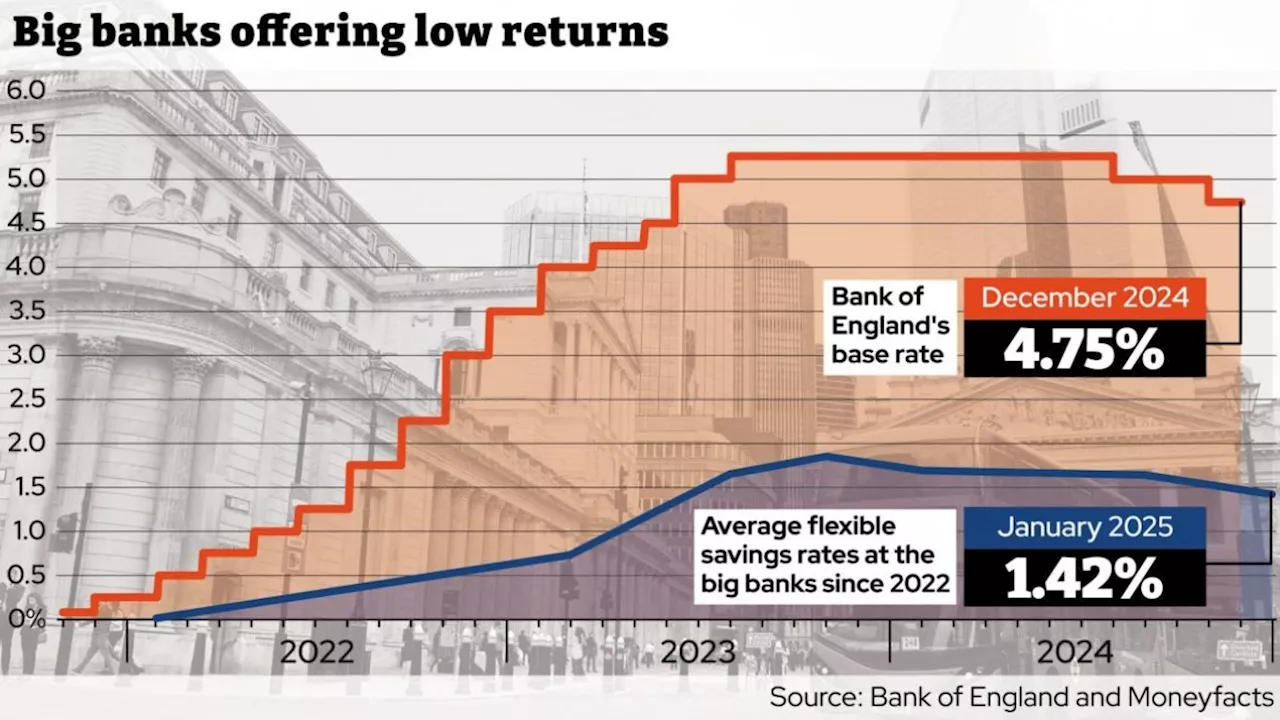

Major UK banks like Barclays, HSBC, Lloyds, NatWest, and Santander are offering significantly lower interest rates on easy-access savings accounts compared to the market average. This comes despite these banks reporting substantial profits in recent years.

Barclays, HSBC, Lloyds, NatWest and Santander pay an average rate of 1.42% between them on easy-access accountsThe UK’s biggest banks have cut rates on their flexible savings accounts, offering typically 1.5 per cent less than the market average despite making bumper profits.

Most banks reserve their best rates for fixed accounts where savers must lock their money away for set periods of time. Rachel Springall, finance expert at Moneyfacts, said it would be “disheartening” for savers to find the biggest banks had cut rates on their most flexible savings accounts, resulting in a further drop in their market positions.

In response, bank bosses argued that attempts were made to encourage savers to look at all the available deals. Should interest rates go down, as expected, fixed rates can be a good option if people can afford to lock their money away as they will offer a better return for longer. “However, the big banks moved like Usain Bolt when it came to increasing their mortgage rates but like a tortoise when it came to improving savings rates.”The government will be concerned that a failure to pass on interest rates will impact on its key performance indicator for this Parliament – which is to make voters feel better off with more money in the pocket.

“Regularly reviewing and switching pots is essential when interest rates change, particularly when base rate cuts flow into the savings market.”

SAVINGS RATES BANKS PROFITS INTEREST RATES MARKET AVERAGE

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

How banks are TRAPPING customers on lower savings rates as they ignore new ISA rules...Prompt: BANK SWITCHING PERKS https://www.thesun.co.

How banks are TRAPPING customers on lower savings rates as they ignore new ISA rules...Prompt: BANK SWITCHING PERKS https://www.thesun.co.

Read more »

Best Savings Accounts 2024: Top Banks RevealedThe Sun analyzed the performance of banks and building societies across various savings account types in 2024. The study highlights the leading institutions offering the most competitive deals and predicts trends for 2025.

Best Savings Accounts 2024: Top Banks RevealedThe Sun analyzed the performance of banks and building societies across various savings account types in 2024. The study highlights the leading institutions offering the most competitive deals and predicts trends for 2025.

Read more »

Barclays and Other Banks Slash Savings Account Interest RatesThousands of Barclays customers face account changes coming into effect on January 31, 2025, with interest rates on savings, investment, and current accounts set to decrease. The impact will vary depending on the account balance, with those holding less than £32,000 seeing the most significant changes. Other banks, including Starling and First Direct, are also making adjustments to their savings account rates, highlighting a trend of decreasing returns on savings.

Barclays and Other Banks Slash Savings Account Interest RatesThousands of Barclays customers face account changes coming into effect on January 31, 2025, with interest rates on savings, investment, and current accounts set to decrease. The impact will vary depending on the account balance, with those holding less than £32,000 seeing the most significant changes. Other banks, including Starling and First Direct, are also making adjustments to their savings account rates, highlighting a trend of decreasing returns on savings.

Read more »

Start 2025 with a Savings ChallengeLearn how to maximize your savings in 2025 with the popular '1p savings challenge'.

Start 2025 with a Savings ChallengeLearn how to maximize your savings in 2025 with the popular '1p savings challenge'.

Read more »

America's Biggest Banks Poised for $31bn Profit Boost as Trump Victory Sparks Market ActivityAmerica's largest banks anticipate a surge in profits to $31 billion for the last quarter of 2024, fueled by increased trading and dealmaking following Donald Trump's election win. Earnings from the six largest US banks are projected to rise 16% compared to the same period last year, excluding $10 billion in payments made to cover regional bank failures. The anticipated increase in profits comes amidst a rise in market volatility leading up to the US election and a subsequent rally in equities. Investment banking fees are expected to jump nearly 30%, driven by corporate debt issuances and equity offerings.

America's Biggest Banks Poised for $31bn Profit Boost as Trump Victory Sparks Market ActivityAmerica's largest banks anticipate a surge in profits to $31 billion for the last quarter of 2024, fueled by increased trading and dealmaking following Donald Trump's election win. Earnings from the six largest US banks are projected to rise 16% compared to the same period last year, excluding $10 billion in payments made to cover regional bank failures. The anticipated increase in profits comes amidst a rise in market volatility leading up to the US election and a subsequent rally in equities. Investment banking fees are expected to jump nearly 30%, driven by corporate debt issuances and equity offerings.

Read more »

Japan’s biggest banks hit valuation landmark as BoJ weighs rate riseLargest lenders now trade at or close to their book values for first time in almost a decade

Japan’s biggest banks hit valuation landmark as BoJ weighs rate riseLargest lenders now trade at or close to their book values for first time in almost a decade

Read more »