Reform UK leader Nigel Farage and deputy leader Richard Tice announced their economic and renewable energy policy, including a windfall tax on renewable energy companies and a ban on farmers who install solar panels on their land from claiming inheritance tax relief. They argue that this will raise £10 billion, enough to cut energy bills by £350 a year, and prevent a conflict of interest between food production and the renewables industry. However, critics warn that the party's stance on climate change could alienate voters.

Reform UK leader Nigel Farage and deputy leader Richard Tice at the press conference setting out their approach to the economy and renewable energy.They included a windfall tax on renewable energy companies and a ban on farmers who build solar panels on their land from claiming inheritance tax relief.

“The British people need to know there is a direct link between the cost of all these subsidies to the vested interests in the renewables industry and your bills, your cost of living,” Tice said. “The danger for Reform has always been that they listen to their very active online base who have very different views from the pool of potential voters that would grow them into a potential party of government.“Majorities in every single UK constituency say they are worried about climate change. It is no longer the fringe liberal metropolitan issue. Do a focus group for Red Wall voters they’ll talk about worries for their kids and fossil fuels meaning reliance on ‘mad men like Putin’.

Sam Hall, director of the Conservative Environment Network, said: “Reform’s statist plan to put new taxes and red tape on British energy would cause household bills to skyrocket and pull the rug on energy firms.

REFORM UK NIGEL FARAGE RENEWABLES ECONOMY CLIMATE CHANGE

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

BBC Licence Fee Reform: 'Netflix Tax', Wealth Tax and Subscription Models on the TableThe BBC is facing calls for reform of its licence fee funding model. Options being considered include asking wealthier viewers to pay more, a 'Netflix tax' on streaming platform subscribers, and voluntary subscriptions. Ministers aim to find a solution that 'future-proofs' the broadcaster without imposing a new 'TV tax' on struggling voters.

BBC Licence Fee Reform: 'Netflix Tax', Wealth Tax and Subscription Models on the TableThe BBC is facing calls for reform of its licence fee funding model. Options being considered include asking wealthier viewers to pay more, a 'Netflix tax' on streaming platform subscribers, and voluntary subscriptions. Ministers aim to find a solution that 'future-proofs' the broadcaster without imposing a new 'TV tax' on struggling voters.

Read more »

Avoid £195 EV Tax Hike: Renew Your Vehicle Tax EarlyElectric vehicle (EV) owners can potentially avoid a £195 annual tax increase by renewing their vehicle tax before April 2025, according to a motoring expert. The change in VED rules comes into effect on April 1, 2025, when EVs will be subject to the same tax as petrol and diesel vehicles. By renewing their tax before the deadline, EV owners can delay the payment of the new rate for an extra year.

Avoid £195 EV Tax Hike: Renew Your Vehicle Tax EarlyElectric vehicle (EV) owners can potentially avoid a £195 annual tax increase by renewing their vehicle tax before April 2025, according to a motoring expert. The change in VED rules comes into effect on April 1, 2025, when EVs will be subject to the same tax as petrol and diesel vehicles. By renewing their tax before the deadline, EV owners can delay the payment of the new rate for an extra year.

Read more »

DWP urged to ‘accelerate plans’ to reform health-related benefits systemThe House of Lords Economic Affairs Committee says urgent action is needed to tackle the ‘spiralling costs of the health benefit trap’.

DWP urged to ‘accelerate plans’ to reform health-related benefits systemThe House of Lords Economic Affairs Committee says urgent action is needed to tackle the ‘spiralling costs of the health benefit trap’.

Read more »

Exclusive: Labour Plans To Use Nigel Farage's NHS Views To Halt The Reform UK SurgeKevin Schofield is HuffPost UK's political editor and is based at Westminster. He has been a political journalist for more than 20 years, and in that time has worked for the Press Association, The Scotsman, The Herald, Daily Record, The Sun and PoliticsHome.

Exclusive: Labour Plans To Use Nigel Farage's NHS Views To Halt The Reform UK SurgeKevin Schofield is HuffPost UK's political editor and is based at Westminster. He has been a political journalist for more than 20 years, and in that time has worked for the Press Association, The Scotsman, The Herald, Daily Record, The Sun and PoliticsHome.

Read more »

BBC Funding Reform: From 'Netflix Tax' to iPlayer PaywallThe BBC is facing a funding crisis and exploring various options to ensure its long-term sustainability, including a 'Netflix tax', progressive licence fee, voluntary subscriptions, and charging for iPlayer access.

BBC Funding Reform: From 'Netflix Tax' to iPlayer PaywallThe BBC is facing a funding crisis and exploring various options to ensure its long-term sustainability, including a 'Netflix tax', progressive licence fee, voluntary subscriptions, and charging for iPlayer access.

Read more »

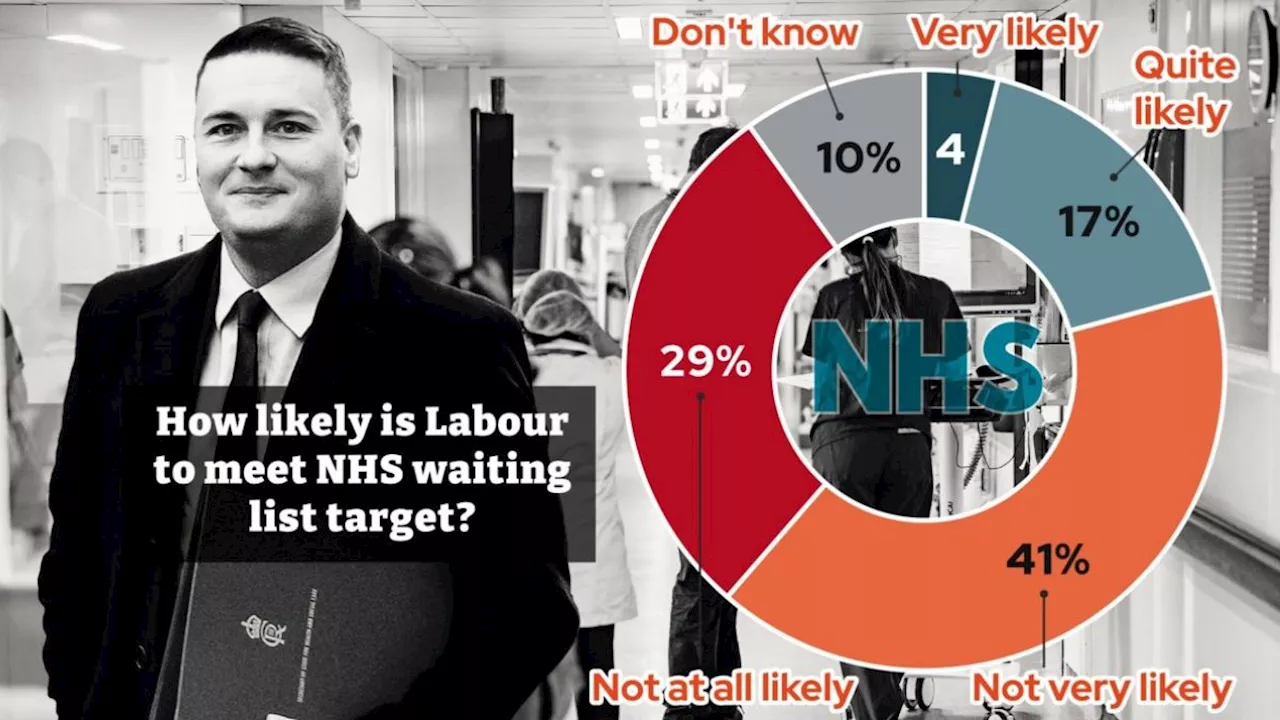

Voters Back NHS Reform Plans but Doubt TargetsA new poll reveals widespread public support for the Government's plans to tackle NHS waiting times, including utilizing private clinics and expanding community care. However, skepticism remains about whether the Government can realistically meet its target of treating nearly all patients within 18 weeks by spring 2029.

Voters Back NHS Reform Plans but Doubt TargetsA new poll reveals widespread public support for the Government's plans to tackle NHS waiting times, including utilizing private clinics and expanding community care. However, skepticism remains about whether the Government can realistically meet its target of treating nearly all patients within 18 weeks by spring 2029.

Read more »