Global markets experienced volatility on Monday as investors reacted to Donald Trump's tariff threats against Canada, Mexico, and China. The S&P 500 initially fell sharply but recovered after Trump agreed to postpone tariffs on Mexico and Canada. Currency markets also fluctuated, with the Mexican peso and Canadian dollar paring back losses. Global investment banks warned that sustained tariffs could halve US economic growth.

Stocks witnessed a partial recovery from their significant losses on Monday as currency markets underwent fluctuations. Investors grappled with keeping pace with Donald Trump's escalating plans for imposing tariffs on several of the United States' key trading partners. The US president issued threats on Saturday to implement a 25 percent tariff on imports originating from Mexico and Canada, a 10 percent levy on Canadian energy, and a 10 percent tariff on imports from China.

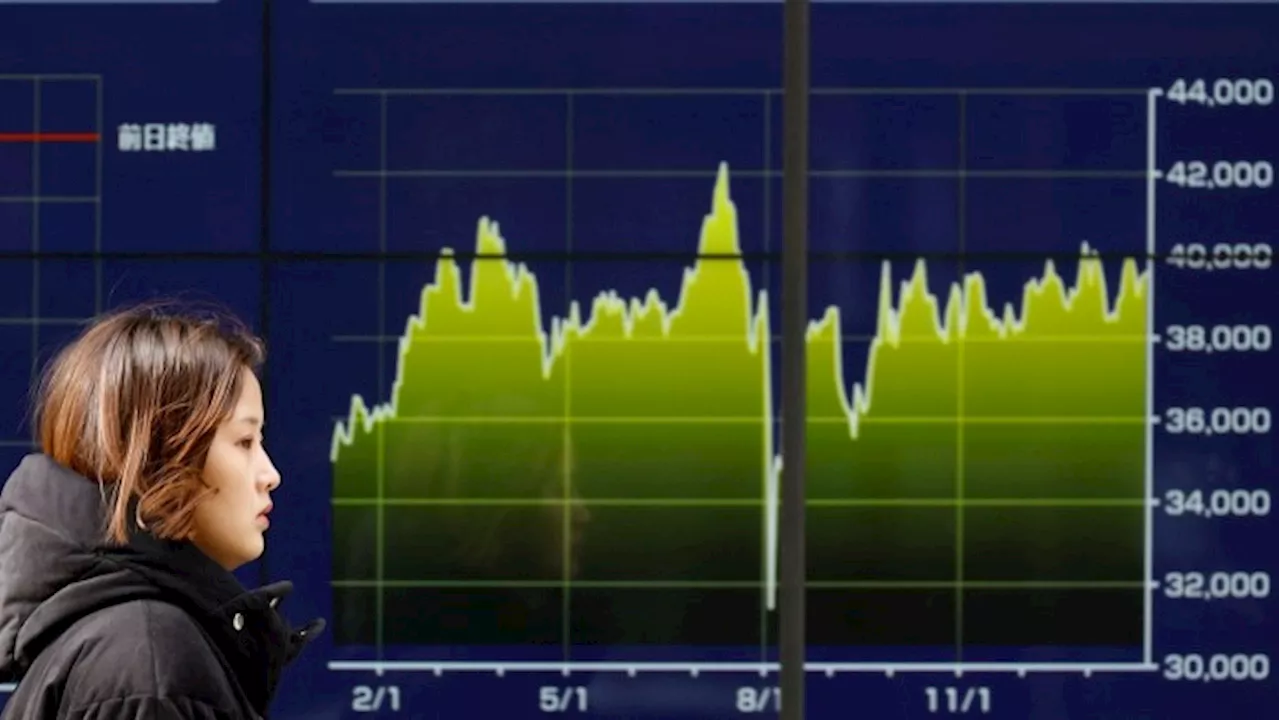

These announcements triggered a substantial sell-off in global equities during the initial trading hours. He also hinted at imposing tariffs against the European Union. However, markets experienced a sharp rebound after Trump agreed to postpone the tariffs on Mexico for a month, following a phone conversation with Mexican President Claudia Sheinbaum on Monday. He subsequently granted a similar 30-day reprieve for Canada after speaking with Prime Minister Justin Trudeau later in the day. The S&P 500, which had earlier declined by nearly 2 percent, concluded the day with a 0.8 percent decrease, with utilities and technology stocks among the worst performers. Investors pointed out that Trump's apparent reversal on Mexico underscored the immense difficulty for markets in keeping up with his rapidly evolving tariff plans. 'What is evident in this new environment is to refrain from making knee-jerk reactions and impulsive moves,' stated Guy Miller, chief market strategist at insurer Zurich. European stocks also staged a partial recovery as investors scrambled to assess the shifting probability of a full-blown global trade war. The continent-wide Stoxx Europe 600 closed 0.9 percent lower, rebounding from steeper losses. Currency markets also experienced significant swings. The Mexican peso, which had earlier depreciated by as much as 3 percent against the dollar, recovered to trade slightly higher on the day. The Canadian dollar also reduced its declines to trade at C$1.457 against the greenback. The US dollar appreciated by 0.5 percent against a basket of currencies, having previously gained more than 1 percent. 'My head hurts,' remarked a foreign exchange trader at a major European bank. 'It's almost impossible to trade; there's simply too much to process. Buy. No, wait, sell. No, actually buy. Just give up,' the individual added. Global investment banks warned that the tariffs would negatively impact the US economy, along with the rest of the world. Analysts at UBS and Morgan Stanley projected that if the tariffs were sustained, they could potentially halve US real GDP growth this year, reducing it by more than 1 percentage point. The US 10-year Treasury yield declined by 0.04 percentage points to 4.53 percent as investors sought refuge in safe assets. Yields fall when prices rise. However, economists have also cautioned that the tariffs are likely to accelerate inflation in the US, discouraging the Federal Reserve from reducing interest rates and bolstering the dollar. 'The most evident implication is a stronger dollar,' stated Eric Winograd, chief economist at AllianceBernstein. 'A long dollar position is the cleanest, clearest expression of the trade war that is now being launched.' Earlier in Asia, Japan's export-heavy Nikkei 225 closed down by 2.7 percent. After experiencing a decline in early trading, Hong Kong's Hang Seng index erased its losses to close flat. Mainland China's stock market remained closed until Wednesday. China's offshore renminbi, which trades freely, dipped as much as 0.7 percent to Rmb7.37 a dollar on Monday morning before retracing its losses to 7.32. Other commodities often viewed as proxies for Chinese and global economic growth also fell. LME copper declined by 0.7 percent to $9,048 per tonne, while nickel and aluminium both dropped by more than 1 percent. Crypto markets also experienced declines as traders reduced their exposure to riskier assets. Ethereum, the second-largest cryptocurrency, fell as much as 27 percent before staging a partial rebound. Bitcoin was down 1 percent to $101,098 per coin. George Saravelos, at Deutsche Bank, stated that the tariff announcements were 'at the most hawkish end of the protectionist spectrum we could have envisaged,' and that markets needed to 'structurally and significantly reprice the trade war risk premium.

TRADE WAR TARIFFS GLOBAL MARKETS US ECONOMY CURRENCY MARKETS

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Trump launches trade war with China, Canada and Mexico, sparking fears for global economyDonald Trump will put in place tariffs on imports from China, Canada and Mexico from Saturday, the White House has confirmed.

Trump launches trade war with China, Canada and Mexico, sparking fears for global economyDonald Trump will put in place tariffs on imports from China, Canada and Mexico from Saturday, the White House has confirmed.

Read more »

Trump's Tariffs on Mexico, Canada, and China May Ripple Across Global EconomyUS President Donald Trump announced new tariffs on goods imported from Mexico, Canada, and China, sparking concerns about potential economic fallout. While the UK won't face direct tariffs, the sanctions could have significant indirect impacts on its economy due to its close trade ties with the US.

Trump's Tariffs on Mexico, Canada, and China May Ripple Across Global EconomyUS President Donald Trump announced new tariffs on goods imported from Mexico, Canada, and China, sparking concerns about potential economic fallout. While the UK won't face direct tariffs, the sanctions could have significant indirect impacts on its economy due to its close trade ties with the US.

Read more »

Trump to Impose Tariffs on China, Mexico, and Canada, Threatening Global Trade WarPresident Donald Trump is set to impose tariffs on goods from China, Mexico, and Canada, potentially sparking a global trade war. The move is seen as a 'punishment' for allowing drugs and migrants to enter the US, but could harm American consumers and disrupt trillions of dollars in trade.

Trump to Impose Tariffs on China, Mexico, and Canada, Threatening Global Trade WarPresident Donald Trump is set to impose tariffs on goods from China, Mexico, and Canada, potentially sparking a global trade war. The move is seen as a 'punishment' for allowing drugs and migrants to enter the US, but could harm American consumers and disrupt trillions of dollars in trade.

Read more »

Trump Launches Global Trade War with Tariffs on Canada, Mexico and ChinaDonald Trump's imposition of tariffs on major trading partners Canada, Mexico and China sets the stage for a global trade war. The tariffs, implemented to curb migrant and drug flows, will impact various industries, particularly automobiles and agriculture. Retaliatory tariffs from Canada and Mexico are expected, and the full impact on global markets remains to be seen.

Trump Launches Global Trade War with Tariffs on Canada, Mexico and ChinaDonald Trump's imposition of tariffs on major trading partners Canada, Mexico and China sets the stage for a global trade war. The tariffs, implemented to curb migrant and drug flows, will impact various industries, particularly automobiles and agriculture. Retaliatory tariffs from Canada and Mexico are expected, and the full impact on global markets remains to be seen.

Read more »

Trump Threatens Tariffs on Mexico and Canada, Sparking Market TurmoilDonald Trump's threats of 25% tariffs on Mexico and Canada by February 1st sent ripples through financial markets. The Mexican peso and Canadian dollar plunged, while the dollar index and U.S. stock futures experienced volatility. This move highlights the potential for upheaval as Trump implements his protectionist agenda.

Trump Threatens Tariffs on Mexico and Canada, Sparking Market TurmoilDonald Trump's threats of 25% tariffs on Mexico and Canada by February 1st sent ripples through financial markets. The Mexican peso and Canadian dollar plunged, while the dollar index and U.S. stock futures experienced volatility. This move highlights the potential for upheaval as Trump implements his protectionist agenda.

Read more »

Trump's Tariffs on Mexico and Canada: Impact on American ConsumersPresident Trump's announcement of 25% tariffs on goods from Mexico and Canada has raised concerns about the potential impact on American consumers' wallets. Economists warn that the tariffs could lead to price increases for a wide range of products, from automobiles and gas to food and construction materials. The text explores the potential economic consequences of Trump's tariffs and analyzes the arguments made by both proponents and critics.

Trump's Tariffs on Mexico and Canada: Impact on American ConsumersPresident Trump's announcement of 25% tariffs on goods from Mexico and Canada has raised concerns about the potential impact on American consumers' wallets. Economists warn that the tariffs could lead to price increases for a wide range of products, from automobiles and gas to food and construction materials. The text explores the potential economic consequences of Trump's tariffs and analyzes the arguments made by both proponents and critics.

Read more »