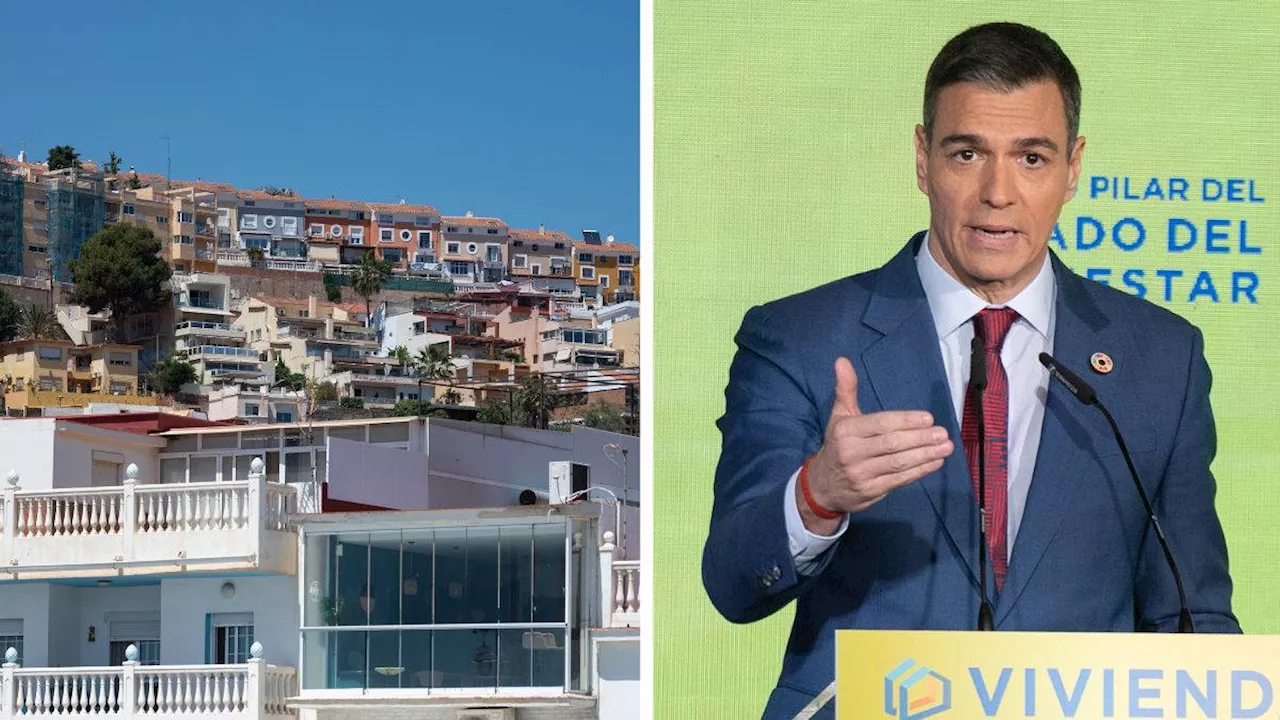

The Spanish government plans to implement a tax on non-EU citizens, including Brits, buying homes in the country. The new measures aim to address the housing shortage and prioritize availability for residents.

The Spanish government has unveiled drastic reforms affecting Brits' ability to buy homes as the country desperately looks to tackle the mounting housing crisis. Prime Minister Pedro Sánchez today announced a new package of 12 measures the government hopes will win over residents furious with the lack of available homes. One contentious proposal is the introduction of a tax for non-EU citizens buying houses in the country who do not already reside in Spain.

The government suggested levying a tax on foreigners, including Brits, by raising the amount paid when purchasing a house to 100 per cent of the value of the property. House-buyers in Spain are currently expected to pay costs and taxes worth between 10 and 12 per cent of the price of the house, depending on where it is. Sanchez said that the new tariff would help 'prioritise the availability of housing for residents'. He noted that in 2023 alone, non-residents from outside of the EU bought 27,000 houses and flats in Spain, 'not to live in them, but mainly to speculate'. He said this was 'something that, in the context of the shortages we are experiencing, we cannot afford'. Spain has seen massive demonstrations grow year-on-year, with aggrieved locals decrying the housing shortage while opportunists buy up homes and rent them out to holidaymakers, or leave them vacant for most of the year. Residency in Spain is open to UK nationals and other non-EU citizens planning to stay longer than 90 days, subject to fees and proof of financial stability. Sanchez's radical plan to address the housing crisis was presented today, outlining 12 measures focused on reforming the construction industry, ensuring affordable rentals and offering incentives to those who follow renting guidelines. This includes transferring land to a new Public Housing Company that the government says it will use to build thousands of new affordable rental houses. Sanchez said in the first half of this year the company will begin to incorporate more than 30,000 Sareb homes, some 13,000 with immediate effect. The government also hopes to 'rehabilitate' vacant homes for additional 'affordable rental', offering incentives to those who renovate flats and make it available for an extended period of time. It hopes an income tax exemption for owners letting out their homes according to the 'Reference Price Index' will encourage a healthier rental ecosystem. In a bid to ensure Spaniards can access homes before wealthy non-EU citizens, the proposals also include a measure to 'limit' the purchase of homes by people who 'do not reside in our country'. This is to be tightened with regulations on fraud for seasonal rentals, disincentivising those who illicitly look to make the most of Spain's lucrative tourist season. 'The objective with all these measures is clear. What we want is to protect citizens, to find a better balance between tourism and investment, which are two key activities for our economy,' Sanchez said with the announcement. 'And also, logically, access to housing, which is a constitutional right of the people and a legitimate objective of our Government when we say that we want to make it the fifth Pillar of the welfare state.

HOUSING CRISIS TAXATION NON-EU SPAIN GOVERNMENT

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Edinburgh to Introduce 5% Tourist TaxEdinburgh City Council is set to become the first in Scotland to implement a 5% tourist tax on accommodation costs. Despite opposition from businesses and visitors, the council aims to raise £50 million annually for the city. The tax, proposed to fund local services, will apply to bookings from May 1, 2026, for overnight stays starting July 24, 2026.

Edinburgh to Introduce 5% Tourist TaxEdinburgh City Council is set to become the first in Scotland to implement a 5% tourist tax on accommodation costs. Despite opposition from businesses and visitors, the council aims to raise £50 million annually for the city. The tax, proposed to fund local services, will apply to bookings from May 1, 2026, for overnight stays starting July 24, 2026.

Read more »

Edinburgh to Introduce 5% Tourist Tax Despite OppositionEdinburgh City Council is set to become the first in Scotland to implement a 5% tourist tax on accommodation costs, aiming to raise £50 million annually. The decision faces backlash from businesses and visitors who oppose the levy or find the rate excessive. Despite a survey showing majority disapproval, councillors will vote on the tax this month.

Edinburgh to Introduce 5% Tourist Tax Despite OppositionEdinburgh City Council is set to become the first in Scotland to implement a 5% tourist tax on accommodation costs, aiming to raise £50 million annually. The decision faces backlash from businesses and visitors who oppose the levy or find the rate excessive. Despite a survey showing majority disapproval, councillors will vote on the tax this month.

Read more »

This UK city is the first to introduce tourist tax — will Brits have to pay?Edinburgh will introduce a tourist tax – 5% per night of room costs – on visitor accommodation from July 2026. Find out if it impacts Brits.

This UK city is the first to introduce tourist tax — will Brits have to pay?Edinburgh will introduce a tourist tax – 5% per night of room costs – on visitor accommodation from July 2026. Find out if it impacts Brits.

Read more »

Queen Letizia dazzles in red at Princess Girona Foundation meetingQueen Letizia of Spain attended a board meeting of the Princess Girona Foundation in Madrid, Spain.

Queen Letizia dazzles in red at Princess Girona Foundation meetingQueen Letizia of Spain attended a board meeting of the Princess Girona Foundation in Madrid, Spain.

Read more »

Spain Imposes New Tax on Foreign HomebuyersSpain is implementing a new tax targeting foreigners, including British citizens, purchasing homes in the country. The move aims to address housing affordability concerns by prioritizing availability for local residents. The tax, levied on non-EU citizens, increases the purchase cost to 100% of the property's value.

Spain Imposes New Tax on Foreign HomebuyersSpain is implementing a new tax targeting foreigners, including British citizens, purchasing homes in the country. The move aims to address housing affordability concerns by prioritizing availability for local residents. The tax, levied on non-EU citizens, increases the purchase cost to 100% of the property's value.

Read more »

Car Tax Changes 2025: Electric Vehicles Face Tax for the First TimeSeven changes to car tax and Vehicle Excise Duty (VED) are coming in 2025, impacting both petrol/diesel and electric vehicle owners. Electric vehicles will no longer be exempt from VED, with a low first-year rate applying to new zero-emission cars. All other cars will face higher VED rates.

Car Tax Changes 2025: Electric Vehicles Face Tax for the First TimeSeven changes to car tax and Vehicle Excise Duty (VED) are coming in 2025, impacting both petrol/diesel and electric vehicle owners. Electric vehicles will no longer be exempt from VED, with a low first-year rate applying to new zero-emission cars. All other cars will face higher VED rates.

Read more »