Analysis by property website Zoopla reveals that stamp duty changes taking effect from April 1st will see a significant increase in the number of homebuyers liable for the tax, particularly in England and Northern Ireland. The changes will reduce the 'nil rate' band for first-time buyers and impact existing homeowners buying new properties.

More home buyers in England and Northern Ireland will be liable to pay stamp duty when changes to the tax take effect from April 1. The proportion of first-time buyers in England and Northern Ireland who will need to pay stamp duty will double from April, according to analysis by a property website. Meanwhile the proportion of existing homeowners buying a new home as their main residence who will be liable to pay stamp duty will increase from 49% to 83%, according to Zoopla ’s calculations.

From April, stamp duty discounts will become less generous, with the “nil rate” band for first-time buyers reducing from £425,000 to £300,000 and other home buyers seeing a reduction from £250,000 to £125,000. Stamp duty applies in England and Northern Ireland. Overall Zoopla estimates that the stamp duty changes could add an extra £1.1 billion annually in the tax to government coffers. The website’s analysis was based on buyer inquiries to estate agents and property prices and excludes the impact of those buying additional homes. Richard Donnell, executive director at Zoopla said: “Stamp duty has become a big source of tax revenue, approaching £10 billion a year for the Government. The reduction in tax reliefs from April will see more home buyers paying stamp duty.” He added: “It’s positive that most first-time buyers will still pay no stamp duty from April, but these changes hit those buying over £300,000 in southern England the most, where buying costs are already high. This will reduce buying power and market activity at a local level. “Stamp duty is a big tax on home movers in southern England, where affordability problems are already a major challenge. The case for reforming stamp duty remains, but the question is where to replace the multi-billion in annual tax revenues.” Simon Gerrard, chairman of Martyn Gerrard estate agents, said: “These upcoming stamp duty changes will disproportionately affect first-time buyers in London, where housing is much more expensive, with 97% of sales set to pay stamp duty from April. “In other areas, the impacts will be less pronounced. On the ground, we saw a big uptick in interest from first-time buyers in the last few months as they sought to get ahead of the changes, which will add thousands to the cost of buying a home. “Some of the negative impacts may be offset by the Bank of England lowering interest rates, which will make mortgages more affordable, but it could also see house prices increase even further. “The route onto the property ladder still contains so many barriers and the upcoming stamp duty threshold reductions will only aggravate an already dire situation.” He suggested that existing stamp duty relief should be kept in place for first-time buyers, “or better still abolish it for first-time buyers”. According to figures from Rightmove, the average asking price for a home has increased by 22% since November 2017, when the £300,000 first-time buyer relief threshold was introduced. The typical price tag has increased from £302,630 in November 2017 to £367,994. Rightmove said there are 28% more first-time buyers in London currently going through the sales completion process than at this time last year. Here are the percentages of transactions where existing homeowners buying a property as their main residence are liable to pay stamp duty now, followed by the estimates from April, according to Zoopla:And here are the percentages of first-time buyer transactions which are liable to pay stamp duty now, followed by the estimates from April, according to Zoopla

STAMP DUTY HOMEBUYERS ENGLAND NORTHERN IRELAND PROPERTY TAX ZOOPLA FIRST-TIME BUYERS HOUSING MARKET

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Met Office Issues New Snow and Ice Warnings for Northern Ireland, Scotland and Northern EnglandThe Met Office has issued two yellow weather warnings for snow and ice, impacting large areas of Northern Ireland, Scotland, and northern England. The warnings are in effect from Friday evening through Saturday morning, with potential for icy conditions and snowfall, particularly on high ground. The Met Office advises the public to plan their journeys accordingly, check for road closures, and take precautions while driving.

Met Office Issues New Snow and Ice Warnings for Northern Ireland, Scotland and Northern EnglandThe Met Office has issued two yellow weather warnings for snow and ice, impacting large areas of Northern Ireland, Scotland, and northern England. The warnings are in effect from Friday evening through Saturday morning, with potential for icy conditions and snowfall, particularly on high ground. The Met Office advises the public to plan their journeys accordingly, check for road closures, and take precautions while driving.

Read more »

Northern Ireland Hotels Face VAT Challenge From RepublicA hotelier in Northern Ireland warns that the Republic of Ireland's planned lower VAT rate will make it harder for Northern Ireland to attract weddings and conferences. The gap in VAT between Northern Ireland (20%) and the Republic of Ireland (13%) is expected to widen further, potentially putting Northern Ireland at a disadvantage.

Northern Ireland Hotels Face VAT Challenge From RepublicA hotelier in Northern Ireland warns that the Republic of Ireland's planned lower VAT rate will make it harder for Northern Ireland to attract weddings and conferences. The gap in VAT between Northern Ireland (20%) and the Republic of Ireland (13%) is expected to widen further, potentially putting Northern Ireland at a disadvantage.

Read more »

Bank of England Interest Rate Cut: Positive News for Northern Ireland Homeowners and BuyersThe Bank of England's decision to cut interest rates for the third time in six months has been welcomed by mortgage advisors in Northern Ireland. Tanya Martin, Financial Planner and Managing Director at Mortgage IQ, explains the potential impact on homeowners, prospective buyers and savers.

Bank of England Interest Rate Cut: Positive News for Northern Ireland Homeowners and BuyersThe Bank of England's decision to cut interest rates for the third time in six months has been welcomed by mortgage advisors in Northern Ireland. Tanya Martin, Financial Planner and Managing Director at Mortgage IQ, explains the potential impact on homeowners, prospective buyers and savers.

Read more »

Stamp Duty Changes Set to Hit Home Buyers in England and Northern IrelandMore home buyers in England and Northern Ireland will be liable to pay stamp duty from April 1 due to changes in the tax system. The proportion of first-time buyers needing to pay stamp duty will double, while the percentage of existing homeowners buying a new home as their main residence facing the tax will increase significantly. The changes, which will see stamp duty discounts become less generous, are estimated to add an extra £1.1 billion annually to government coffers.

Stamp Duty Changes Set to Hit Home Buyers in England and Northern IrelandMore home buyers in England and Northern Ireland will be liable to pay stamp duty from April 1 due to changes in the tax system. The proportion of first-time buyers needing to pay stamp duty will double, while the percentage of existing homeowners buying a new home as their main residence facing the tax will increase significantly. The changes, which will see stamp duty discounts become less generous, are estimated to add an extra £1.1 billion annually to government coffers.

Read more »

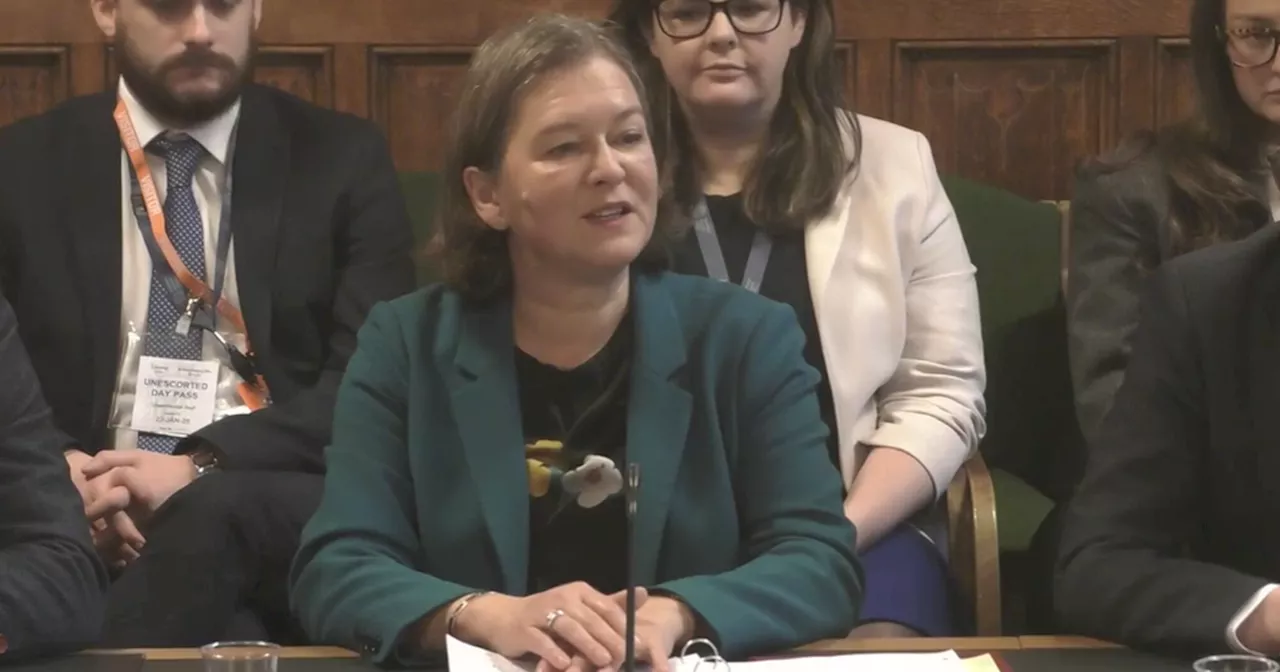

Northern Ireland Minister Backs All-Ireland Health Cooperation to Tackle Waiting ListsNorthern Ireland Minister Fleur Anderson has expressed support for cross-border collaboration to address the significant health waiting lists in Northern Ireland. During a recent appearance before the Northern Ireland Affairs Select Committee, Minister Anderson emphasized the importance of exploring all avenues to improve patient outcomes, including partnerships with the Republic of Ireland.

Northern Ireland Minister Backs All-Ireland Health Cooperation to Tackle Waiting ListsNorthern Ireland Minister Fleur Anderson has expressed support for cross-border collaboration to address the significant health waiting lists in Northern Ireland. During a recent appearance before the Northern Ireland Affairs Select Committee, Minister Anderson emphasized the importance of exploring all avenues to improve patient outcomes, including partnerships with the Republic of Ireland.

Read more »

Funding Dispute Between Northern Ireland and Republic of Ireland Governments Over North-South BodiesA disagreement has erupted between the Northern Ireland government and the Irish government regarding funding for cross-border organizations established under the Good Friday Agreement. Sinn Féin finance minister Caoimhe Archibald proposed an alternative funding model, but DUP deputy first minister Emma Little-Pengelly expressed opposition, arguing that it would disrupt the existing balance between contributions from both jurisdictions.

Funding Dispute Between Northern Ireland and Republic of Ireland Governments Over North-South BodiesA disagreement has erupted between the Northern Ireland government and the Irish government regarding funding for cross-border organizations established under the Good Friday Agreement. Sinn Féin finance minister Caoimhe Archibald proposed an alternative funding model, but DUP deputy first minister Emma Little-Pengelly expressed opposition, arguing that it would disrupt the existing balance between contributions from both jurisdictions.

Read more »