A group of junior bondholders at Thames Water has challenged the proposed £3bn emergency loan from senior creditors, alleging predatory conditions and an attempt to circumvent regulatory oversight. The bondholders are seeking court approval for their own rival plan, raising concerns about the company's financial stability and the potential for nationalization.

Thames Water ’s junior bondholders have accused the troubled utility’s senior creditors of attaching “predatory” conditions to a £3bn emergency loan , which they claim is an attempt to “sidestep” regulatory oversight. The claims by a group of Thames Water ’s so-called class B bondholders came on Tuesday as it formally filed paperwork to seek court approval for its own rival loan proposal.

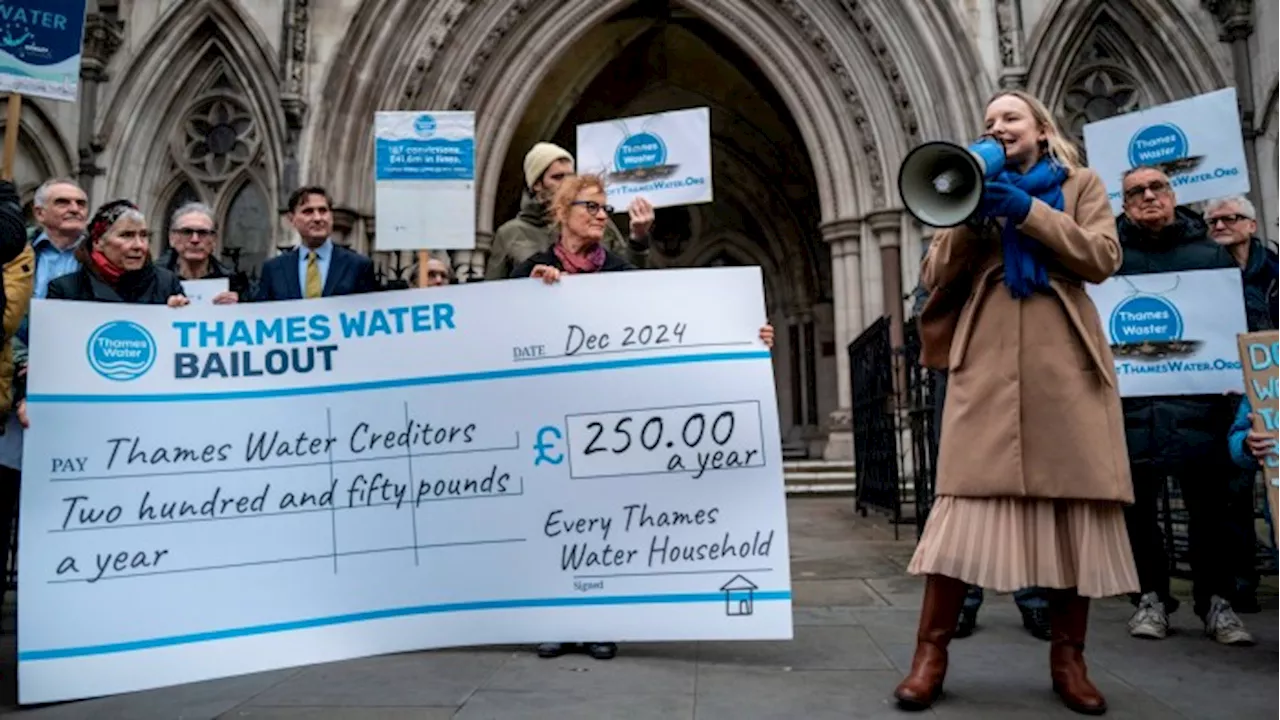

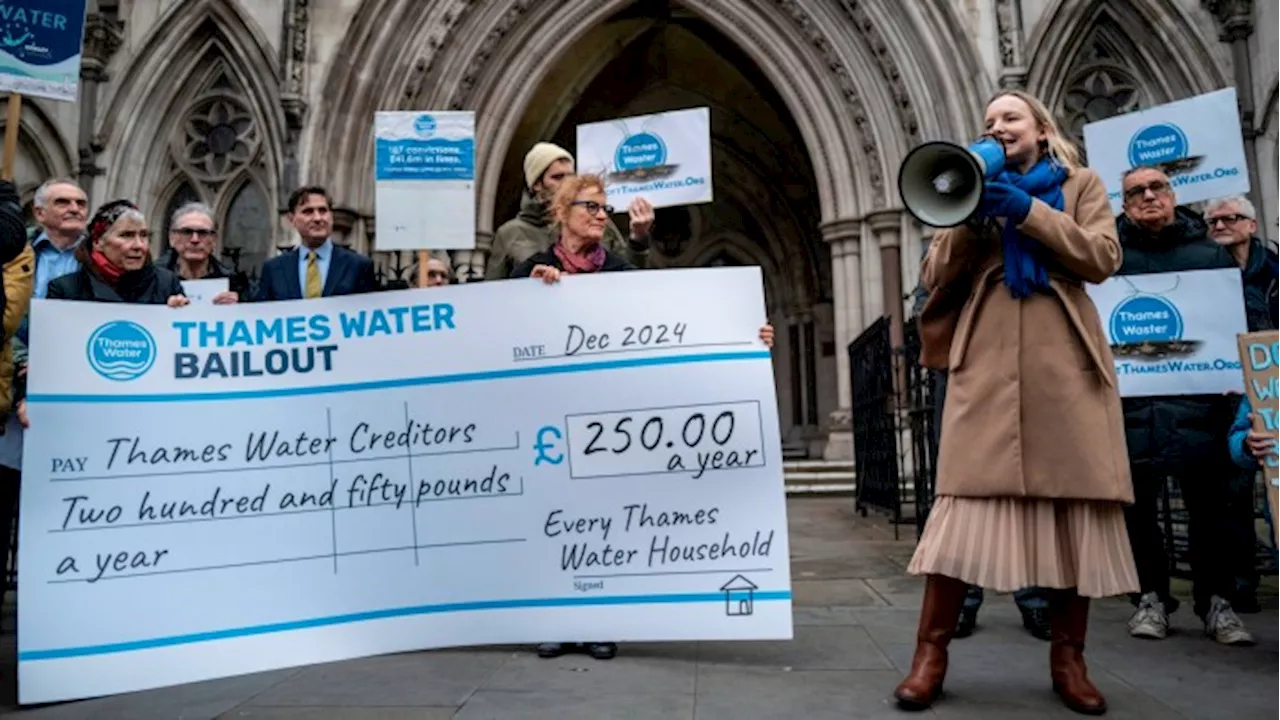

Thames Water, which is the UK’s largest water utility serving customers in and around London, is trying to win court approval for the controversial £3bn loan agreed with its top-ranking creditors. Thames Water faces the prospect of running out of cash in March if it cannot raise new financing, which would likely lead to the utility being temporarily renationalised under the government’s special administration regime. “The company’s proposed plan looks to sidestep Ofwat’s approval, undermining proper regulatory procedures critical for a national utility with 16mn customers,” said the junior bondholders in a summary of their grounds of objection to the proposed loan filed with the court. Thames Water’s rival classes of bondholders took aim at one another in a London high court hearing last month, during which the class B bondholders indicated that they would challenge proceedings and launch their own parallel restructuring plan for the company. The class B bondholders announced on Tuesday that they had also formally filed “grounds of objection” to Thames Water’s proposal earlier this month. Beyond the “excessive” costs of the class A loan, the lower-ranking bondholders said they had also objected to “predatory conditions” on the debt that could hamper the company’s ability to raise equity; and the fact that Thames Water’s proposal was based on “flawed evidence”, as it did not incorporate the impact of a five-year price review agreed with water regulator Ofwat last month over how much utilities could raise customer bills by

THAMES WATER BONDHOLDERS EMERGENCY LOAN REGULATORY OVERSIGHT FINANCIAL CRISIS

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Thames Water warns that rival bondholders’ plan risks nationalisationJunior bondholders are planning to challenge emergency £3bn loan in court next week

Thames Water warns that rival bondholders’ plan risks nationalisationJunior bondholders are planning to challenge emergency £3bn loan in court next week

Read more »

Thames Water Bondholders Clash in Court Over Emergency LoanThames Water, facing financial distress, seeks a £3 billion emergency loan from its top-ranking bondholders. However, junior bondholders argue the terms are unfavorable and that they have a better alternative offer. This legal battle marks the first time rival restructuring plans will be considered under the UK's new insolvency regime.

Thames Water Bondholders Clash in Court Over Emergency LoanThames Water, facing financial distress, seeks a £3 billion emergency loan from its top-ranking bondholders. However, junior bondholders argue the terms are unfavorable and that they have a better alternative offer. This legal battle marks the first time rival restructuring plans will be considered under the UK's new insolvency regime.

Read more »

Thames Water rival bondholders face off in court hearingTroubled utility seeks approval for ‘urgent’ £3bn loan from its top-ranking lenders

Thames Water rival bondholders face off in court hearingTroubled utility seeks approval for ‘urgent’ £3bn loan from its top-ranking lenders

Read more »

Water Bills to Rise 36% in England and Wales as Thames Water Faces CrisisOfwat, the water regulator, has approved an average 36% increase in water bills for the next five years, a move welcomed by investors but not a solution to the industry's underlying financial problems. Thames Water, the UK's largest water company, is facing a severe crisis with £19 billion in debt and only enough funds to last until March. While a £3 billion emergency loan is expected, Thames Water still needs billions more to avoid collapse.

Water Bills to Rise 36% in England and Wales as Thames Water Faces CrisisOfwat, the water regulator, has approved an average 36% increase in water bills for the next five years, a move welcomed by investors but not a solution to the industry's underlying financial problems. Thames Water, the UK's largest water company, is facing a severe crisis with £19 billion in debt and only enough funds to last until March. While a £3 billion emergency loan is expected, Thames Water still needs billions more to avoid collapse.

Read more »

Thames Water creditors head for courtroom showdown over £3bn emergency loanJunior bondholders to mount a rival plan as utility asks judge to sign off on restructuring

Thames Water creditors head for courtroom showdown over £3bn emergency loanJunior bondholders to mount a rival plan as utility asks judge to sign off on restructuring

Read more »

UK should temporarily take over Thames Water, says ex-government adviserDieter Helm warns biggest water utility risks a ‘slow death’ that could spread to other companies

UK should temporarily take over Thames Water, says ex-government adviserDieter Helm warns biggest water utility risks a ‘slow death’ that could spread to other companies

Read more »