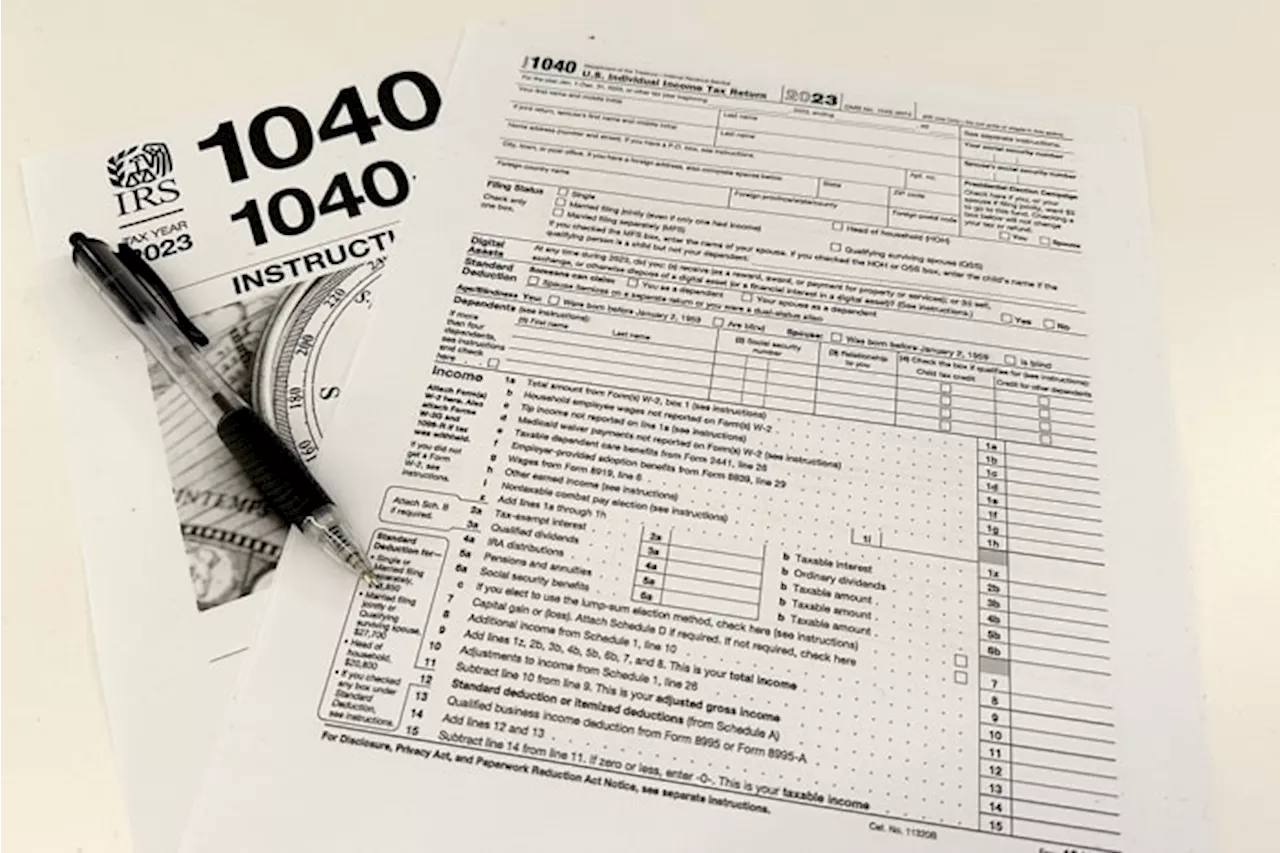

With just a few days left until Tax Day, Americans are seeing larger tax refunds this year. The IRS has already received over 90 million tax returns and processed more than 88 million. Find out about common tax relief exceptions and how to request a tax filing extension.

WASHINGTON — Tax Day falls on April 15 for most Americans this year, meaning there's just a few days left toThe Internal Revenue Service has already received over 90 million tax returns and processed more than 88 million, according to theEarly tax data suggests Americans are seeing larger tax refunds this year, partly due to the provision changes made by the IRS to counteract inflation.

Here's what you need to know about the tax deadline, including common tax relief exceptions and what to do if you need an extension. deadline is extended until April 17, 2024,Yes. The IRS says some taxpayers living overseas and disaster victims have later filing deadlines. That means storm, flooding and wildfire victims in some parts of Maine, Rhode Island, Hawaii, Alaska and other states have extra time to file; extended deadlines vary by state.

Part of the reason that Americans are receiving bigger tax refunds on average is due to the provision changes the IRS made to counteract inflation. The tax agency pushedYes, you can check the status of your tax refund

Tax Day Tax Refunds IRS Tax Returns Tax Relief Tax Filing Extension

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Tax deadline day is approaching fast: Get 50% off QuickBooks OnlineThe tax deadline for filing is almost here, and if you're not ready to file, you're going to need some help. Learn how QuickBooks Online offers exactly that.

Tax deadline day is approaching fast: Get 50% off QuickBooks OnlineThe tax deadline for filing is almost here, and if you're not ready to file, you're going to need some help. Learn how QuickBooks Online offers exactly that.

Read more »

Tax Day Approaching: Penalties for Late Filing and PaymentWith Tax Day just around the corner, taxpayers who fail to file or pay their taxes on time may face costly penalties. The IRS imposes a failure-to-file penalty of 5% of the unpaid taxes for each month your return is late, with a maximum of 25% of the total balance due. Additionally, there is a failure-to-pay penalty of 0.5% per month, also capped at 25% of the total balance due. If both penalties are imposed, the IRS will reduce one by 0.5%.

Tax Day Approaching: Penalties for Late Filing and PaymentWith Tax Day just around the corner, taxpayers who fail to file or pay their taxes on time may face costly penalties. The IRS imposes a failure-to-file penalty of 5% of the unpaid taxes for each month your return is late, with a maximum of 25% of the total balance due. Additionally, there is a failure-to-pay penalty of 0.5% per month, also capped at 25% of the total balance due. If both penalties are imposed, the IRS will reduce one by 0.5%.

Read more »

Tax crunch time is here: what to do before Tax DayWith just days remaining until Tax Day, April 15, a tax expert shows what you should be doing this week.

Tax crunch time is here: what to do before Tax DayWith just days remaining until Tax Day, April 15, a tax expert shows what you should be doing this week.

Read more »

Tax time: When 'free' tax filing programs aren't actually freeWhat are your options?

Tax time: When 'free' tax filing programs aren't actually freeWhat are your options?

Read more »

Advice from the BBB to avoid being ghosted by your tax preparerA 'ghost tax preparer' is someone who isn't certified but still prepares tax returns.

Advice from the BBB to avoid being ghosted by your tax preparerA 'ghost tax preparer' is someone who isn't certified but still prepares tax returns.

Read more »

Bruce Willis' loved ones share heartfelt birthday tributesBexar County tax accessor reminds families to apply for homestead tax exemption

Bruce Willis' loved ones share heartfelt birthday tributesBexar County tax accessor reminds families to apply for homestead tax exemption

Read more »