Goldman Sachs is creating a new unit, the Capital Solutions Group, to bolster its private credit and equity financing operations. The move aims to address competition from private credit funds and capitalize on the growing demand for alternative investment financing.

Goldman Sachs has said it will build a new unit to expand its financing operations, as the bank looks to combat mounting competition from private credit funds and better position itself to lend to the alternative investment behemoths that now dominate Wall Street.

The newly created Capital Solutions Group will be made up of bankers who have a speciality in working with private credit and private equity funds, as well as others who directly structure the types of transactions — often leveraged buyouts — that are financed by those investors. ‘There is significant demand from our investing clients for private credit and private equity — from investment grade and leveraged lending to hybrid capital and asset-backed finance as well as equity,’ chief executive David Solomon said, adding that the bank would seek to ‘channel the growing synergies between our clients in global banking and markets and those in asset and wealth management’. The rise of private credit firms has created a complex problem for banks that service them as clients but also compete with them in financing. Several large lenders, including Citigroup and Wells Fargo, have inked partnerships with private credit firms to boost their lending. Goldman has so far avoided similar splashy tie-ups as it competes against the funds that are increasingly winning more of the business financing large corporate transactions, and other areas of lending. At the same time, Goldman is also trying to woo those same firms as clients, including providing them financing for deals. Goldman said the new group would be led by Peter Lyon, who had previously been the New York group’s top banker to other financial firms, and Mahesh Saireddy, who had headed up the mortgage and structured finance division. The two executives are being added to the firm’s management committee. Goldman has already expanded its lending to private equity and credit funds. The group’s loans to non-bank financial firms totalled $86bn at the end of the third quarter, up nearly a third in the previous year from $65bn. Loans to these firms now make up nearly half of all lending by Goldman. Regulations in the aftermath of the 2008 financial crisis made it difficult for banks like Goldman to finance particularly risky buyouts from their own balance sheets. However, banks mostly have the green light to provide leverage to funds that want to finance those same deals — exposing the bank to the risk of a fund as opposed to an individual company. Goldman’s asset management arm has for many years been a major player in private credit, having managed similar funds even before the term was coined. Previously known as merchant banking, the firm raised tens of billions of dollars for funds to make private loans to businesses, in many cases through transactions organised by the firm’s investment banking arm

PRIVATE CREDIT PRIVATE EQUITY GOLDMAN SACHS FINANCING INVESTING

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Goldman Sachs’ investment arm agrees €2bn deal for drugmaker SynthonDeal with BC Partners aims to capitalise on rising demand for off-patent versions of complex drugs

Goldman Sachs’ investment arm agrees €2bn deal for drugmaker SynthonDeal with BC Partners aims to capitalise on rising demand for off-patent versions of complex drugs

Read more »

Goldman Sachs: High Spare Capacity Weighs on Brent Crude PricesGoldman Sachs analysts predict Brent crude prices will average $76 per barrel in 2025 due to high spare production capacity and an expected surplus.

Goldman Sachs: High Spare Capacity Weighs on Brent Crude PricesGoldman Sachs analysts predict Brent crude prices will average $76 per barrel in 2025 due to high spare production capacity and an expected surplus.

Read more »

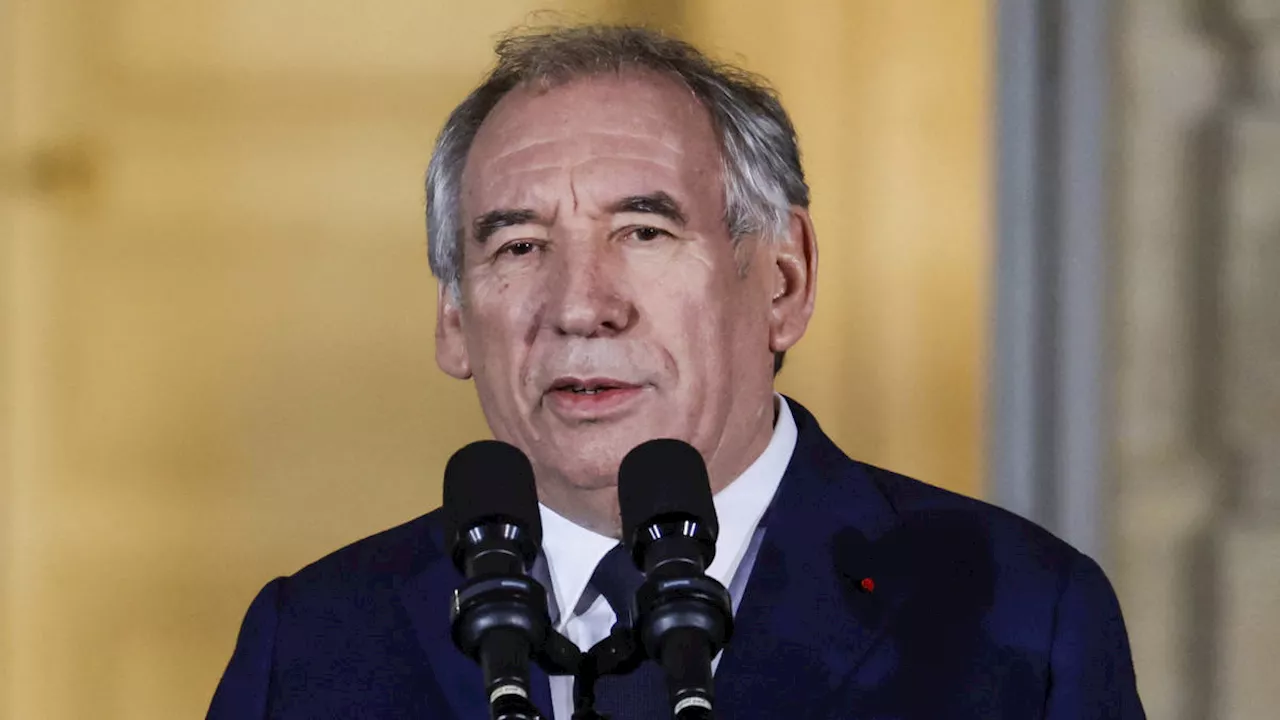

France Forms New Government Amid Political TurmoilPresident Macron appoints a new Prime Minister, Francois Bayrou, to lead a government composed of both outgoing and new figures. The new Cabinet faces challenges including political deadlock and pressure to reduce France's debt.

France Forms New Government Amid Political TurmoilPresident Macron appoints a new Prime Minister, Francois Bayrou, to lead a government composed of both outgoing and new figures. The new Cabinet faces challenges including political deadlock and pressure to reduce France's debt.

Read more »

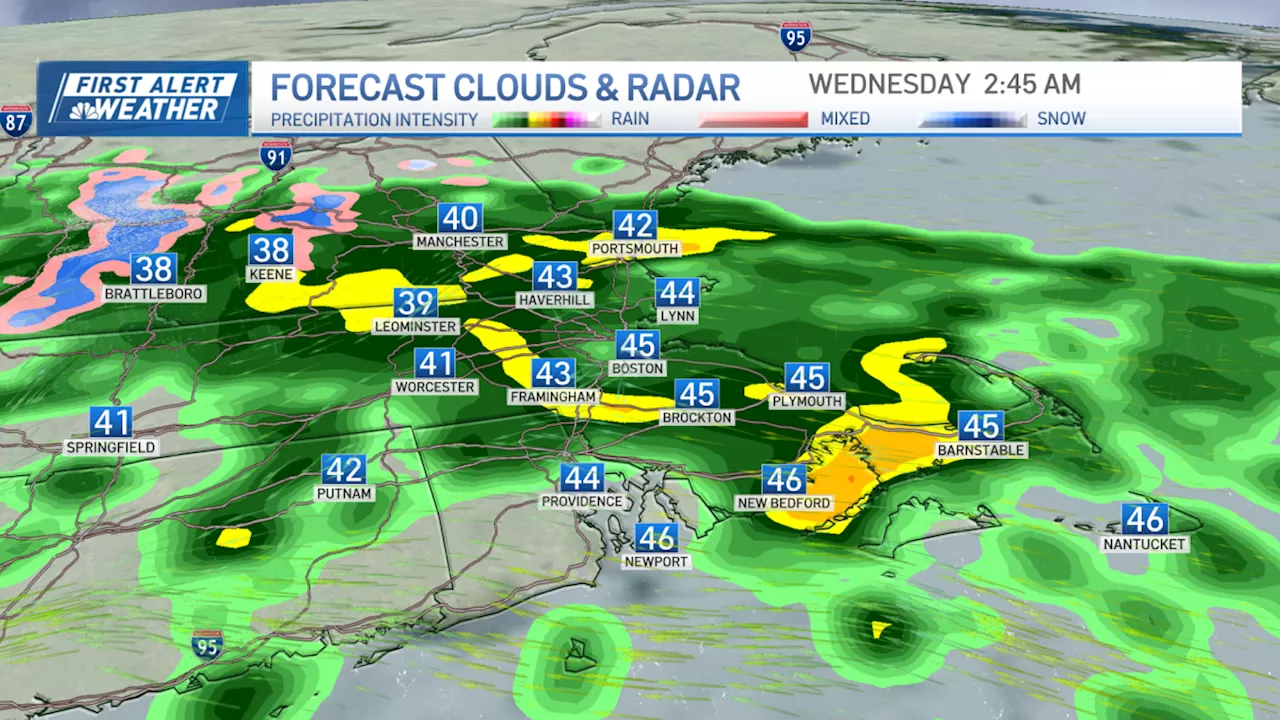

New Year's Eve Rain and Chilly New Year in Store for New EnglandNew Year's Eve will be dry with mild temperatures until midnight when showers begin and last through New Year's Day. A colder air mass moves in Wednesday bringing snow to northern New England. Strong winds expected Thursday combined with snow could cause power outages and damage. Lake-effect and ocean effect snow possible northwest and off the coast, but much of New England will see a dry, sunny, and chilly weekend. A potential storm next week could bring rain and snow to southern New England.

New Year's Eve Rain and Chilly New Year in Store for New EnglandNew Year's Eve will be dry with mild temperatures until midnight when showers begin and last through New Year's Day. A colder air mass moves in Wednesday bringing snow to northern New England. Strong winds expected Thursday combined with snow could cause power outages and damage. Lake-effect and ocean effect snow possible northwest and off the coast, but much of New England will see a dry, sunny, and chilly weekend. A potential storm next week could bring rain and snow to southern New England.

Read more »

New Governor, New Challenges for New Hampshire RepublicansNew Hampshire's incoming governor faces a host of pressing issues, including housing affordability, homelessness, and a challenging budget cycle. Simultaneously, the state GOP is undergoing a leadership change, raising questions about the party's direction and future prospects.

New Governor, New Challenges for New Hampshire RepublicansNew Hampshire's incoming governor faces a host of pressing issues, including housing affordability, homelessness, and a challenging budget cycle. Simultaneously, the state GOP is undergoing a leadership change, raising questions about the party's direction and future prospects.

Read more »

Alex Goldman's New Podcast, Hyperfixed, Tackles Life's Intractable ProblemsThe new podcast, Hyperfixed, hosted by Alex Goldman, focuses on answering listeners' complex questions through in-depth research and conversations with various individuals. Goldman's previous success with Reply All, where he explored tech-related conundrums with co-host PJ Vogt, sets high expectations for this solo venture.

Alex Goldman's New Podcast, Hyperfixed, Tackles Life's Intractable ProblemsThe new podcast, Hyperfixed, hosted by Alex Goldman, focuses on answering listeners' complex questions through in-depth research and conversations with various individuals. Goldman's previous success with Reply All, where he explored tech-related conundrums with co-host PJ Vogt, sets high expectations for this solo venture.

Read more »