TSB Bank and Halifax have recently provided clarity on crucial savings limits rules for their customers, responding to queries about making payments and managing Individual Savings Accounts (ISAs). TSB addressed limits on external transfers from savings accounts and outlined the daily transfer limits for current accounts. Halifax explained the rules surrounding reactivating existing ISAs after opening new ones with other providers within the same tax year.

TSB Bank recently clarified important savings limits rules for its customers after a customer inquired about making payments via social media. The customer asked about the maximum amount they could send from their savings and current accounts , specifically if they could send £100,000 from each. TSB explained that savings accounts have a restriction preventing external transfers . Customers can only transfer funds to other TSB accounts in their name.

Current accounts, however, have different rules. Customers can send up to £25,000 per day as a faster payment through their Online Banking. For larger payments, they can either make multiple smaller payments over several days or visit a branch with their card and valid photo ID. The bank also suggested visiting a branch for larger payments, as they can send up to £100,000 per day as a faster payment or arrange a CHAPS payment with no limit for even larger transactions. This clarification follows a similar situation at Halifax, where a customer inquired about reactivating an existing ISA after opening a new one with a different provider within the same tax year. Halifax initially clarified that customers can only contribute to one cash ISA with them per tax year, but can also contribute to other types of ISAs, such as stocks and shares ISAs, Lifetime ISAs, or Innovative Finance ISAs, as long as they are eligible. They emphasized that the total contribution to all ISAs cannot exceed the annual ISA allowance, which is currently £20,000. Regarding the customer's desire to reactivate their Halifax ISA to collect interest and potentially close the account, Halifax confirmed that reactivating an existing ISA does not incur any penalties from HMRC and does not affect the newly opened ISA.

Savings Limits TSB Bank Halifax Current Accounts ISA Rules External Transfers

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Halifax Warns Customers of Savings Limit on Monthly Saver AccountHalifax clarifies rules for its Monthly Saver account, stating that a £100 monthly deposit cap can limit savings potential if payments are missed.

Halifax Warns Customers of Savings Limit on Monthly Saver AccountHalifax clarifies rules for its Monthly Saver account, stating that a £100 monthly deposit cap can limit savings potential if payments are missed.

Read more »

Start 2025 with a Savings ChallengeLearn how to maximize your savings in 2025 with the popular '1p savings challenge'.

Start 2025 with a Savings ChallengeLearn how to maximize your savings in 2025 with the popular '1p savings challenge'.

Read more »

Inflation Bites: Best Savings Strategies to Protect Your MoneyInflation continues to soar, impacting savers nationwide. This article explores the current inflation rate, its implications for savings, and various strategies for maximizing returns. It examines the pros and cons of fixed-rate and easy-access accounts, highlights the benefits of Individual Savings Accounts (ISAs), and emphasizes the importance of active engagement in managing savings.

Inflation Bites: Best Savings Strategies to Protect Your MoneyInflation continues to soar, impacting savers nationwide. This article explores the current inflation rate, its implications for savings, and various strategies for maximizing returns. It examines the pros and cons of fixed-rate and easy-access accounts, highlights the benefits of Individual Savings Accounts (ISAs), and emphasizes the importance of active engagement in managing savings.

Read more »

Simple Savings Challenge Could Net You Nearly £700 by the End of the YearA straightforward savings challenge called the '1p savings challenge' allows individuals to build a substantial savings pot by the end of 2025, potentially reaching nearly £700. Even if you join later, significant savings are achievable.

Simple Savings Challenge Could Net You Nearly £700 by the End of the YearA straightforward savings challenge called the '1p savings challenge' allows individuals to build a substantial savings pot by the end of 2025, potentially reaching nearly £700. Even if you join later, significant savings are achievable.

Read more »

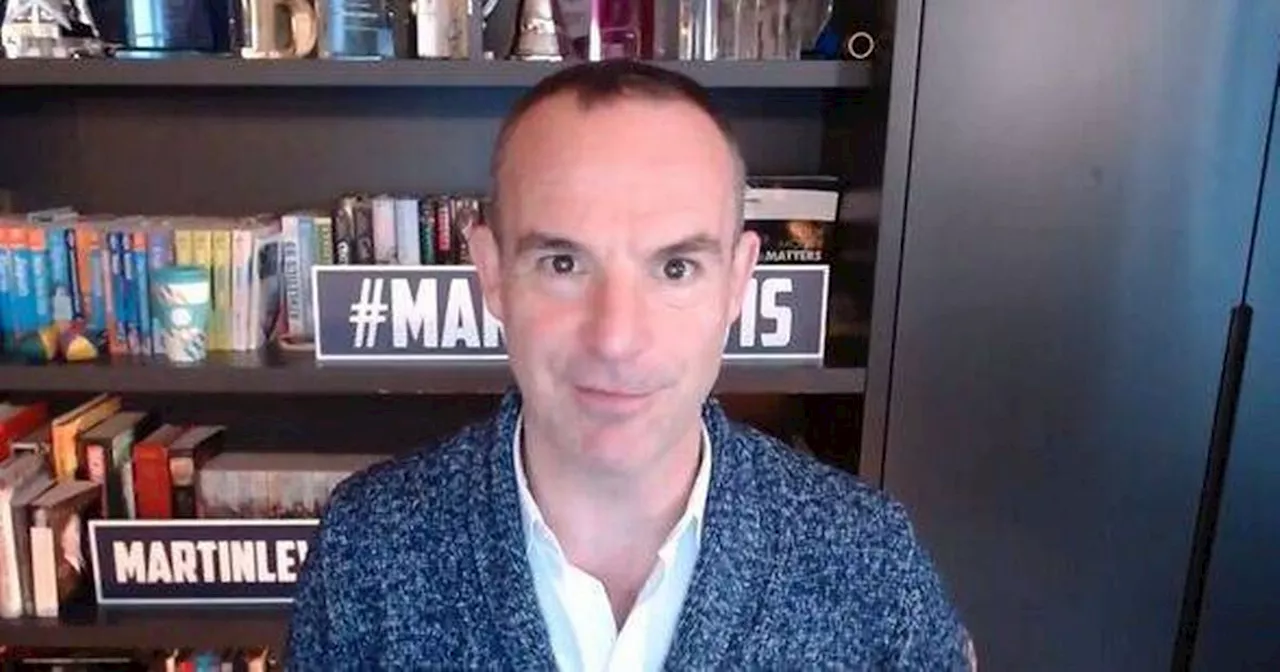

Martin Lewis Reveals Two Legal Methods to Avoid Paying Tax on SavingsFinancial expert Martin Lewis shares two legal strategies to minimize taxes on savings, including utilizing cash ISAs and Premium Bonds.

Martin Lewis Reveals Two Legal Methods to Avoid Paying Tax on SavingsFinancial expert Martin Lewis shares two legal strategies to minimize taxes on savings, including utilizing cash ISAs and Premium Bonds.

Read more »

Martin Lewis Reveals Tax-Saving Strategies for UK SaversMoney Saving Expert founder Martin Lewis shares practical tips on how to avoid paying taxes on savings exceeding £10,000. He highlights the benefits of Cash ISAs and Premium Bonds, emphasizing the importance of understanding personal savings allowances based on income level.

Martin Lewis Reveals Tax-Saving Strategies for UK SaversMoney Saving Expert founder Martin Lewis shares practical tips on how to avoid paying taxes on savings exceeding £10,000. He highlights the benefits of Cash ISAs and Premium Bonds, emphasizing the importance of understanding personal savings allowances based on income level.

Read more »