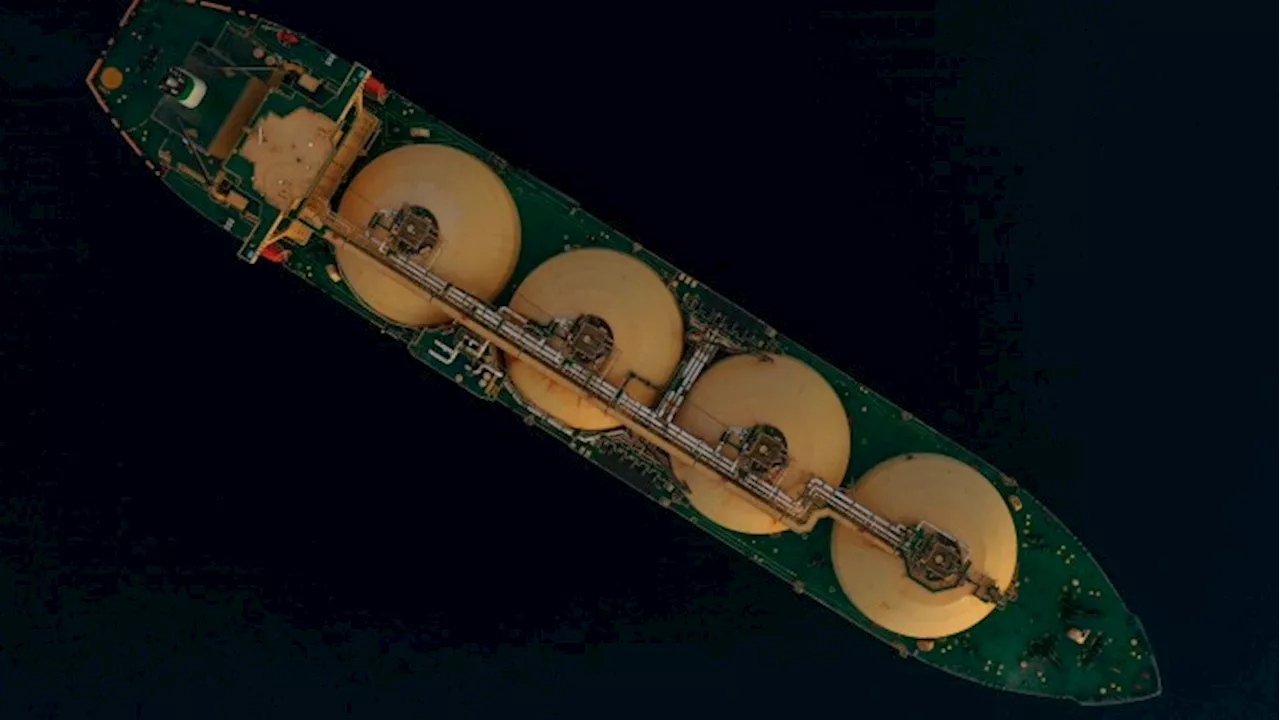

Shell anticipates weaker fourth-quarter 2024 earnings across its LNG, trading, and oil businesses, citing seasonal trends and lifting schedules. Despite strong gas division performance in Q3, the company expects a $1.3 billion Q4 charge related to emissions certificates and up to $1.2 billion in non-cash impairments in its renewables division. Lower natural gas production and LNG liquefaction volumes are also contributing factors.

Shell expects its LNG production and trading and oil trading businesses to book significantly lower results for the fourth quarter of 2024, due to seasonality and timing of lifting, the UK-based supermajor said on Wednesday. For the third quarter, Shell booked better-than-expected earnings on the back of strong performance in its gas division which offset weak refining margins in the downstream business.

Now previewing the fourth-quarter results, the international oil and gas firm expects to book on a group level a charge of $1.3 billion for Q4, related to the timing of payments of emissions certificates in relation to its fuel trading in Germany and U.S. biofuel programs. Shell will also recognize up to $1.2 billion in non-cash post-tax impairments in its renewables and energy solutions division, the company said in its update note ahead of the full fourth-quarter results which will be published on January 30. In the Integrated Gas division, Shell expects lower natural gas production in Q4 compared to the prior quarter, due to the scheduled maintenance at Pearl GTL in Qatar. LNG liquefaction volumes were also lower in the fourth quarter, due to lower feedgas and fewer cargos due to the timing of liftings. In the gas business, trading and optimization results are expected to be significantly lower compared to the third quarter, driven by the non-cash impact of expiring hedging contracts, Shell said. While the indicative refining margin was flat in Q4 compared to Q3, the chemicals margins for Shell declined in the fourth quarter and Shell expects the adjusted earnings in its Chemicals sub-segment to reflect a loss for the last quarter of 2024. Shell’s warning comes hours after U.S. supermajor ExxonMobil said it expects to book a weaker profit for the fourth quarter of 2024 because of lower refining margins, estimating the size of the negative impact at $1.75 billion

Shell Earnings Q4 LNG Oil Trading Seasonality Emissions Certificates Renewables Natural Gas Production Refining Margins

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

US to Remain World's Largest LNG Exporter in 2024The United States is projected to retain its position as the world's leading liquefied natural gas (LNG) exporter in 2024, surpassing Qatar and Australia. U.S. LNG shipments are anticipated to reach a new record high, exceeding the previous all-time high set in 2023. This growth is fueled by increased export capacity, with new plants like Plaquemines LNG coming online.

US to Remain World's Largest LNG Exporter in 2024The United States is projected to retain its position as the world's leading liquefied natural gas (LNG) exporter in 2024, surpassing Qatar and Australia. U.S. LNG shipments are anticipated to reach a new record high, exceeding the previous all-time high set in 2023. This growth is fueled by increased export capacity, with new plants like Plaquemines LNG coming online.

Read more »

EU imports record quantities of Russian LNG in 2024Bloc received 16.5mn tonnes of liquefied natural gas by mid-December despite efforts to reduce supplies from Russia

EU imports record quantities of Russian LNG in 2024Bloc received 16.5mn tonnes of liquefied natural gas by mid-December despite efforts to reduce supplies from Russia

Read more »

Petrol Prices Rise for Third Month, But Still Lower Than 2024 PeakPetrol prices increased for the third consecutive month in December, reaching over 136p per litre. However, costs remain lower than the peak of 150.6p seen in April 2024. Drivers are currently saving 14p per litre compared to last year's high, amounting to £7.70 for a full tank. Diesel prices have also dropped below 145p, with a peak of 158.7p in April 2024. The RAC advises that retailer margins remain high and could be lowered to benefit consumers.

Petrol Prices Rise for Third Month, But Still Lower Than 2024 PeakPetrol prices increased for the third consecutive month in December, reaching over 136p per litre. However, costs remain lower than the peak of 150.6p seen in April 2024. Drivers are currently saving 14p per litre compared to last year's high, amounting to £7.70 for a full tank. Diesel prices have also dropped below 145p, with a peak of 158.7p in April 2024. The RAC advises that retailer margins remain high and could be lowered to benefit consumers.

Read more »

Shell Inks $50 Billion LNG Deal with Argentina's YPFShell and Argentina's YPF have announced a $50 billion partnership to develop the first phase of Argentina LNG, aiming to produce 10 million metric tons of liquefied natural gas annually. The project will leverage the vast Vaca Muerta shale formation and export LNG through pipelines to Rio Negro. This deal marks a significant step for Argentina to capitalize on its energy reserves and become a major player in the global LNG market.

Shell Inks $50 Billion LNG Deal with Argentina's YPFShell and Argentina's YPF have announced a $50 billion partnership to develop the first phase of Argentina LNG, aiming to produce 10 million metric tons of liquefied natural gas annually. The project will leverage the vast Vaca Muerta shale formation and export LNG through pipelines to Rio Negro. This deal marks a significant step for Argentina to capitalize on its energy reserves and become a major player in the global LNG market.

Read more »

Lower Chinese LNG Imports Could Ease Europe's Energy WoesChina could inadvertently help alleviate concerns in Europe about supply and rising prices, if the high spot Asian prices continue to deter Chinese LNG buyers

Lower Chinese LNG Imports Could Ease Europe's Energy WoesChina could inadvertently help alleviate concerns in Europe about supply and rising prices, if the high spot Asian prices continue to deter Chinese LNG buyers

Read more »

Stacey Solomon 'crying' as she responds to Joe Swash update after 2024 'made'It cames after the Loose Women star joked that she had been 'estranged' from her other half

Stacey Solomon 'crying' as she responds to Joe Swash update after 2024 'made'It cames after the Loose Women star joked that she had been 'estranged' from her other half

Read more »