asian trading hours on Thursday.

Read more »

GBP/USD holds positive ground above the 1.2600 mark, investors await Fed, BoE policymakers' speechThe GBP/USD pair holds positive ground above the 1.2600 psychological support during the early European session on Monday.

GBP/USD holds positive ground above the 1.2600 mark, investors await Fed, BoE policymakers' speechThe GBP/USD pair holds positive ground above the 1.2600 psychological support during the early European session on Monday.

Read more »

GBP/USD hovers around 1.2530 after paring gains, focus on US ISM Manufacturing PMIGBP/USD trims intraday gains, remaining higher around 1.2530 during the Asian hours on Monday.

GBP/USD hovers around 1.2530 after paring gains, focus on US ISM Manufacturing PMIGBP/USD trims intraday gains, remaining higher around 1.2530 during the Asian hours on Monday.

Read more »

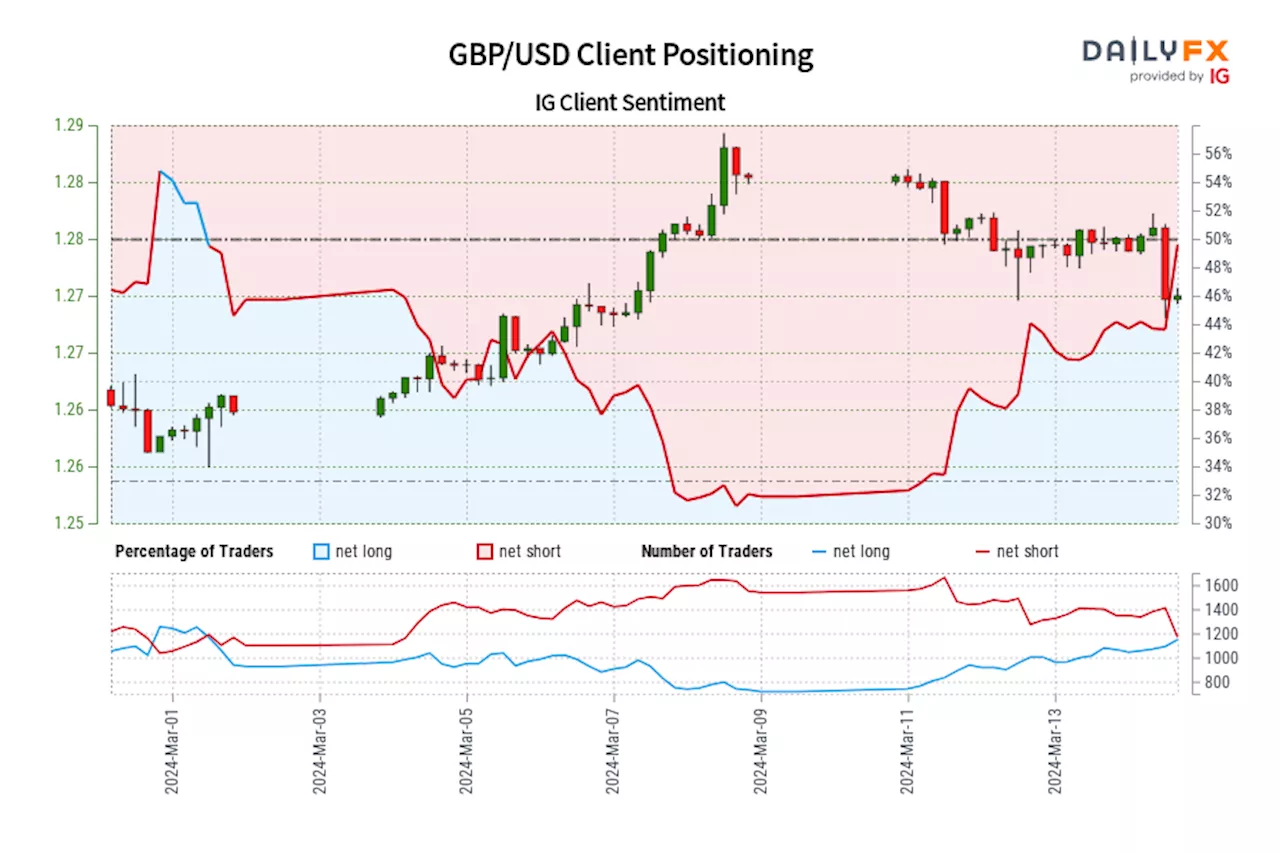

GBP/USD IG Client Sentiment: Our data shows traders are now net-long GBP/USD for the first time since Mar 01, 2024 when GBP/USD traded near 1.26.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBP/USD-bearish contrarian trading bias.

GBP/USD IG Client Sentiment: Our data shows traders are now net-long GBP/USD for the first time since Mar 01, 2024 when GBP/USD traded near 1.26.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBP/USD-bearish contrarian trading bias.

Read more »

GBP/USD holds above the 1.2800 mark ahead of US Retail Sales dataThe GBP/USD pair hovers around the 1.2800 mark during the early Asian trading hours on Thursday.

GBP/USD holds above the 1.2800 mark ahead of US Retail Sales dataThe GBP/USD pair hovers around the 1.2800 mark during the early Asian trading hours on Thursday.

Read more »

GBP/USD holds above the 1.2700 mark, UK CPI, Fed rate decision eyedThe GBP/USD pair trades in negative territory for the fifth consecutive day during the early Asian session on Wednesday.

GBP/USD holds above the 1.2700 mark, UK CPI, Fed rate decision eyedThe GBP/USD pair trades in negative territory for the fifth consecutive day during the early Asian session on Wednesday.

Read more »