Since the RBA was formed in 1960, inflation has been up to 18 per cent and down to -1. Here’s how each governor dealt with their economic curveballs.

When Michele Bullock starts her new job on Monday she will be the Reserve Bank of Australia’s ninth governor since “Nugget” Coombs was appointed in 1960 to lead the newly formed institution.

Coombs got his first gig at the Commonwealth Bank of Australia in 1935 as an assistant to the organisation’s first economist, Sir Leslie Melville. Melville’s previous assistant, Mary Debenham, was forced by the Commonwealth Bank to resign after her marriage to Jock Phillips, who would become the RBA’s second governor.

Those controls had been in place since 1952 because Australia’s exports like wool, wheat and flour did not earn enough revenue to pay for the volume of imports required in a rapidly developing economy. Coombs was both a creature of the Great Depression and a disciple of Keynesian economics. He had played a leading role in the preparation of Labor treasurer Ben Chifley’s full-employment white paper in 1945. The paper committed the federal government to maintaining full employment as a matter of policy.

Coombs served as chancellor of the Australian National University from 1967 to 1976 and was named Australian of the Year in 1972. He also started the RBA’s valuable art collection.Phillips, who was Coombs’ deputy, took the reins as the RBA’s second governor as inflation started inching higher after decades of relative stability.

A recession followed, and by the end of Phillips’ term in 1975, unemployment had climbed to 5 per cent for the first time since 1940 and stagflation – the combination of rising inflation and rising joblessness – had put an end to the postwar golden age, both locally and abroad.Cornish says Phillips was a strong advocate for replacing the RBA’s lending controls with the market-based monetary policy seen today, but nothing would come of this push until the 1980s due to opposition from Treasury.

His calls to tighten policy by raising bank deposit requirements were frequently ignored by Fraser and his treasurer, John Howard, who were less keen on slowing the economy than the RBA, and Knight would have to make frequent appearances before cabinet to argue for action.

Johnston would use the RBA’s new toolkit to navigate currency crises in the mid-1980s, the Black Tuesday sharemarket crash in 1987, and the late-1980s credit and asset price bubble. Johnston rapidly increased the cash rate to 18 per cent from 10.5 per cent over the course of 1988 and 1989 to get on top of persistently high inflation.

The board had an emergency meeting in January 1990 to cut rates, and by November 1990 Australia was in the midst of what Keating famously described as “the recession we had to have”. But Keating wouldn’t approve the proposal, so from 1992 the RBA began to slip into Fraser’s speeches references to inflation being kept at 2 to 3 per cent.Cornish says the choice of 2 to 3 per cent was partly opportunistic, given inflation had fallen to this level, and partly a nod to the 1950s and 1960s economic “golden age”, where inflation largely hovered between 0 and 3 per cent.Leading the RBA between 1996 and 2006, Macfarlane presided over a period of almost uninterrupted expansion.

Under Macfarlane, the RBA’s independence and 2 to 3 per cent inflation target was formalised through the first statement on the conduct of monetary policy in 1996, signed by Macfarlane and then-treasurer Peter Costello. On the morning of October 8, 2008, as the global financial markets spun ever more rapidly out of control following the collapse of Lehman Brothers a few weeks earlier, theHaving just days earlier prepared to recommend his nine-member board approve a 50 basis point rate cut, Stevens sought the advice of his closest colleagues one final time.

The episode continues to elicit grumbles from some Liberals – people who generally ignore the broader economic reality of the time, which was dominated by rising inflation.Another difficult time came before the crisis struck in April 2008 when Stevens was attacked byon its front page as Australia’s “most useless man” for hiking interest rates when other central banks were cutting.

Lowe oversaw a period of dramatically shifting economic fortunes. Underlying inflation was within the RBA’s 2 per cent to 3 per cent target band for just six months of his seven-year tenure.

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

I rented a Tesla for a month. It was a steep learning curveA major car rental company was renting Teslas out for about one-third the cost of a petrol car. We figured, how different could it be?

I rented a Tesla for a month. It was a steep learning curveA major car rental company was renting Teslas out for about one-third the cost of a petrol car. We figured, how different could it be?

Read more »

Rugby World Cup 2023: what to look out for on the second weekendSouth Africa’s selection puzzler; Samoa want more time with tier one; Tshiunza’s steep learning curve; and fuelling with baguettes

Rugby World Cup 2023: what to look out for on the second weekendSouth Africa’s selection puzzler; Samoa want more time with tier one; Tshiunza’s steep learning curve; and fuelling with baguettes

Read more »

Eight of the best homes for sale in Sydney right nowLooking for your next home in Sydney? We’ve got you covered, from a cleverly crafted Redfern home to a Kirribilli apartment with stunning views.

Eight of the best homes for sale in Sydney right nowLooking for your next home in Sydney? We’ve got you covered, from a cleverly crafted Redfern home to a Kirribilli apartment with stunning views.

Read more »

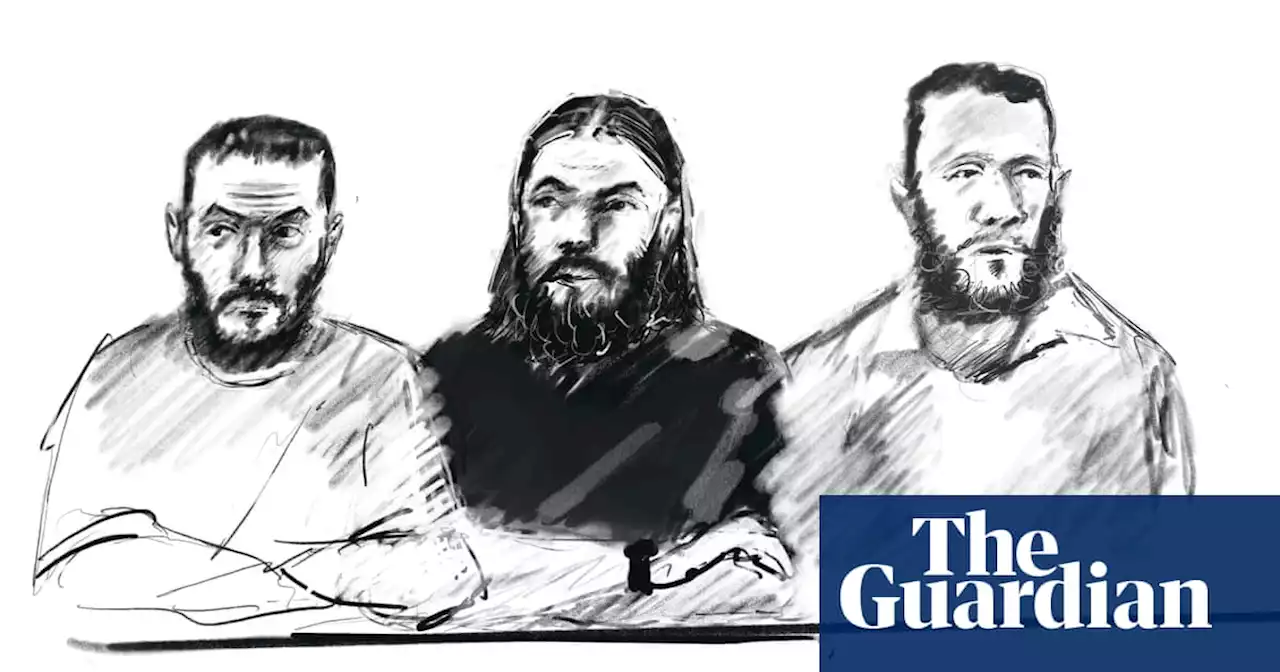

Eight men sentenced over 2016 Brussels bombings, ending Belgium’s largest-ever criminal trialTerms ranged up to life in prison and included high-profile culprits Salah Abdeslam and Mohamed Abrini

Eight men sentenced over 2016 Brussels bombings, ending Belgium’s largest-ever criminal trialTerms ranged up to life in prison and included high-profile culprits Salah Abdeslam and Mohamed Abrini

Read more »

Eight arrested, $5000 in counterfeit notes seized in MelbourneA group of eight men, allegedly armed with knives, was seen entering a car park on Flinders Street at about 9.50am Saturday.

Eight arrested, $5000 in counterfeit notes seized in MelbourneA group of eight men, allegedly armed with knives, was seen entering a car park on Flinders Street at about 9.50am Saturday.

Read more »

Penny had an eight-week-old baby when there were fires in neighbouring bushland. She didn't wait aroundPenny Buchan, from Sydney's south, loves living in a place that fronts onto bush, except for the 'scary days'.

Penny had an eight-week-old baby when there were fires in neighbouring bushland. She didn't wait aroundPenny Buchan, from Sydney's south, loves living in a place that fronts onto bush, except for the 'scary days'.

Read more »