The proposed sovereign wealth fund or the Maharlika Investment Fund (MIF) does not have enough safeguards to protect public funds from losses or being looted, Bayan Muna chairperson Neri Colmenares said Monday.

which allocates as capital for the proposed fund P250 billion from state financial institutions—including pension funds SSS and GSIS—and P25 billion from the National Treasury.

“Safeguards? The bill states the fund will be exempted from regulatory restrictions. It is exempted from the Procurement law which was crafted to prevent lack of public bidding. It will be exempted from tax laws, not only the Maharlika fund transaction but all those connected and related transactions. Given that, what will be left for the COA [Commission on Audit] to audit?” he added.

“[I]t is not right to say this initiative does not have any risk. In fact, there are insufficient safeguards,” Colmenares added. “When it comes to these things, you say you don’t have funds, but for the Maharlika fund, you have P125 billion,” Castro added.“The health emergency allowance for health workers has long been signed into law by former President Rodrigo Duterte but until now, it remains unfunded. The health workers are demoralized already,” Mendoza said.

Salceda's statement also said that tax provisions of the MIF Act that have been approved "ensure that the benefits of the tax savings go purely towards the investment fund, increasing potential returns for the SSS and the GSIS." In a separate statement, former senator Paolo Benigno Aquino IV said that his proposal creating a sovereign wealth fund back in 2016 was made under different circumstances.

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

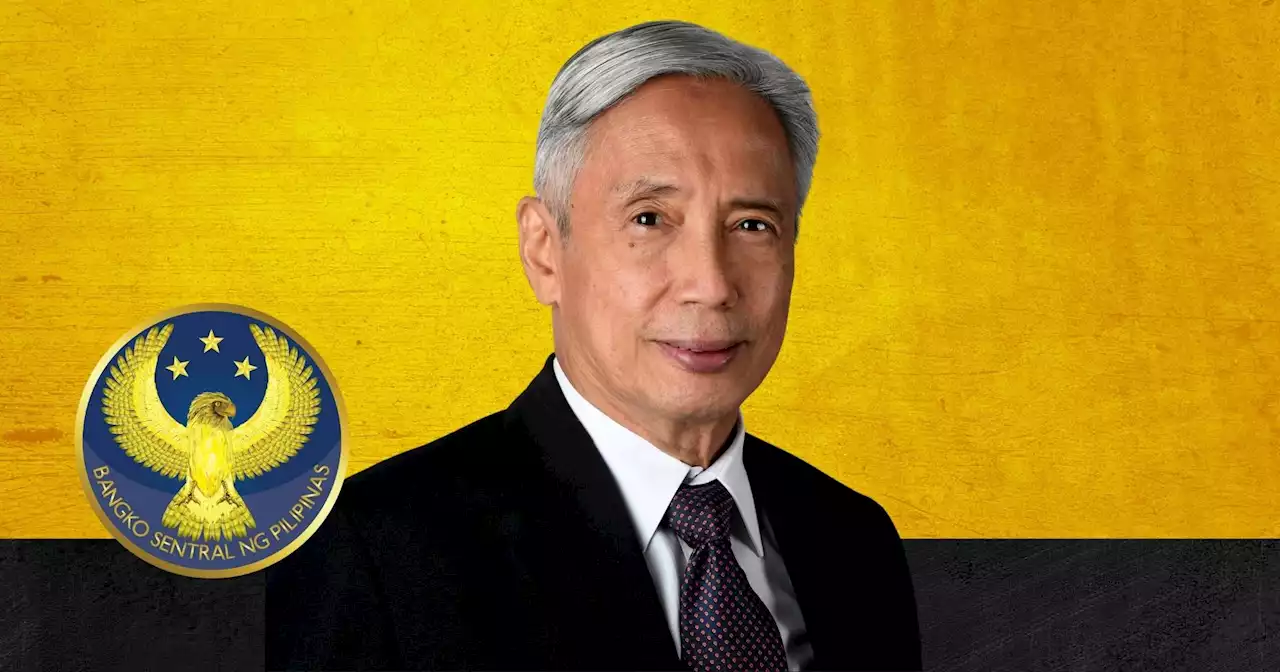

BSP chief joins concerned groups on Maharlika Fund - BusinessMirrorPrimarily pushed by House Speaker Rep. Martin Romualdez and Deputy Majority Leader Sandro Marcos, HB 6398 proposes to use pension funds under the Social Security System and Government Service Insurance System, as well as funds of state-owned Land Bank of the Philippines and Development Bank of the Philippines, as seed capital for the Maharlika Wealth Fund

BSP chief joins concerned groups on Maharlika Fund - BusinessMirrorPrimarily pushed by House Speaker Rep. Martin Romualdez and Deputy Majority Leader Sandro Marcos, HB 6398 proposes to use pension funds under the Social Security System and Government Service Insurance System, as well as funds of state-owned Land Bank of the Philippines and Development Bank of the Philippines, as seed capital for the Maharlika Wealth Fund

Read more »

Sandro denies 'railroading' of Maharlika Wealth FundSenior Deputy Majority Leader and Ilocos Norte 1st district Rep. Sandro Marcos refuted claims Monday, Dec. 5 that the proposed P275-billion Maharlika Wealth Fund (MWF) is being “railroaded” in the House of Representatives.

Sandro denies 'railroading' of Maharlika Wealth FundSenior Deputy Majority Leader and Ilocos Norte 1st district Rep. Sandro Marcos refuted claims Monday, Dec. 5 that the proposed P275-billion Maharlika Wealth Fund (MWF) is being “railroaded” in the House of Representatives.

Read more »

Arroyo: Marcos ultimately accountable for proposed Maharlika Investment Fund“The success of any fund, sovereign or private, lies in the quality of its management. In the current version of the Maharlika Wealth Fund, the President of the Philippines chairs its governing Board,” Arroyo said.“This is a powerful statement that the highest official of the land will hold himself as ultimately accountable to the Filipino people for the performance of the Fund,” she added.

Arroyo: Marcos ultimately accountable for proposed Maharlika Investment Fund“The success of any fund, sovereign or private, lies in the quality of its management. In the current version of the Maharlika Wealth Fund, the President of the Philippines chairs its governing Board,” Arroyo said.“This is a powerful statement that the highest official of the land will hold himself as ultimately accountable to the Filipino people for the performance of the Fund,” she added.

Read more »

Maharlika Wealth Fund wasn't PBBM's brainchild--SandroThe proposed P275-billion Maharlika Wealth Fund (MWF) wasn’t the idea of President Ferdinand “Bongbong” Marcos Jr. per se.

Maharlika Wealth Fund wasn't PBBM's brainchild--SandroThe proposed P275-billion Maharlika Wealth Fund (MWF) wasn’t the idea of President Ferdinand “Bongbong” Marcos Jr. per se.

Read more »

‘Maharlika Investment Fund’: Good idea or not? - BusinessMirrorA sovereign wealth fund (SWF) is an investment fund, a state-owned pool of money, with funding coming from surplus reserves from state-owned enterprises, reserves from budgeting excesses, foreign currency operations, and money from privatizations that is invested in various financial assets. The US state of Texas was the first in 1854 to establish a program

‘Maharlika Investment Fund’: Good idea or not? - BusinessMirrorA sovereign wealth fund (SWF) is an investment fund, a state-owned pool of money, with funding coming from surplus reserves from state-owned enterprises, reserves from budgeting excesses, foreign currency operations, and money from privatizations that is invested in various financial assets. The US state of Texas was the first in 1854 to establish a program

Read more »

Gov’t told: Give sufficient aid to poor instead of pushing for corruption-prone Maharlika wealth fundBrosas urged the government to heed the call to provide direct and sufficient aid to poverty-stricken Filipinos instead of directing its efforts toward the creation of the controversial Maharlika sovereign wealth fund. | BPinlacINQ

Gov’t told: Give sufficient aid to poor instead of pushing for corruption-prone Maharlika wealth fundBrosas urged the government to heed the call to provide direct and sufficient aid to poverty-stricken Filipinos instead of directing its efforts toward the creation of the controversial Maharlika sovereign wealth fund. | BPinlacINQ

Read more »