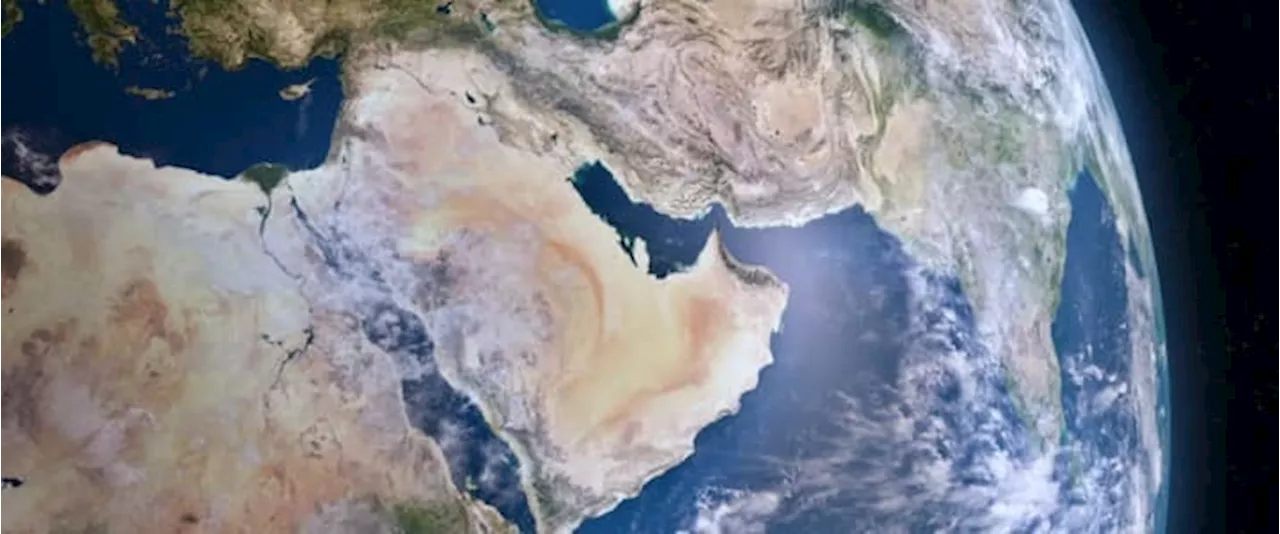

This article explores the hidden connection between oil shortages, economic instability, and rising global conflicts.

We live in a conflict-filled world today. I believe that this is ultimately a “not-enough-to-go-around” problem. Hidden oil shortages are the problem. Strangely, at this stage in the economic cycle, oil shortages seem to appear as high interest rates rather than high prices. The “climate is our biggest problem” narrative gets told repeatedly because it makes cutting back on fossil fuels sound like a virtuous thing, rather than something we are being forced to do.

Because of the use of very inexpensive coal and low-cost labor, the shift would allow for the world production of manufactured goods to grow at very low cost. Businesses in the US and Europe could hopefully take advantage of this shift because US and European oil and coal supplies were becoming depleted, making it impossible to make this change without the assistance of coal supplies from China and elsewhere.

Energy Crisis Global Conflict Interest Rates Economic Instability Climate Change Renewable Energy Fossil Fuels Finite Resources Geopolitics

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Peak Oil A Looming Threat to Economic StabilityThis article explores the complex relationship between oil prices, production, and global economic stability, arguing that crude oil extraction may have already peaked.

Peak Oil A Looming Threat to Economic StabilityThis article explores the complex relationship between oil prices, production, and global economic stability, arguing that crude oil extraction may have already peaked.

Read more »

Big Oil Set to Bid in Algeria's New Oil and Gas Licensing RoundAlgeria is launching a new licensing round for its oil and gas sector, attracting interest from major international energy companies.

Big Oil Set to Bid in Algeria's New Oil and Gas Licensing RoundAlgeria is launching a new licensing round for its oil and gas sector, attracting interest from major international energy companies.

Read more »

Scots oil executive demands urgent review Grangemouth oil refinery closure plansSUNDAY MAIL EXCLUSIVE: Gulfsands Petroleum CEO John Bell and former Grangemouth apprentice has joined leading industry figures in calling for government action to save vital national asset.

Scots oil executive demands urgent review Grangemouth oil refinery closure plansSUNDAY MAIL EXCLUSIVE: Gulfsands Petroleum CEO John Bell and former Grangemouth apprentice has joined leading industry figures in calling for government action to save vital national asset.

Read more »

EIA Slashes Forecasts of Oil Demand Growth and Oil Prices in 2025The U.S. Energy Information Administration lowered its forecast for global oil demand growth in 2025 due to weaker economic outlooks in developed nations, causing a decrease in predicted Brent crude oil prices.

EIA Slashes Forecasts of Oil Demand Growth and Oil Prices in 2025The U.S. Energy Information Administration lowered its forecast for global oil demand growth in 2025 due to weaker economic outlooks in developed nations, causing a decrease in predicted Brent crude oil prices.

Read more »

Oil Rises Israel Hints At Attack on Iran's Oil & Gas InfrastructureCrude oil prices rose on continued geopolitical tensions following Iran's 200-missile barrage on Israel.

Oil Rises Israel Hints At Attack on Iran's Oil & Gas InfrastructureCrude oil prices rose on continued geopolitical tensions following Iran's 200-missile barrage on Israel.

Read more »

Oil Explodes 4% Amid Talk of Israel Attacking Iranian Oil & GasBenchmark crude oil prices surged well over 4% on Thursday on fears of an Israeli strike that could target Iran's oil and gas infrastructure

Oil Explodes 4% Amid Talk of Israel Attacking Iranian Oil & GasBenchmark crude oil prices surged well over 4% on Thursday on fears of an Israeli strike that could target Iran's oil and gas infrastructure

Read more »