The DWP estimates it has underpaid 165,000 people on the Basic State Pension a total of £1.2billion

The Department for Work and Pensions now estimates that 165,000 State Pensioners have been underpaid £1.2billion due to historical official errors relating to married women, widows and people aged over 80.

However, the DWP cannot begin to correct cases until HM Revenue & Customs , which administers both National Insurance and Child Benefit records, corrects the National Insurance records and notifies the DWP. It plans to start sending out letters to people who may be affected in the autumn. Between January 2021 and the end of March 2023 the DWP checking process has identified 50,569 underpayments, owed a total of £324million.

Married Widowed Over 80 Top Money Stories Today Who might be due back payments for State Pension? There are six particular groups strongly encouraged to contact the pension service to see if they could be entitled to more State Pension.How to check if you are affected or make a claim A phone call to the pension service is the quickest way to find out if you are eligible for a State Pension refund. The best number to call is 0800 731 0469 but full contact details can be found on the Gov.

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

DWP to review PIP, State Pension and four other benefits for fraud and errorThe DWP has also announced that claims for New State Pension made online will be measured this year

DWP to review PIP, State Pension and four other benefits for fraud and errorThe DWP has also announced that claims for New State Pension made online will be measured this year

Read more »

DWP benefits older people can no longer claim when they reach State Pension ageThere are two benefits people under 66 may be eligible to claim now that could carry over into State Pension age.

DWP benefits older people can no longer claim when they reach State Pension ageThere are two benefits people under 66 may be eligible to claim now that could carry over into State Pension age.

Read more »

10 health conditions providing people of State Pension age with up to £407The latest figures from the Department for Work and Pensions (DWP) show by the end of November 2022, there were more than 1.4 million older people receiving additional financial support through Attendance Allowance

10 health conditions providing people of State Pension age with up to £407The latest figures from the Department for Work and Pensions (DWP) show by the end of November 2022, there were more than 1.4 million older people receiving additional financial support through Attendance Allowance

Read more »

Older people living on their own could be due £3,500 annual State Pension top-upHouseholds aged between 65-74 had an average weekly spend of £455 in 2021/22.

Older people living on their own could be due £3,500 annual State Pension top-upHouseholds aged between 65-74 had an average weekly spend of £455 in 2021/22.

Read more »

New calls for income tax on State Pension to be scrapped due official responseThe freezing of the Personal Allowance at £12,570 could see more pensioners paying tax this year.

New calls for income tax on State Pension to be scrapped due official responseThe freezing of the Personal Allowance at £12,570 could see more pensioners paying tax this year.

Read more »

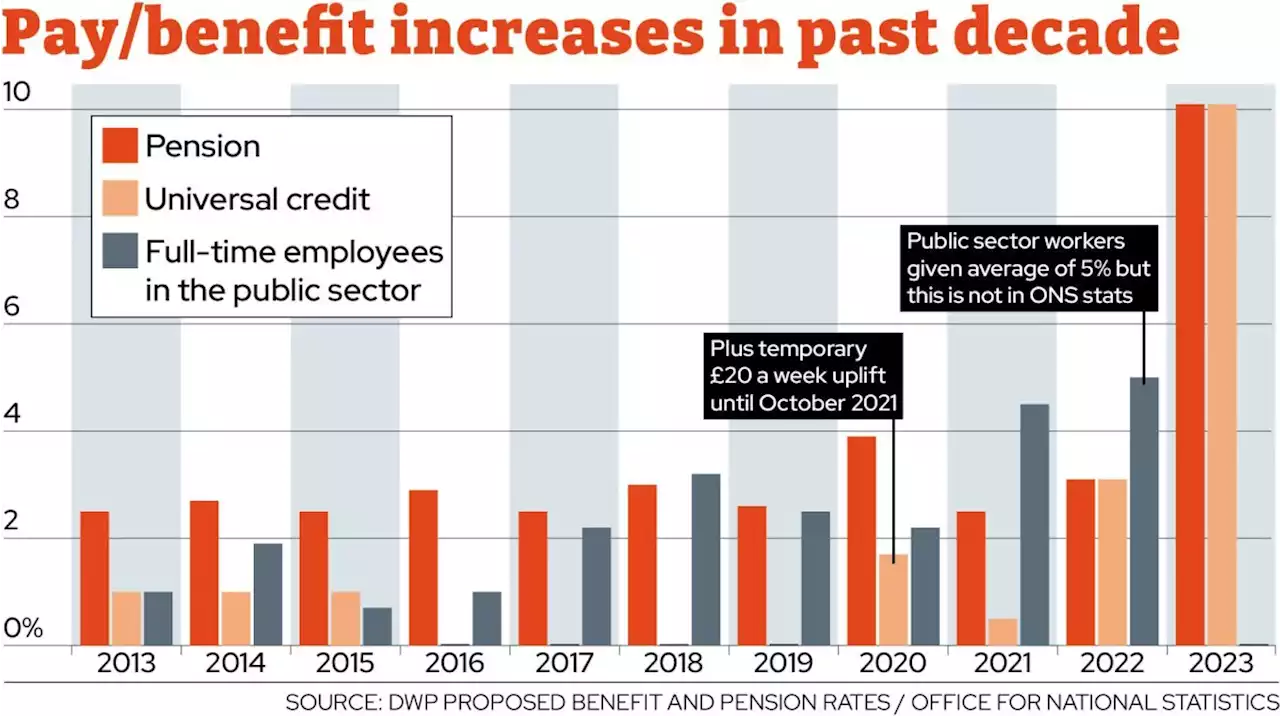

How the state pension has increased faster than public sector pay over a decadeAs the Government prepares to announce its decision on this year’s public sector pay award there are concerns ministers are not prepared to offer the recommended 6% increase ⬇️ ChaplainChloe explains how increases in the state pension compare

How the state pension has increased faster than public sector pay over a decadeAs the Government prepares to announce its decision on this year’s public sector pay award there are concerns ministers are not prepared to offer the recommended 6% increase ⬇️ ChaplainChloe explains how increases in the state pension compare

Read more »