The Internal Revenue Service (IRS) has issued a warning about fraudulent tax return preparers who may scam taxpayers out of their refunds and personal information.

Our content is fact checked by our senior editorial staff to reflect accuracy and ensure our readers get sound information and advice to make the smartest, healthiest choices.

Werfel concluded,"We urge people to choose a trusted tax professional that will be around if questions arise later." Another giveaway of a shady preparer is if they don't sign the tax return. The IRS notes that paid preparers are required to sign and include their preparer tax identification number on each return they complete. A ghost preparer doesn't sign a complete paper return or a digital form, the agency warns.

IRS Tax Preparers Scam Fraudulent Refunds Personal Information

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

IRS Warns of 'Elaborate Scam' to Steal Your Tax Refund in New AlertDigital destination for sophisticated men & women. Live your best life with expert tips and news on health, food, sex, relationships, fashion and lifestyle.

IRS Warns of 'Elaborate Scam' to Steal Your Tax Refund in New AlertDigital destination for sophisticated men & women. Live your best life with expert tips and news on health, food, sex, relationships, fashion and lifestyle.

Read more »

IRS Warns Americans to Claim $1 Billion in Unclaimed Tax RefundsThe IRS is urging taxpayers to submit their tax returns for unclaimed refunds worth over $1 billion for the 2020 tax year before the May 17 deadline. Nearly 940,000 people nationwide are eligible for these refunds, with Texas, California, Florida, and New York having the largest number of eligible taxpayers. The median refund for 2020 is $932, and low- and moderate-income workers can also claim the Earned Income Tax Credit.

IRS Warns Americans to Claim $1 Billion in Unclaimed Tax RefundsThe IRS is urging taxpayers to submit their tax returns for unclaimed refunds worth over $1 billion for the 2020 tax year before the May 17 deadline. Nearly 940,000 people nationwide are eligible for these refunds, with Texas, California, Florida, and New York having the largest number of eligible taxpayers. The median refund for 2020 is $932, and low- and moderate-income workers can also claim the Earned Income Tax Credit.

Read more »

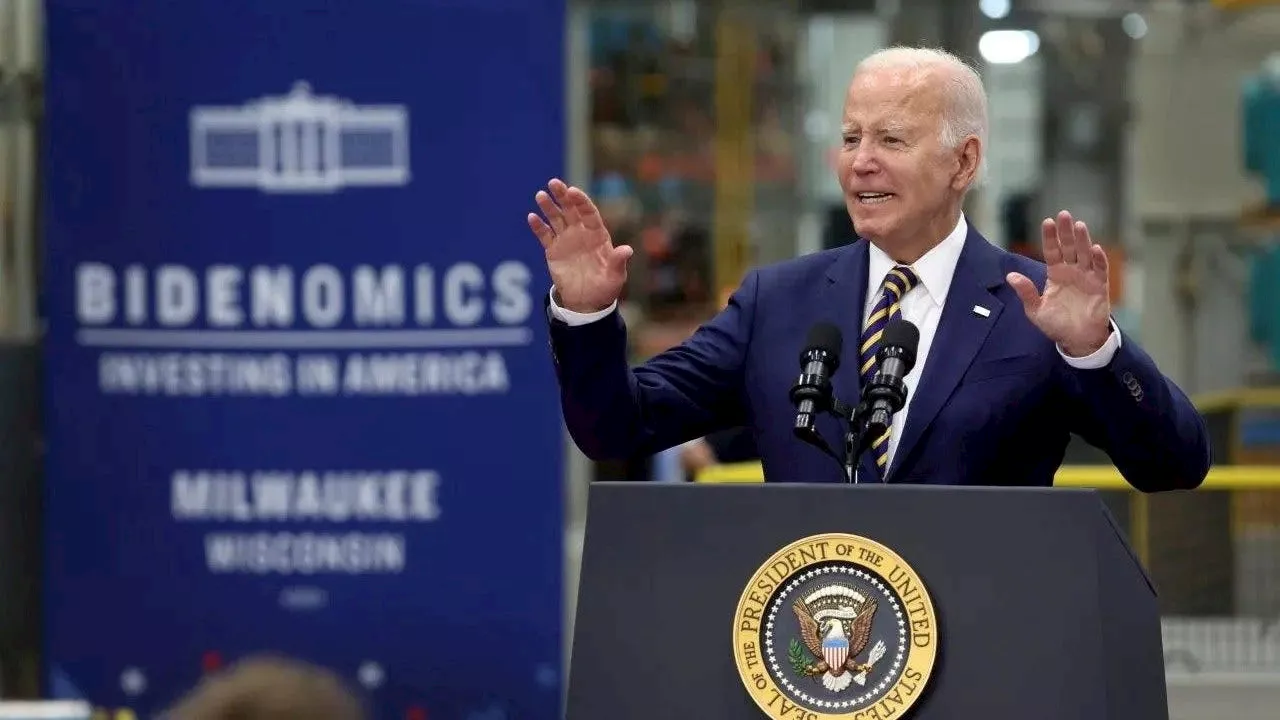

Biden's Tax Hikes Could Weigh on Fragile U.S. Economy, Tax Foundation WarnsThe Tax Foundation warns that President Biden's proposed tax hikes targeting corporations and wealthy Americans could have a negative impact on the already-fragile U.S. economy. According to their findings, the higher taxes outlined in Biden's budget blueprint for fiscal 2025 would reduce economic output, slash wages, and result in job losses. The Tax Foundation also criticizes the plan for making the tax code more complicated and expanding spending for non-revenue related policy goals.

Biden's Tax Hikes Could Weigh on Fragile U.S. Economy, Tax Foundation WarnsThe Tax Foundation warns that President Biden's proposed tax hikes targeting corporations and wealthy Americans could have a negative impact on the already-fragile U.S. economy. According to their findings, the higher taxes outlined in Biden's budget blueprint for fiscal 2025 would reduce economic output, slash wages, and result in job losses. The Tax Foundation also criticizes the plan for making the tax code more complicated and expanding spending for non-revenue related policy goals.

Read more »

IRS claws back money given to businesses under fraud-ridden COVID-era tax credit programThe IRS says it’s making progress with initiatives to claw back money improperly distributed under the Employee Retention Credit

IRS claws back money given to businesses under fraud-ridden COVID-era tax credit programThe IRS says it’s making progress with initiatives to claw back money improperly distributed under the Employee Retention Credit

Read more »

IRS claws back money given to businesses under fraud-ridden COVID-era tax credit programThe IRS says it’s making progress with initiatives to claw back money improperly distributed under the Employee Retention Credit.

IRS claws back money given to businesses under fraud-ridden COVID-era tax credit programThe IRS says it’s making progress with initiatives to claw back money improperly distributed under the Employee Retention Credit.

Read more »

IRS claws back money given to businesses under fraud-ridden COVID-era tax credit programThe IRS says it’s making progress with initiatives to claw back money improperly distributed under the Employee Retention Credit.

IRS claws back money given to businesses under fraud-ridden COVID-era tax credit programThe IRS says it’s making progress with initiatives to claw back money improperly distributed under the Employee Retention Credit.

Read more »