Stocks jump, yields drop as Fed cut hopes bloom

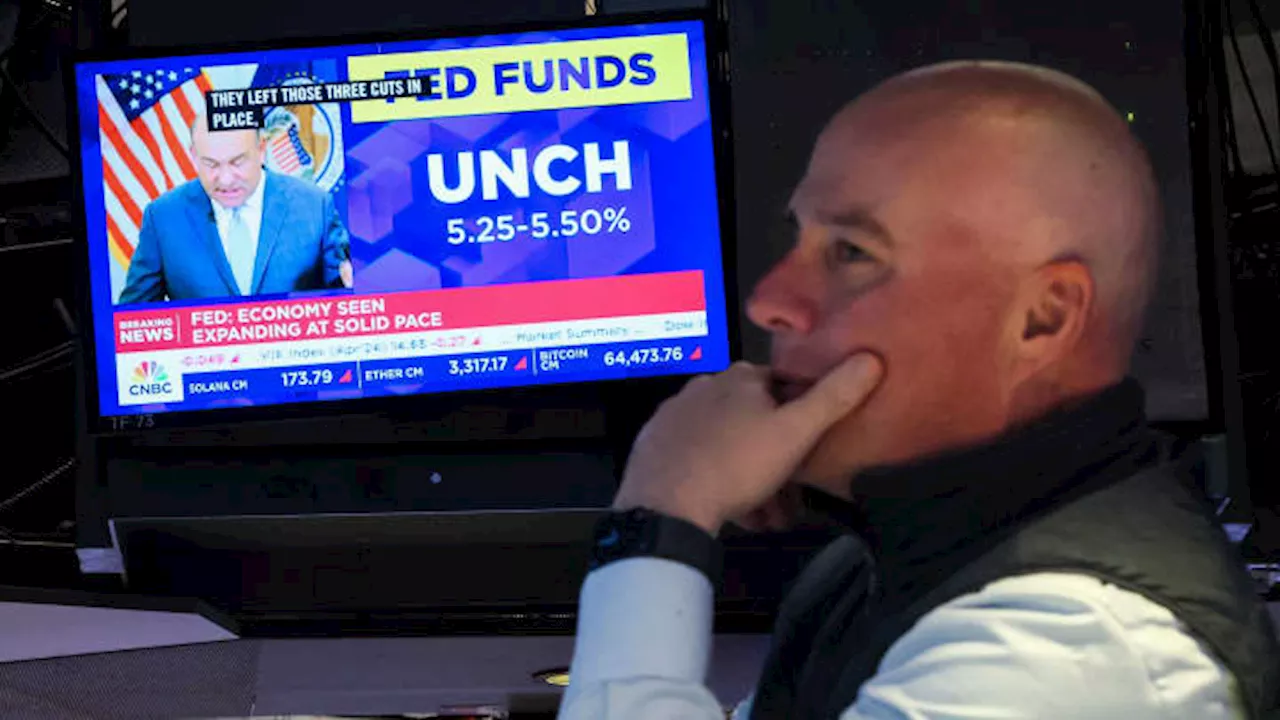

NEW YORK -A gauge of global stocks rallied while Treasury yields fell on Friday after a U.S. payrolls report was softer than anticipated, easing concerns the Federal Reserve would keep interest rates higher for longer.

Recent data on inflation and the labor market had fueled concerns the Fed could would be forced to keep rates higher for longer than the market was anticipating, or even raise rates again. On Wall Street, U.S. stocks rallied, with each of the three major indexes up more than 1% and the Nasdaq leading the advance with a jump of about 2%.

MSCI's gauge of stocks across the globe rose 8.67 points, or 1.14%, to 769.19 and was up 0.91% on the week, on pace for its second straight weekly gain.Against the Japanese yen, the dollar weakened 0.48% at 152.89 while Sterling strengthened 0.1% to $1.2547. The greenback has fallen more than 3% against the yen on the week, its biggest weekly percentage decline since late November.

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Stocks muted, gold at new peak as markets weigh Fed cut timingStocks muted, gold at new peak as markets weigh Fed cut timing

Stocks muted, gold at new peak as markets weigh Fed cut timingStocks muted, gold at new peak as markets weigh Fed cut timing

Read more »

Asian stocks rise as tech boost offsets Fed jitters; China leadsAsian stocks rise as tech boost offsets Fed jitters; China leads

Asian stocks rise as tech boost offsets Fed jitters; China leadsAsian stocks rise as tech boost offsets Fed jitters; China leads

Read more »

Asian stocks: Japan, Australia dip as Fed meeting loomsAsian stocks: Japan, Australia dip as Fed meeting looms

Asian stocks: Japan, Australia dip as Fed meeting loomsAsian stocks: Japan, Australia dip as Fed meeting looms

Read more »

Asia stocks rise as Fed tamps down hike fears; yen leapsAsia stocks rise as Fed tamps down hike fears; yen leaps

Asia stocks rise as Fed tamps down hike fears; yen leapsAsia stocks rise as Fed tamps down hike fears; yen leaps

Read more »

Europe stocks open mixed as earnings roll in; ING up 5%; traders react to Fed decisionEuropean stocks opened mixed on Thursday as global markets react to the U.S. Federal Reserve's latest monetary policy decision.

Europe stocks open mixed as earnings roll in; ING up 5%; traders react to Fed decisionEuropean stocks opened mixed on Thursday as global markets react to the U.S. Federal Reserve's latest monetary policy decision.

Read more »

These are the stocks with the most to gain or lose from the Fed decisionWatch for Federal Reserve Chair Jerome Powell's comments on Wednesday and what that means for these interest rate sensitive stocks.

These are the stocks with the most to gain or lose from the Fed decisionWatch for Federal Reserve Chair Jerome Powell's comments on Wednesday and what that means for these interest rate sensitive stocks.

Read more »