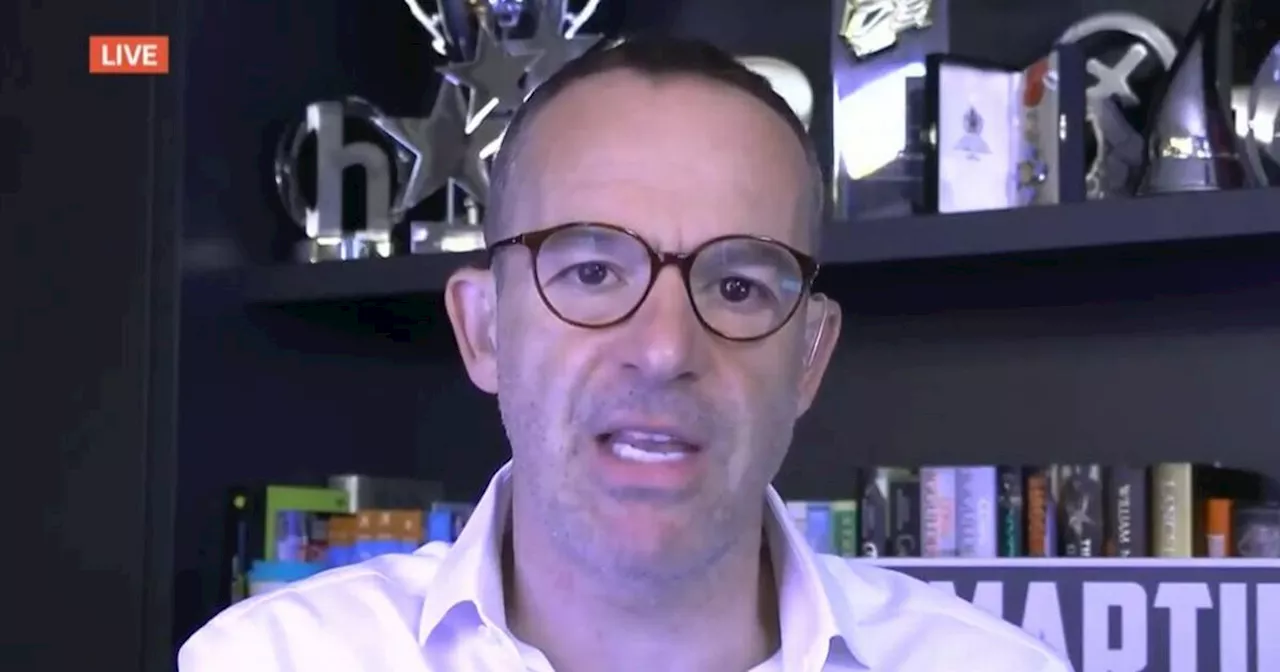

Martin Lewis spoke on Good Morning Britain this morning about the dangers of the debt 'marketed as a lifestyle choice'

Martin Lewis has said that people are using the Buy Now, Pay Later option as a "lifestyle choice" rather than what it is, getting yourself into "debt" - and it's something that needs to be stopped, he warns.

However if something goes wrong, finance experts are warning users that they could incur late fees and marks on your credit file. Talking about the "explosive growth" of Buy Now, Pay Later debt, he recalled payday loans and said that the treasury committee in 2020 were warned they can't make the same mistake . So when a new form of debt grows, "we need to regulate it sooner rather than later", he urged and despite talks four years ago, nothing happened to regulate it.

"But Buy Now, Pay Later, which is you ubiquitous when you shop online you're asked 'Hey, do you wanna spread the payment?" which should really be phrased 'Hey do you want to get into debt' because it is a debt", he stresses. "It’s not necessarily a bad thing, it's interest free and if you got a plan budgeting one off purchase that you need to make for something like paying for emergency plumber or car repairs, well use it to spread the payment.

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Martin Lewis' MSE says 'ditch your shopping basket' when buying giftsWorth knowing with Christmas almost around the corner

Martin Lewis' MSE says 'ditch your shopping basket' when buying giftsWorth knowing with Christmas almost around the corner

Read more »

Martin Lewis' MSE warns all Amazon Prime Day shoppers 'don't'A huge Amazon Prime sale event is about to get under way, but customers have been warned

Martin Lewis' MSE warns all Amazon Prime Day shoppers 'don't'A huge Amazon Prime sale event is about to get under way, but customers have been warned

Read more »

Martin Lewis' MSE says 'everyone should know' in £9,000 warningMoney Saving Expert has said people could potentially lose thousands of pounds

Martin Lewis' MSE says 'everyone should know' in £9,000 warningMoney Saving Expert has said people could potentially lose thousands of pounds

Read more »

Man clawed back £7.5k in council tax following Martin Lewis MSE adviceHundreds of thousands of homes may be in the 'wrong council band', according to MSE

Man clawed back £7.5k in council tax following Martin Lewis MSE adviceHundreds of thousands of homes may be in the 'wrong council band', according to MSE

Read more »

Martin Lewis' MSE issues warning to mortgage holdersThe Money Saving Expert team have issued a warning to mortgage holders after the Bank of England's latest interest rate decision

Martin Lewis' MSE issues warning to mortgage holdersThe Money Saving Expert team have issued a warning to mortgage holders after the Bank of England's latest interest rate decision

Read more »