Several lenders, including First Direct and HSBC, have started 2024 by cutting mortgage rates, providing positive news for borrowers. Brokers predict further reductions in the coming weeks, although the scope for significant drops remains limited.

The start of the year has been positive for mortgage borrowers and potential borrowers. First Direct cut its mortgage rates on Tuesday, following several other lenders in starting the new year with price reductions. The lender is now offering a five-year mortgage at 4.13 per cent for buyers with large deposits of 40 per cent, and 4.1 per cent for existing customers remortgaging.

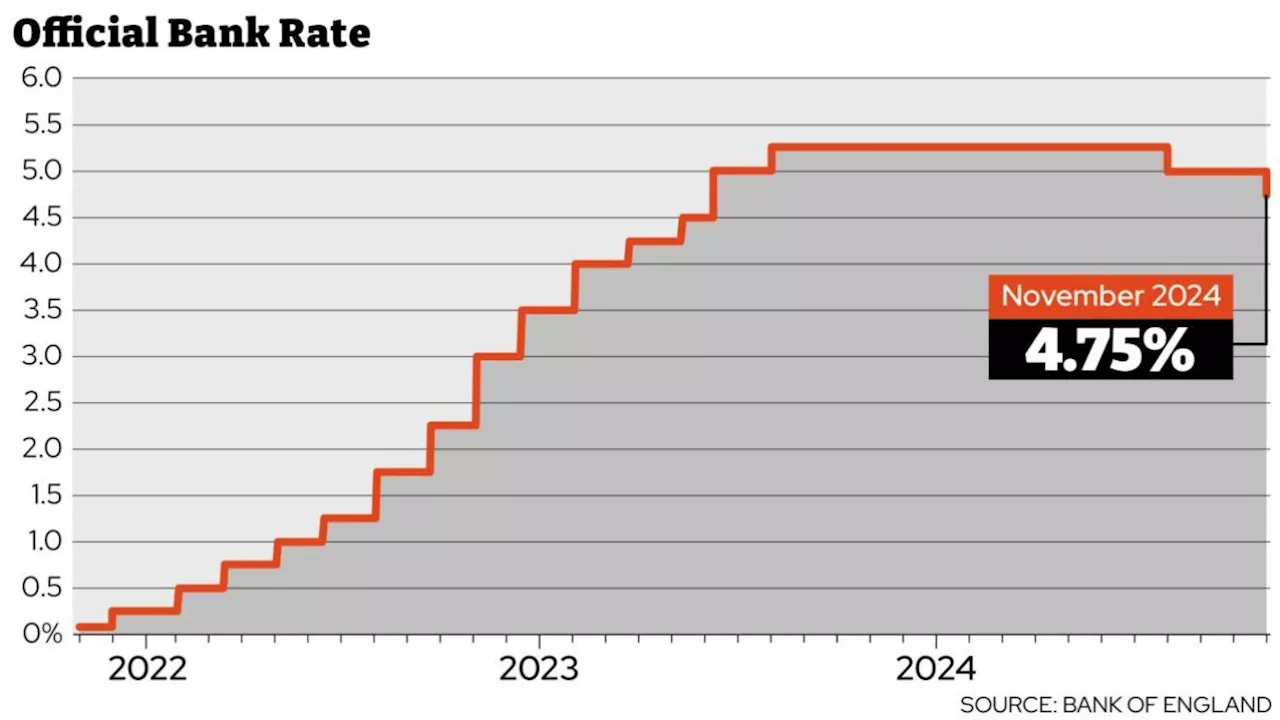

HSBC cut rates on many of its mortgage products on Monday, while smaller lenders such as Gen H and Market Harborough Building Society also reduced prices. Brokers said the cuts were good news and that further cuts were likely to come over the coming weeks. Nick Mendes of John Charcol brokers said: “First Direct’s decision to reduce mortgage rates by up to 0.3 percentage points across its repayment mortgage range is a welcome move for borrowers. “It reflects the competitive nature of the market and offers potential savings for first-time buyers, home movers, and those looking to remortgage. “It’s been a positive start to the new year, with competition slowly increasing among mainstream lenders. The rate cuts, such as those from First Direct, highlights that lenders are keen to attract borrowers, but the scope for reductions remains limited. “While we’re likely to see further rate cuts over the coming weeks, these are expected to be modest, with only minimal changes to the best deals currently available.” Aaron Strutt, of Trinity Financial added: “We may well see more pricing improvements over the coming days based on the changes we’ve seen so far this year.” Mortgage rates started to climb after the Budget following an increase to swap rates, which are based on expectations for where the, and this meant that markets began to predict that the Bank of England would cut interest rates from its current level of 4.75 per cent more slowly than previously predicted. Even though rates have started dropping, they are still higher than they were at their lowest point in 2024, when deals below 4 per cent were availabl

MORTGAGE RATES INTEREST RATES BANK OF ENGLAND COMPETITION LENDERS

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Mortgage rates set to fall below 4% in early 2025Banks are said to want a 'positive start' to next year by offering the lowest deals possible

Mortgage rates set to fall below 4% in early 2025Banks are said to want a 'positive start' to next year by offering the lowest deals possible

Read more »

ADVICE COLUMN: Overview of property and mortgage market in 2025Mortgage advisor Kevin McCarthy looks ahead to the next 12 months in the mortgage market.

ADVICE COLUMN: Overview of property and mortgage market in 2025Mortgage advisor Kevin McCarthy looks ahead to the next 12 months in the mortgage market.

Read more »

Jump in average fixed mortgage rates recorded in December, says MoneyfactsLenders would need to grapple with future uncertainty surrounding interest-rate pricing while aiming to hit any year-end targets, the firm said.

Jump in average fixed mortgage rates recorded in December, says MoneyfactsLenders would need to grapple with future uncertainty surrounding interest-rate pricing while aiming to hit any year-end targets, the firm said.

Read more »

Barclays, Natwest and TSB cut mortgage rates but interest costs creep up...Prompt: GETTING on the property ladder can feel like a daunting task but there are schemes out there to help first-time buyers have their own home. Help to Buy Isa - It's a tax-free savings account where for every £200 you save, the Government will add an extra £50.

Barclays, Natwest and TSB cut mortgage rates but interest costs creep up...Prompt: GETTING on the property ladder can feel like a daunting task but there are schemes out there to help first-time buyers have their own home. Help to Buy Isa - It's a tax-free savings account where for every £200 you save, the Government will add an extra £50.

Read more »

Barclays cuts mortgage rates with experts predicting more pre-Christmas reductionsRates climbed for weeks after October's Budget, but some lenders are now making reductions again

Barclays cuts mortgage rates with experts predicting more pre-Christmas reductionsRates climbed for weeks after October's Budget, but some lenders are now making reductions again

Read more »

Mortgage rates cut as price war heats up ahead of ChristmasIt comes as finance experts are predicting a home sales boom in the coming weeks as buyers attempt to avoid a rise in stamp duty from April 1

Mortgage rates cut as price war heats up ahead of ChristmasIt comes as finance experts are predicting a home sales boom in the coming weeks as buyers attempt to avoid a rise in stamp duty from April 1

Read more »