Backed by Bill Gates and Jeff Bezos, KoBold Metals secures funding to accelerate its mission of discovering and developing critical minerals for the energy transition.

A mining and artificial intelligence start-up backed by Bill Gates and Jeff Bezos has raised $537 million in its latest funding round, as it seeks to become a key player in the race for the critical minerals needed for the energy transition. Berkeley-based KoBold Metals said its series C funding round valued the company at $2.96 billion, and was co-led by existing investor T Rowe Price, which has been joined by Durable Capital Partners.

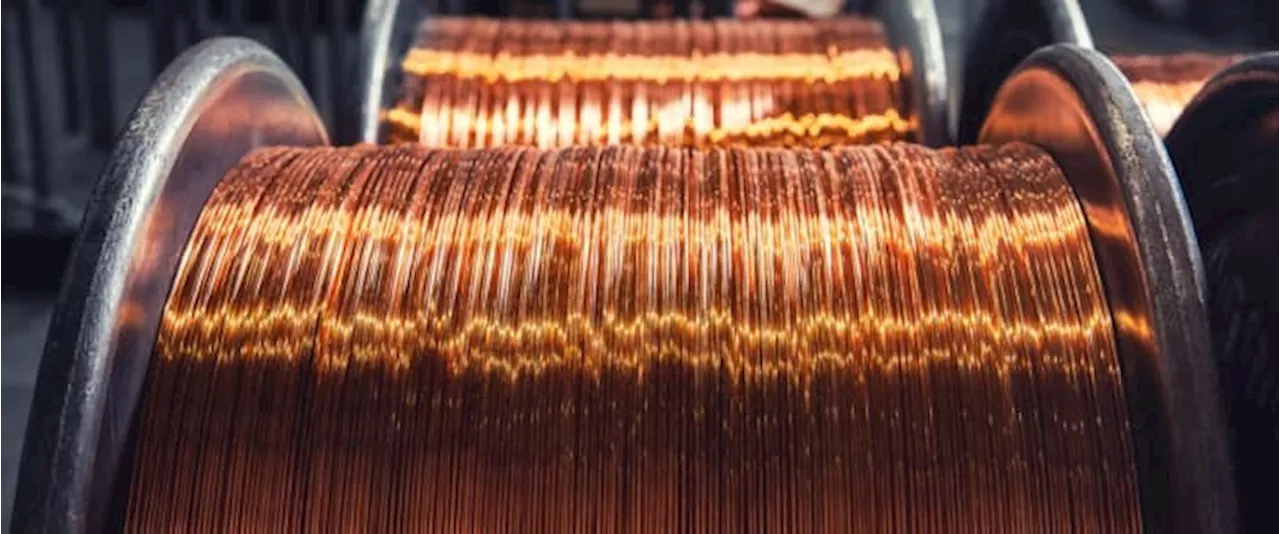

Existing investors including Gates’ Breakthrough Energy Ventures and US venture capital group Andreessen Horowitz also participated in the round, along with new backers including private capital group StepStone. KoBold, which has raised $1 billion to date, is among the western mining companies seeking to compete with Chinese rivals to produce metals such as copper, lithium and nickel. The metals are used in everything from batteries for electric vehicles to the defence industry, and western governments have been increasingly seeking to diversify away from supply chains dominated by China. As part of these efforts, the US is helping finance the revival of the Lobito railway line that will transport critical minerals across swaths of Africa and connect the Democratic Republic of Congo with Zambia and Angola. KoBold, which uses AI to comb through historical and scientific data to identify untapped mineral deposits, said in February that it had discovered a huge deposit of copper in Zambia. The $2 billion Mingomba site would produce at least 300,000 tonnes per year from the 2030s, KoBold said. KoBold’s co-founder and chief executive Kurt House said about 40 per cent of the new capital would be spent on developing existing projects into mines, with the Zambian copper project taking “the lion’s share of that”

CRITICAL MINERALS MINING AI Kobold Metals ENERGY TRANSITION INVESTMENT

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Mining start-up backed by Bill Gates and Jeff Bezos valued at $2.96bnKoBold Metals aims to lead race for critical minerals needed for energy transition

Mining start-up backed by Bill Gates and Jeff Bezos valued at $2.96bnKoBold Metals aims to lead race for critical minerals needed for energy transition

Read more »

London-listed news in briefGreatland Gold, Thor Energy, Panther Metals, Empire Metals, Brazilian Nickel

London-listed news in briefGreatland Gold, Thor Energy, Panther Metals, Empire Metals, Brazilian Nickel

Read more »

Fulcrum Metals Taps into Gold-Laden Tailings for ProfitFulcrum Metals believes it has found a unique money-making opportunity by extracting gold from tailings left over from the Teck-Hughes historic gold mine in Kirkland Lake, Ontario. The company, in collaboration with Extrakt and engineering partner Bechtel, is using sustainable technology to recover gold from the waste, with initial success achieving gold recovery rates up to 59%.

Fulcrum Metals Taps into Gold-Laden Tailings for ProfitFulcrum Metals believes it has found a unique money-making opportunity by extracting gold from tailings left over from the Teck-Hughes historic gold mine in Kirkland Lake, Ontario. The company, in collaboration with Extrakt and engineering partner Bechtel, is using sustainable technology to recover gold from the waste, with initial success achieving gold recovery rates up to 59%.

Read more »

Vale Base Metals has billion-dollar copper planMiner wants to double copper production to 700,000tpa by 2035

Vale Base Metals has billion-dollar copper planMiner wants to double copper production to 700,000tpa by 2035

Read more »

PetroChina Plans to Launch Trading of Energy Transition MetalsPetroChina is expanding its business into metals trading, particularly copper and lithium, to capitalize on the energy transition.

PetroChina Plans to Launch Trading of Energy Transition MetalsPetroChina is expanding its business into metals trading, particularly copper and lithium, to capitalize on the energy transition.

Read more »

Peruvian Company Bids to Takeover Sierra MetalsAlpayana, a private Peruvian mining company, has made a hostile C$179 million takeover bid for base metals company Sierra Metals, directly appealing to shareholders. Alpayana proposes a price of 85 per share, representing a 26% premium to Sierra's 30-day volume weighted average price. Sierra's board has formed a special committee to review the offer, advising shareholders to take no action. Alpayana's offer is considered 'opportunistic' and a 10% premium over Sierra's closing price on December 13.

Peruvian Company Bids to Takeover Sierra MetalsAlpayana, a private Peruvian mining company, has made a hostile C$179 million takeover bid for base metals company Sierra Metals, directly appealing to shareholders. Alpayana proposes a price of 85 per share, representing a 26% premium to Sierra's 30-day volume weighted average price. Sierra's board has formed a special committee to review the offer, advising shareholders to take no action. Alpayana's offer is considered 'opportunistic' and a 10% premium over Sierra's closing price on December 13.

Read more »