We went shopping with Utah consumers, to see how much the state's sales tax on food costs them — and how much they might gain if the tax is eliminated. The proposal has been used as an incentive to pass other tax laws, and was part of the now-voided Amendment A on this year's ballot.

The Salt Lake Tribune went grocery shopping with Utahns and checked their receipts to see how much they would save if lawmakers eliminated the state tax on food.

Consumers currently pay 3% in sales taxes on grocery food in Utah: 1.75% is levied by the state, and 1.25% is charged by local governments. He also bought corn and other vegetables, cheese crackers and a couple of Lunchables for his kids’ lunches. He picked up a few kinds of cereal , as well as blueberries and grapes for his kids to snack on.

Hunting is “very quintessential Mountain West for a lot of people,” Warner said, but when he moved up to Salt Lake City for college, “people thought that was kind of strange.” With her income limited to Social Security benefits, she said, she tries not to spend more than $50 a week on food. She usually eats one full meal a day, she said, and otherwise snacks between meals.

This was a pretty typical grocery shopping trip for Paxman, she said. Sometimes she shops at a nearby Smith’s, “if they have something good on sale.” But he lost his job a little over a year ago. Now he’s in the midst of a “career transition,” he said, working various jobs and finding multiple sources of income while he works to complete a data analytics boot camp through UC Berkeley Extension.

His family lives equidistant to a Ream’s, a Smith’s, a Macey’s, a Walmart and a Harmons, he said, but he finds Harmons’ prices too high as he shops for seven people. He often will have apps for multiple stores open on his phone at the same time, he said, so he can compare prices with a few taps. In general, anything you’d have to prepare yourself, or that isn’t ready to eat as soon as it’s purchased, is taxed as grocery food. Anything that doesn’t provide nutritional value, or is ready to eat as soon as it’s purchased, is taxed as “non-food/prepared food.”

Jason Gardner, the spokesperson for the Utah State Tax Commission, summed it up like this: If you went into a convenience store and bought a bottled soda, that would be taxed according to the 3% rate, because you could take it home and put it in your fridge, and if you consumed it later, it would be in the same state as when you purchased it.

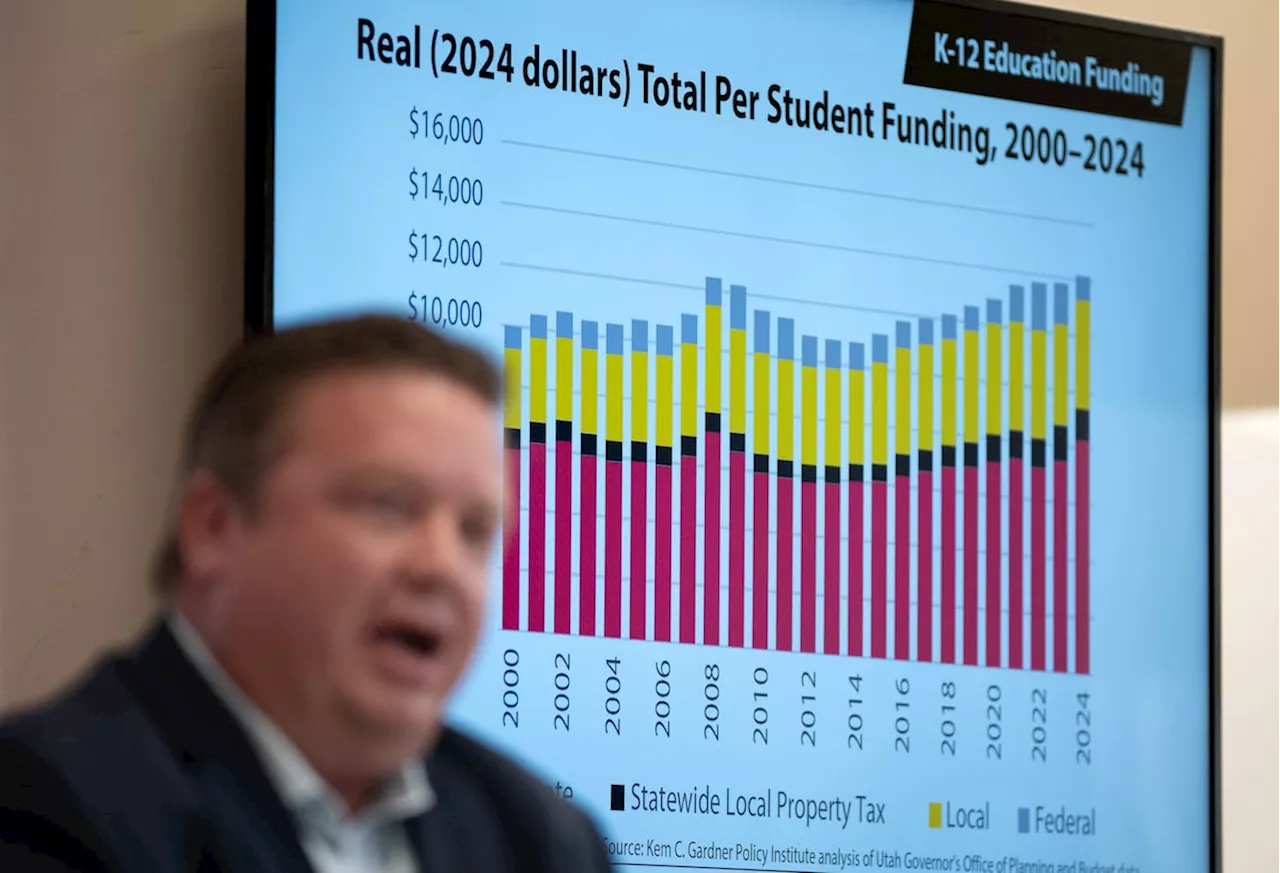

“If there was the will in the Legislature and leadership was behind it, they could do this legislatively,” Cornia told The Tribune. “They do not need to tie it to this larger change that they want to make.” Rep. Judy Weeks Rohner, R-West Valley City, testified to a Utah Senate committee in February 2023 — as Amendment A was being proposed — that “Utahns have made it clear that removing the tax on food is a top priority. Rising costs of groceries and high inflation have impacted Utahns across the state.”the state would give up roughly $200 million in revenue by eliminating the sales tax on food — money that would have been going into the state’s general fund.

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Voices: As the president of Utah PTA, I urge you to vote against Amendment A“Last year, a prominent lobbyist for Utah private schools said she wants to ‘destroy public education’ with vouchers. She is right — that is exactly what would happen should Amendment A pass,” writes Corey Fairholm, president of Utah PTA.

Voices: As the president of Utah PTA, I urge you to vote against Amendment A“Last year, a prominent lobbyist for Utah private schools said she wants to ‘destroy public education’ with vouchers. She is right — that is exactly what would happen should Amendment A pass,” writes Corey Fairholm, president of Utah PTA.

Read more »

Utah Supreme Court Hears Arguments On Counting Votes For Amendment DThe Utah Supreme Court is hearing arguments on whether votes for or against Amendment D, a proposed constitutional amendment that would enshrine the Legislature’s ability to repeal or amend voter-approved ballot initiatives, should be counted in November’s general election.

Utah Supreme Court Hears Arguments On Counting Votes For Amendment DThe Utah Supreme Court is hearing arguments on whether votes for or against Amendment D, a proposed constitutional amendment that would enshrine the Legislature’s ability to repeal or amend voter-approved ballot initiatives, should be counted in November’s general election.

Read more »

Utah Supreme Court to decide the fate of constitutional Amendment DThe Utah Supreme Court on Wednesday held oral arguments on the validity of proposed constitutional Amendment D after a lower court voided the question that will go before voters in November

Utah Supreme Court to decide the fate of constitutional Amendment DThe Utah Supreme Court on Wednesday held oral arguments on the validity of proposed constitutional Amendment D after a lower court voided the question that will go before voters in November

Read more »

Utah Supreme Court Hears Arguments On Proposed Constitutional AmendmentThe Utah Supreme Court heard arguments Wednesday on a proposed constitutional amendment that would change the way legislators are elected in the state.

Utah Supreme Court Hears Arguments On Proposed Constitutional AmendmentThe Utah Supreme Court heard arguments Wednesday on a proposed constitutional amendment that would change the way legislators are elected in the state.

Read more »

Utah Supreme Court upholds decision to void Amendment DBen Winslow is a reporter with FOX 13 covering a variety of topics including government, the Great Salt Lake, vice and polygamy.

Utah Supreme Court upholds decision to void Amendment DBen Winslow is a reporter with FOX 13 covering a variety of topics including government, the Great Salt Lake, vice and polygamy.

Read more »

Utah Supreme Court Overturns Controversial Amendment D, Upholding Voter RightsThe Utah Supreme Court has unanimously ruled against a proposed constitutional amendment, Amendment D, citing its misleading ballot language and interference with voter initiatives. The decision marks a victory for those who sought to preserve the power of the people to shape state policy.

Utah Supreme Court Overturns Controversial Amendment D, Upholding Voter RightsThe Utah Supreme Court has unanimously ruled against a proposed constitutional amendment, Amendment D, citing its misleading ballot language and interference with voter initiatives. The decision marks a victory for those who sought to preserve the power of the people to shape state policy.

Read more »