This article explores the complex and potentially contradictory aims of US president-elect Donald Trump regarding the US dollar. It examines how his desire for a weaker dollar to boost exports and compete globally clashes with his ambition for a strong dollar and US financial dominance. The article analyzes the potential consequences of Trump's policies on the dollar's value and its role as a global reserve currency, highlighting the risks of volatility and uncertainty in US trade and financial markets.

The writer is a professor in the Dyson School at Cornell University and senior fellow at Brookings. US president-elect Donald Trump wants a weaker dollar in order to boost exports, protect American jobs from foreign competition and reduce the trade deficit. He also wants a strong dollar and will not brook any challenges to its dominance in global finance . If that is not enough of an inconsistency, the new administration’s policies could well be at cross-purposes with both of those intentions.

Its actions will probably boost the dollar’s value in the short run while its status as a reserve currency may well become shakier. What it means for the world, though, is a great deal of uncertainty on US trade policies — accompanied by turbulence in global capital flows and exchange rates. Volatility in US policies and financial markets invariably spills over into other countries’ economies and markets. In the greatest irony of all, this will encourage flight into dollar assets, which are still perceived as the safest investments. This would cement the dollar’s dominance even as Trump undercuts the institutional framework that is its bedrock. The president-elect has talked about devaluing the dollar, but the imposition of tariffs on imports from key US trading partners would have the opposite effect — driving up the dollar’s value and making it harder for US exporters to compete in global markets. The new administration is likely to widen the US budget deficit: tax cuts are unlikely to be matched by spending reductions. This will drive down US national saving. Meanwhile, with China, Europe, Japan and the rest of the world in the economic doldrums, the US remains one of the best places to invest. The country’s recent productivity “boomlet” is a sharp contrast to weak productivity growth in other major economies. So the imbalance between saving and investment, which is the root of the overall US trade deficit, is only going to widen. Tariffs do matte

US Dollar Trade Policy Global Finance Trump Administration Economic Uncertainty

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

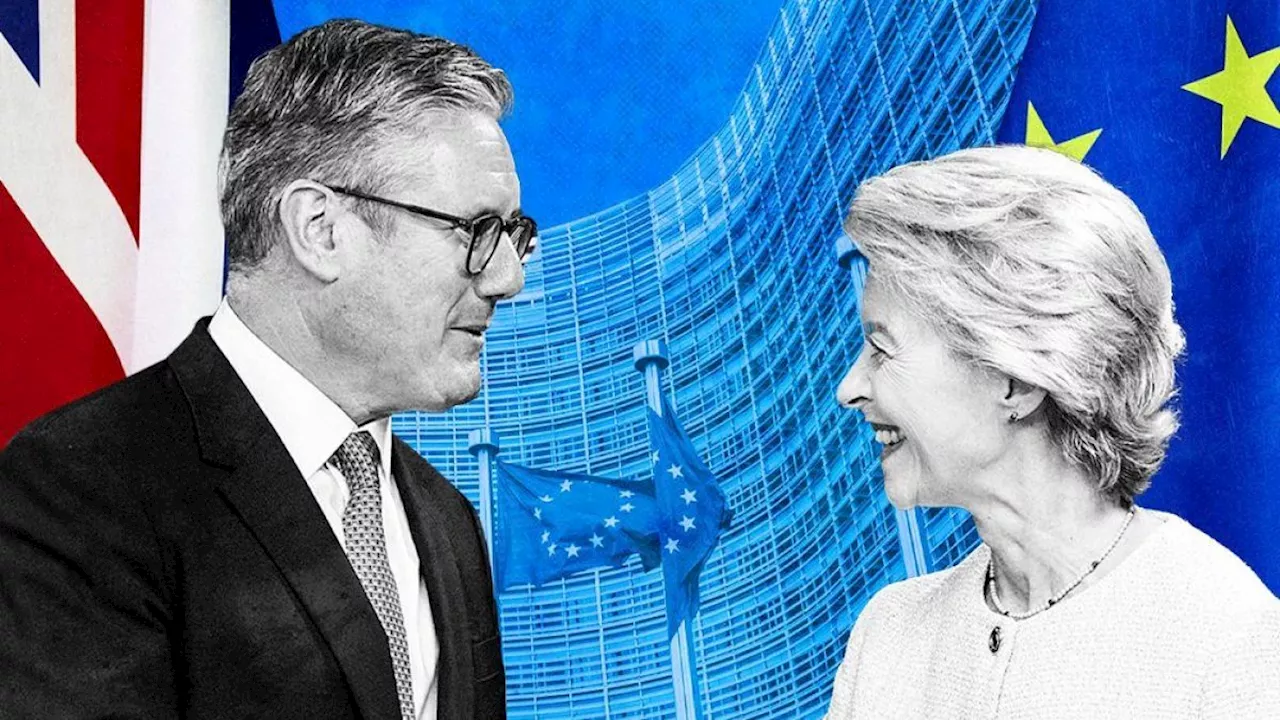

Trump 2.0 fears are boosting Starmer's Brexit reset'It needs to be more attractive and less bureaucratic for Europeans to spend time in the UK and vice versa,” says a prominent MEP.

Trump 2.0 fears are boosting Starmer's Brexit reset'It needs to be more attractive and less bureaucratic for Europeans to spend time in the UK and vice versa,” says a prominent MEP.

Read more »

Dollar climbs after Donald Trump’s Brics tariff threat and French political woesCurrency on course for biggest daily rise since November 5 US presidential election

Dollar climbs after Donald Trump’s Brics tariff threat and French political woesCurrency on course for biggest daily rise since November 5 US presidential election

Read more »

Trump’s tricky dollar problemThe president-elect might want a weaker US currency but market forces are pushing in the other direction

Trump’s tricky dollar problemThe president-elect might want a weaker US currency but market forces are pushing in the other direction

Read more »

Wall Street Predicts Dollar Strength Despite Trump's Weaker Currency DesireThe US dollar is predicted to strengthen further despite President-elect Donald Trump's call for a weaker currency. Financial institutions anticipate the dollar's continued rise in 2017, citing market expectations for Trump's trade policies and tax cuts. This contradicts Trump's view on the strong dollar's negative impact on the US economy.

Wall Street Predicts Dollar Strength Despite Trump's Weaker Currency DesireThe US dollar is predicted to strengthen further despite President-elect Donald Trump's call for a weaker currency. Financial institutions anticipate the dollar's continued rise in 2017, citing market expectations for Trump's trade policies and tax cuts. This contradicts Trump's view on the strong dollar's negative impact on the US economy.

Read more »

Trump threatens Brics nations with 100% tariffs if they undermine dollarWarning against pushing alternatives to reserve currency is latest trade threat from incoming president

Trump threatens Brics nations with 100% tariffs if they undermine dollarWarning against pushing alternatives to reserve currency is latest trade threat from incoming president

Read more »

Billion dollar squirrel: Trump effect fuels crypto’s ‘memecoin’ boomTokens based on online viral moments outpace bitcoin over past month but critics say they reflect market froth

Billion dollar squirrel: Trump effect fuels crypto’s ‘memecoin’ boomTokens based on online viral moments outpace bitcoin over past month but critics say they reflect market froth

Read more »