Analysts from Standard Chartered note discrepancies between supply estimates from IEA, OPEC, and the U.S. Energy Information Administration, suggesting the perceived 2025 oversupply might be exaggerated.

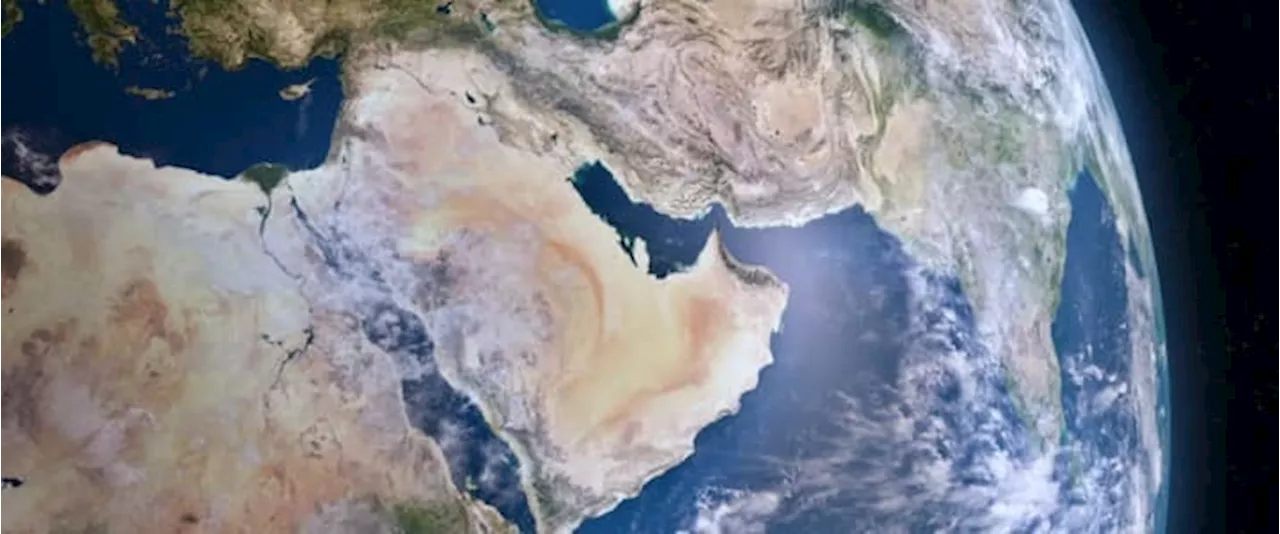

Oil prices are little changed in Wednesday's intraday sessions after they tumbled more than 4% on Tuesday to a near two-week low on easing Iranian supply disruption fears. According to a report by the Washington Post, Israeli Prime Minister Netanyahu told the Biden administration that Israel is willing to strike Iran’s military infrastructure rather than oil or nuclear facilities, and that Israel would take U.S. opinion into consideration.

Related Oil Jumps After API Reports Draws in Crude and Fuel Inventories StanChart points out that whereas the market has been focusing more on the considerable gap between IEA and OPEC Secretariat estimates of demand growth, relatively little attention has been given to even larger differences between IEA and U.S .Energy Information Administration EIA estimates of OPEC also known as Declaration of Cooperation, DoC oil output.

Oil Brent Oil Prices Oil Markets Volatility

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Rumors of a Saudi Production Hike Boost Bearish Sentiment in Oil MarketsThe combination of Saudi Arabia's anticipated production increase, weak demand growth from China, and additional supply from Libya suggests that downward pressure will continue

Rumors of a Saudi Production Hike Boost Bearish Sentiment in Oil MarketsThe combination of Saudi Arabia's anticipated production increase, weak demand growth from China, and additional supply from Libya suggests that downward pressure will continue

Read more »

Oil Prices Start the Week in Decline on Bearish Economic Data From ChinaOil prices fell at the start of the week due to concerns about weak Chinese demand, despite the announcement of stimulus measures and US sanctions on Iran.

Oil Prices Start the Week in Decline on Bearish Economic Data From ChinaOil prices fell at the start of the week due to concerns about weak Chinese demand, despite the announcement of stimulus measures and US sanctions on Iran.

Read more »

Big Oil Set to Bid in Algeria's New Oil and Gas Licensing RoundAlgeria is launching a new licensing round for its oil and gas sector, attracting interest from major international energy companies.

Big Oil Set to Bid in Algeria's New Oil and Gas Licensing RoundAlgeria is launching a new licensing round for its oil and gas sector, attracting interest from major international energy companies.

Read more »

Scots oil executive demands urgent review Grangemouth oil refinery closure plansSUNDAY MAIL EXCLUSIVE: Gulfsands Petroleum CEO John Bell and former Grangemouth apprentice has joined leading industry figures in calling for government action to save vital national asset.

Scots oil executive demands urgent review Grangemouth oil refinery closure plansSUNDAY MAIL EXCLUSIVE: Gulfsands Petroleum CEO John Bell and former Grangemouth apprentice has joined leading industry figures in calling for government action to save vital national asset.

Read more »

EIA Slashes Forecasts of Oil Demand Growth and Oil Prices in 2025The U.S. Energy Information Administration lowered its forecast for global oil demand growth in 2025 due to weaker economic outlooks in developed nations, causing a decrease in predicted Brent crude oil prices.

EIA Slashes Forecasts of Oil Demand Growth and Oil Prices in 2025The U.S. Energy Information Administration lowered its forecast for global oil demand growth in 2025 due to weaker economic outlooks in developed nations, causing a decrease in predicted Brent crude oil prices.

Read more »

Oil Rises Israel Hints At Attack on Iran's Oil & Gas InfrastructureCrude oil prices rose on continued geopolitical tensions following Iran's 200-missile barrage on Israel.

Oil Rises Israel Hints At Attack on Iran's Oil & Gas InfrastructureCrude oil prices rose on continued geopolitical tensions following Iran's 200-missile barrage on Israel.

Read more »