HMRC warns that 'cooling off period' policies don't apply to returning withdrawn lump sums, leaving people liable for tax.

Ahead of Rachel Reeves’ Autumn Budget there was a lot of speculation on what taxes, benefits and topics might be on the agenda. While experts warned people against making hasty decisions before any official announcements, some people took what they believed would be protective measures.

Amid fears that the maximum amount you can withdraw from your pension fund as a lump sum without incurring tax would be cut down by over 50%, some people opted to withdraw as much as they could before the budget. Thinking they would be getting some tax savings if the threshold was cut or simply put the money back later if it wasn’t. However, HMRC has now warned savers that the “cooling off period” policy offered by pension providers that may have covered this reversal doesn’t actually apply. The policy only covers new products, while putting this lump sum back into the pension would technically be the return or addition to an existing product. It declared: “The payment of a tax-free lump sum cannot be undone and the member’s lump sum allowance will not be restored. The lump sum must be tested against their lump sum allowance at the time the lump sum was paid from their pension scheme. Unauthorised payment charges may apply if contributions to pension schemes are made out of tax-free lump sums and the conditions for the recycling rule are met.” This means people wanting to return the lump sum they protectively took out of their pension will be liable for tax on this payment. However, pension providers have pushed back on the ruling made earlier this month. Brits can take 25% out of their pension pots completely tax-free as a lump sum, with a maximum of £268,275. Ahead of the Budget there was major speculation that this would be cut as low as £100,000 but ultimately the cap was left entirely untouche

PENSIONS TAX BUDGET HMRC INVESTMENT

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

UK Pension Tax Breaks: A Boon for Savers, But Do They Boost Growth?This article examines the effectiveness of UK pension tax breaks in encouraging long-term saving and supporting domestic investment. While the generous incentives have been successful in boosting pension assets, their impact on economic growth is questioned due to the significant reliance on UK assets by pension funds.

UK Pension Tax Breaks: A Boon for Savers, But Do They Boost Growth?This article examines the effectiveness of UK pension tax breaks in encouraging long-term saving and supporting domestic investment. While the generous incentives have been successful in boosting pension assets, their impact on economic growth is questioned due to the significant reliance on UK assets by pension funds.

Read more »

Families could face ‘double hit’ from inheritance tax pension changeWith countless more Brits facing inheritance tax liability, here’s how to figure out if you’ll be among the unfortunate few slammed with a bill of over 70%

Families could face ‘double hit’ from inheritance tax pension changeWith countless more Brits facing inheritance tax liability, here’s how to figure out if you’ll be among the unfortunate few slammed with a bill of over 70%

Read more »

New pension rules could be a 'gamechanger' for people's retirementsThe changes could mean pension savers being 'nudged' towards making better decisions about their retirement savings

New pension rules could be a 'gamechanger' for people's retirementsThe changes could mean pension savers being 'nudged' towards making better decisions about their retirement savings

Read more »

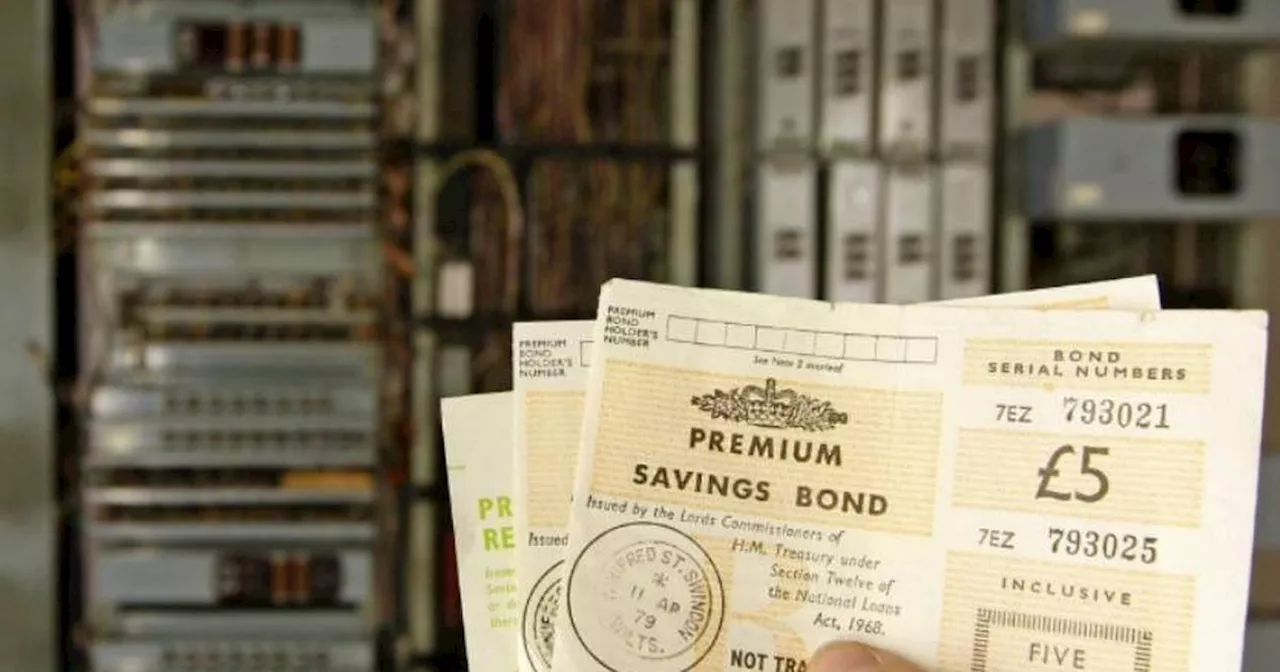

Premium Bonds savers told 'close account now' ahead of tax changeThe overall tax-free value of prizes will drop from January

Premium Bonds savers told 'close account now' ahead of tax changeThe overall tax-free value of prizes will drop from January

Read more »

DWP state pension payments to rise by £101 for people born in these yearsThe over 80 pension is a State Pension for people aged 80 or over

DWP state pension payments to rise by £101 for people born in these yearsThe over 80 pension is a State Pension for people aged 80 or over

Read more »

The pension pot I planned to gift my son is being hit by inheritance tax chargesMother Louise Rollings feels 'disappointed' that her pension pot will be affected by changes to inheritance tax

The pension pot I planned to gift my son is being hit by inheritance tax chargesMother Louise Rollings feels 'disappointed' that her pension pot will be affected by changes to inheritance tax

Read more »