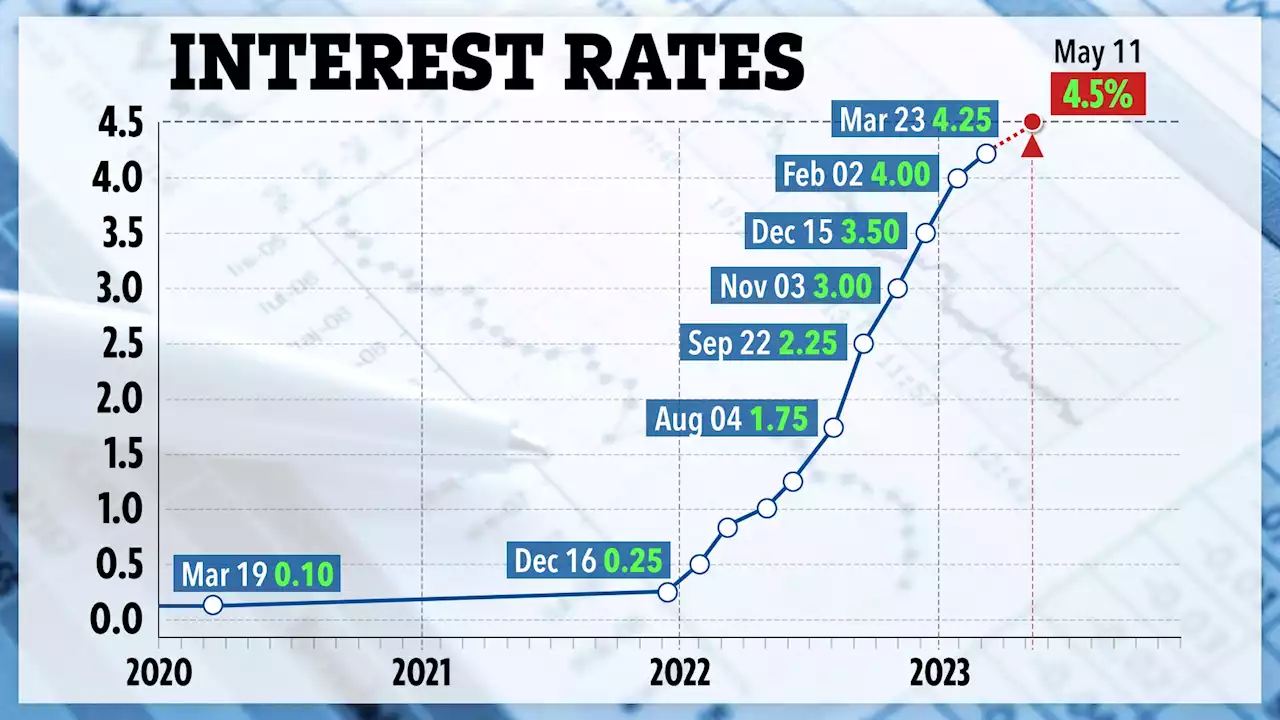

MILLIONS of homeowners will face higher mortgage repayments after the Bank of England hiked interest rates again. The central bank’s base rate has increased from 4.25% to 4.5%. The rate is us…

Rising interest rates are meant to encourage households to save rather than spend, which forces inflation down.

This means that the country will now avoid a recession that was previously forecast in November 2022. The 1.4 million households on a tracker or variable rate mortgage will see an increase in their costs. MoneyFacts data shows that the average SVR has leapt over 7% and this means that someone coming off the average two-year fix from 2021 will see their rate rise from 2.58% to 7.3%.

She said: "If you fix now, you're likely to see rates fall in the coming months, but you can't be certain when they'll fall, or how far."You might want to fix for two years on the basis that you'll pay more for it now, but rates could be lower when you come to re-mortgage.

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Bank of England hikes interest rates to 4.5% - its highest level since 2008BREAKING: Britain’s interest rates have risen to 4.5%, the Bank of England's highest level since 2008.

Bank of England hikes interest rates to 4.5% - its highest level since 2008BREAKING: Britain’s interest rates have risen to 4.5%, the Bank of England's highest level since 2008.

Read more »

‘We will not change Bank of England’s inflation target’ Treasury ministers vowFinancial watchdogs facing benchmarks to keep City competitive amid claims of 'unaccountable' regulators

‘We will not change Bank of England’s inflation target’ Treasury ministers vowFinancial watchdogs facing benchmarks to keep City competitive amid claims of 'unaccountable' regulators

Read more »

What the Bank of England's interest rate announcement this week means for youEconomists are concerned that the Base Rate could rise to the same levels it was at during the 2008 financial crisis

What the Bank of England's interest rate announcement this week means for youEconomists are concerned that the Base Rate could rise to the same levels it was at during the 2008 financial crisis

Read more »

Bank of England to impose another interest rate hike as UK inflation proves stubbornFinancial markets and economists have priced in another rate rise today and their focus will be on the Bank's updated forecasts for signs that a pause lies ahead.

Bank of England to impose another interest rate hike as UK inflation proves stubbornFinancial markets and economists have priced in another rate rise today and their focus will be on the Bank's updated forecasts for signs that a pause lies ahead.

Read more »

Interest rates expected to rise for 12th time in a rowThe Bank of England is expected to raise the rate from 4.25% to 4.5%, pushing up mortgage costs.

Interest rates expected to rise for 12th time in a rowThe Bank of England is expected to raise the rate from 4.25% to 4.5%, pushing up mortgage costs.

Read more »

Interest rates expected to rise for 12th time in a rowThe Bank of England is expected to raise the rate from 4.25% to 4.5%, pushing up mortgage costs.

Interest rates expected to rise for 12th time in a rowThe Bank of England is expected to raise the rate from 4.25% to 4.5%, pushing up mortgage costs.

Read more »