Hotter-than-expected inflation readings in recent months are now keeping the Federal Reserve from cutting interest rates anytime soon

Home sales based on contract signings unexpectedly jumped in March despite elevated mortgage rates that month. And the latest data from Freddie Mac showed that mortgage rates edged higher this week, reaching a fresh five-month high.

The broader US housing market began the year with some momentum, as home sales climbed, homebuilder sentiment improved and traders priced in several interest rate cuts this year. Now, the narrative has shifted. “Pending home sales probably will drop back significantly over the next couple of months. Sales cannot defy weaker mortgage demand indefinitely, and applications have continued to soften in April,” Oliver Allen, senior US economist at Pantheon Macroeconomics, wrote in a note Thursday.

The median US home price was $393,500 last month, up 4.8% from a year earlier and the highest level since August 2023. It was also the highest March price on record. S&P Global releases a comprehensive index of home prices across the country next week and that one reached a record high in January. Those are the so-called “golden handcuffs” of low mortgage rates. They began to climb in early 2022 when the Federal Reserve started to hike interest rates in a bid to tamp down high inflation. Homeowners have opted to stay put, but life events such as marriage, divorce, and new children could force some of them to give up on waiting for mortgage rates to decline and sell their home, Yun has said.Mortgage rates continue to rise The 30-year fixed-rate mortgage averaged 7.

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Robust Job Gains in March May Impact Federal Reserve's Rate Cut PlansMarch's strong job gains may lead the Federal Reserve to reconsider its plans for rate cuts, as conflicting signs about the labor market's strength emerge. The Labor Department's nonfarm payrolls report showed a gain of 303,000, raising concerns about potential inflation pressures. This could make the central bank more cautious about easing policy. Despite this, the stock market experienced a relief rally on Friday.

Robust Job Gains in March May Impact Federal Reserve's Rate Cut PlansMarch's strong job gains may lead the Federal Reserve to reconsider its plans for rate cuts, as conflicting signs about the labor market's strength emerge. The Labor Department's nonfarm payrolls report showed a gain of 303,000, raising concerns about potential inflation pressures. This could make the central bank more cautious about easing policy. Despite this, the stock market experienced a relief rally on Friday.

Read more »

Fed Minutes Preview: Looking at hints of policy pivotThe Federal Reserve (Fed) will release the minutes of the March policy meeting on Wednesday.

Fed Minutes Preview: Looking at hints of policy pivotThe Federal Reserve (Fed) will release the minutes of the March policy meeting on Wednesday.

Read more »

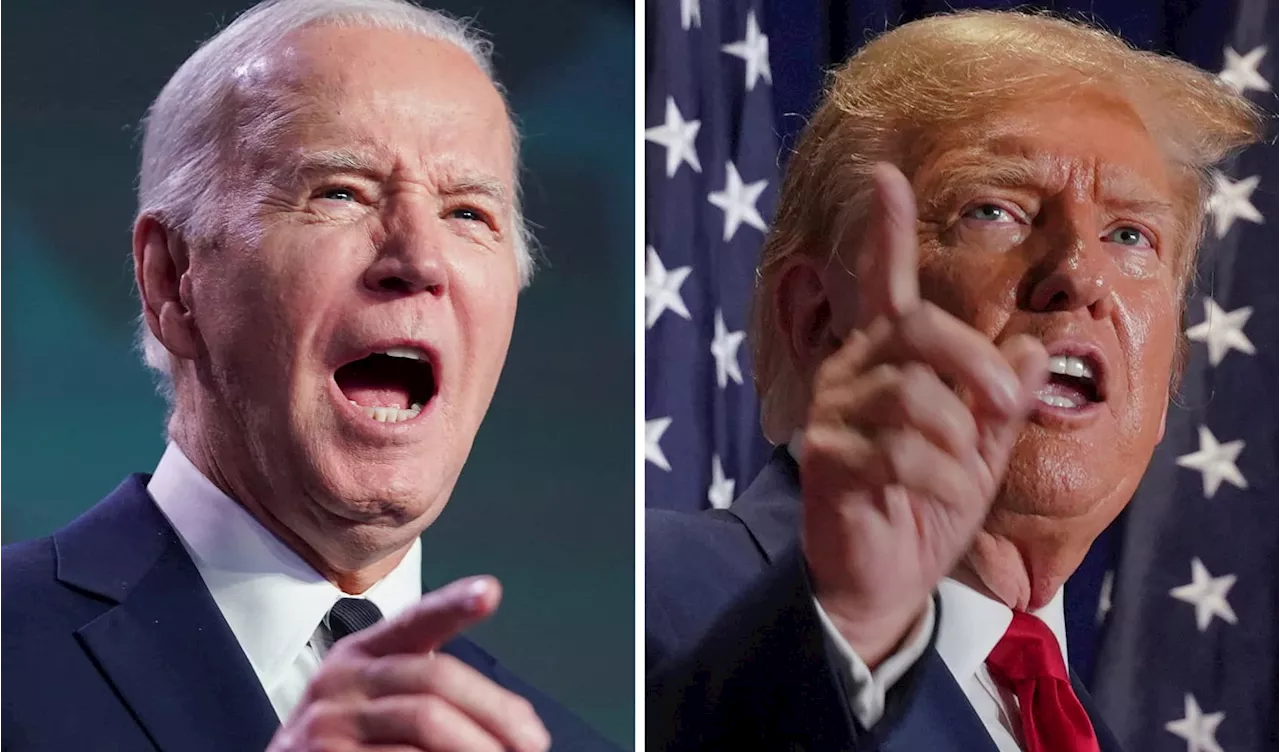

Trump slams Biden for ‘raging' inflation after hotter-than-expected March price reportTrump regularly attacks Biden’s economy as it remains a top voter issue in the 2024 election.

Trump slams Biden for ‘raging' inflation after hotter-than-expected March price reportTrump regularly attacks Biden’s economy as it remains a top voter issue in the 2024 election.

Read more »

Trump slams Biden for ‘raging' inflation after hotter-than-expected March price reportTrump regularly attacks Biden’s economy as it remains a top voter issue in the 2024 election.

Trump slams Biden for ‘raging' inflation after hotter-than-expected March price reportTrump regularly attacks Biden’s economy as it remains a top voter issue in the 2024 election.

Read more »

Will the Federal Reserve still cut rates this year?The Federal Reserve has indicated that it would cut interest rates this year, but stubborn inflation is shifting expectations. The Union-Tribune's Econometer panel of economists and executives weighs in on whether cuts are still on the horizon.

Will the Federal Reserve still cut rates this year?The Federal Reserve has indicated that it would cut interest rates this year, but stubborn inflation is shifting expectations. The Union-Tribune's Econometer panel of economists and executives weighs in on whether cuts are still on the horizon.

Read more »

Federal Reserve Chair Powell: US Economy Strong, but Inflation Still Below TargetFederal Reserve Chair Jerome Powell stated that the US economy is strong, but inflation has not reached the central bank's goal. He mentioned that interest rate cuts are unlikely in the near future and that the current policy will remain unchanged.

Federal Reserve Chair Powell: US Economy Strong, but Inflation Still Below TargetFederal Reserve Chair Jerome Powell stated that the US economy is strong, but inflation has not reached the central bank's goal. He mentioned that interest rate cuts are unlikely in the near future and that the current policy will remain unchanged.

Read more »