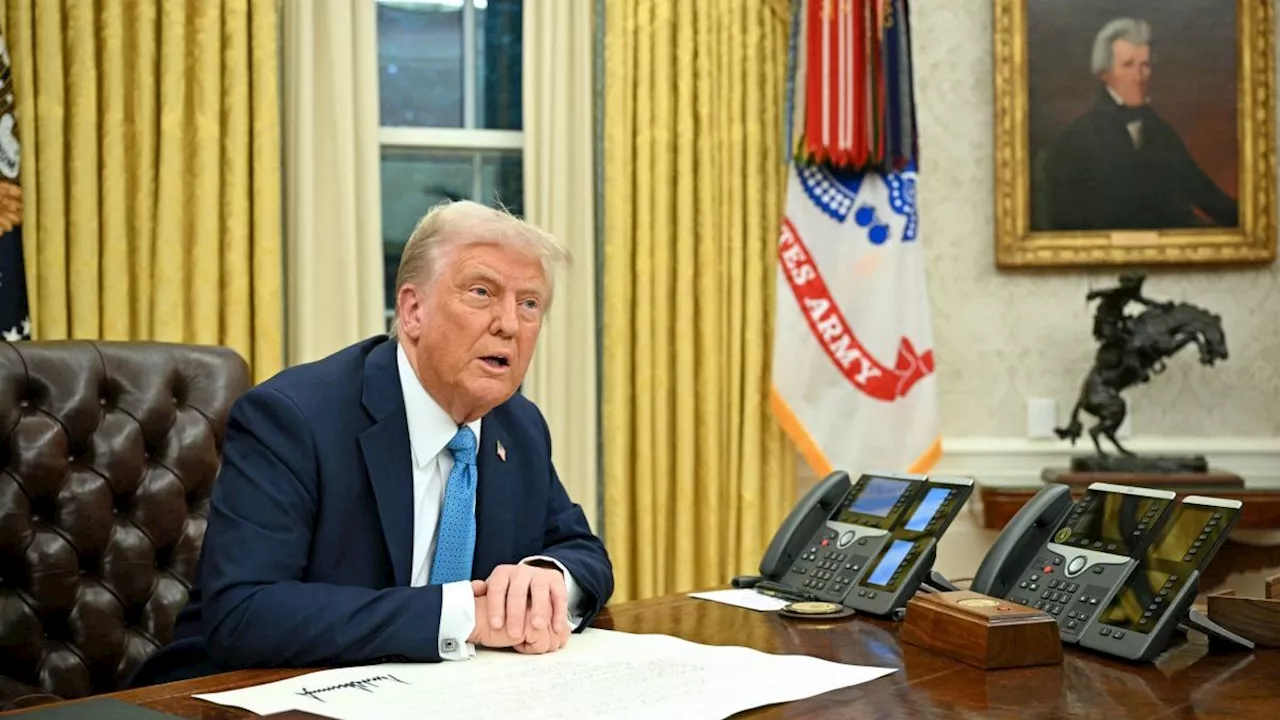

International companies are restructuring their supply chains and expanding operations in the US to mitigate the effects of Donald Trump's planned tariffs. Executives from major firms like LVMH and Shell express optimism about the US business environment, citing lower taxes, energy costs, and growth potential. This trend signifies a shift towards regionalization of production, with companies seeking to source goods closer to their key markets.

International companies are overhauling their supply chains and boosting their presence in the US to align themselves with Donald Trump’s nationalist economic agenda and minimise the impact of his planned tariffs. As the US president prepares to levy duties on imports as soon as this weekend, top executives from Europe and beyond, including LVMH’s Bernard Arnault and Shell’s Wael Sawan, say they expect to invest more in the US.

In an FT article, Christine Lagarde and Ursula von der Leyen, presidents of the European Central Bank and European Commission, warned regulation was an obstacle to investment, adding “we need to make doing business in Europe cheaper, especially in terms of energy costs”. The threat of US tariffs is also spurring a rebalancing of investments, according to executives and bankers, in an effort that spans sectors.

ECONOMY TARIFFS SUPPLY CHAINS INVESTMENTS US

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Donald Trump’s return raises prospect of global tax warPlans to levy higher rates on US multinationals could spur president-elect to respond with tariffs

Donald Trump’s return raises prospect of global tax warPlans to levy higher rates on US multinationals could spur president-elect to respond with tariffs

Read more »

![]() Trump Threatens Tariffs on Imported Semiconductors, Raising Prices for Consumers and Tech CompaniesPresident Trump's proposed tariffs on foreign-made computer chips could lead to a significant spike in electronics prices for American consumers. The tariffs, ranging from 25% to 100%, aim to incentivize the return of semiconductor manufacturing to the US. However, experts warn that such tariffs are likely to backfire, ultimately increasing costs for consumers and potentially harming US technology companies.

Trump Threatens Tariffs on Imported Semiconductors, Raising Prices for Consumers and Tech CompaniesPresident Trump's proposed tariffs on foreign-made computer chips could lead to a significant spike in electronics prices for American consumers. The tariffs, ranging from 25% to 100%, aim to incentivize the return of semiconductor manufacturing to the US. However, experts warn that such tariffs are likely to backfire, ultimately increasing costs for consumers and potentially harming US technology companies.

Read more »

Trump Threatens 100% Tariffs on Imported Computer Chips, Rattling Global Semiconductor IndustryPresident Trump's proposed tariffs on computer chips could lead to significant price increases for electronics in the US. The move is likely to impact companies worldwide, particularly Taiwan and South Korea, the leading producers of advanced semiconductors.

Trump Threatens 100% Tariffs on Imported Computer Chips, Rattling Global Semiconductor IndustryPresident Trump's proposed tariffs on computer chips could lead to significant price increases for electronics in the US. The move is likely to impact companies worldwide, particularly Taiwan and South Korea, the leading producers of advanced semiconductors.

Read more »

Trump's Tariffs on Mexico, Canada, and China May Ripple Across Global EconomyUS President Donald Trump announced new tariffs on goods imported from Mexico, Canada, and China, sparking concerns about potential economic fallout. While the UK won't face direct tariffs, the sanctions could have significant indirect impacts on its economy due to its close trade ties with the US.

Trump's Tariffs on Mexico, Canada, and China May Ripple Across Global EconomyUS President Donald Trump announced new tariffs on goods imported from Mexico, Canada, and China, sparking concerns about potential economic fallout. While the UK won't face direct tariffs, the sanctions could have significant indirect impacts on its economy due to its close trade ties with the US.

Read more »

Sahel Mining Crisis: Military Regimes Unleash 'Terrifying' Tactics on Global CompaniesMilitary coups and growing nationalistic sentiment in Mali, Niger, and Burkina Faso are forcing international mining companies to grapple with a volatile and unpredictable environment. These countries, rich in gold and uranium reserves, are rewriting mining laws, demanding higher taxes, and seizing assets from foreign companies.

Sahel Mining Crisis: Military Regimes Unleash 'Terrifying' Tactics on Global CompaniesMilitary coups and growing nationalistic sentiment in Mali, Niger, and Burkina Faso are forcing international mining companies to grapple with a volatile and unpredictable environment. These countries, rich in gold and uranium reserves, are rewriting mining laws, demanding higher taxes, and seizing assets from foreign companies.

Read more »

Trump's Mexican Tariffs: A Trade War or a Trade Shift?Donald Trump's renewed focus on tariffs against Mexico and Canada, despite a new trade deal with those countries, highlights the complexities of global trade and Trump's unique economic perspective. While tariffs on China were a defining part of his first term, the current shift in trade flows raises questions about the impact of these new tariffs and their potential to disrupt global supply chains.

Trump's Mexican Tariffs: A Trade War or a Trade Shift?Donald Trump's renewed focus on tariffs against Mexico and Canada, despite a new trade deal with those countries, highlights the complexities of global trade and Trump's unique economic perspective. While tariffs on China were a defining part of his first term, the current shift in trade flows raises questions about the impact of these new tariffs and their potential to disrupt global supply chains.

Read more »