USD/CAD extends losses for the second consecutive day, trading around 1.3780 during the early European session on Wednesday.

USD/CAD depreciates as commodity-linked CAD improves due to rising Oil prices. WTI Oil price edges higher due to supply threat amid escalated geopolitical tensions in the Middle East. The US Dollar may struggle due to dovish remarks from the Fed officials. The Canadian Dollar gains strength due to rising crude prices, as Canada is the largest Oil exporter to the United States. This increase in Oil prices puts pressure on the USD/CAD pair.

Other factors include market sentiment – whether investors are taking on more risky assets or seeking safe-havens – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar. How do the decisions of the Bank of Canada impact the Canadian Dollar? The Bank of Canada has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another.

Majors Macroeconomics Canada Oil

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

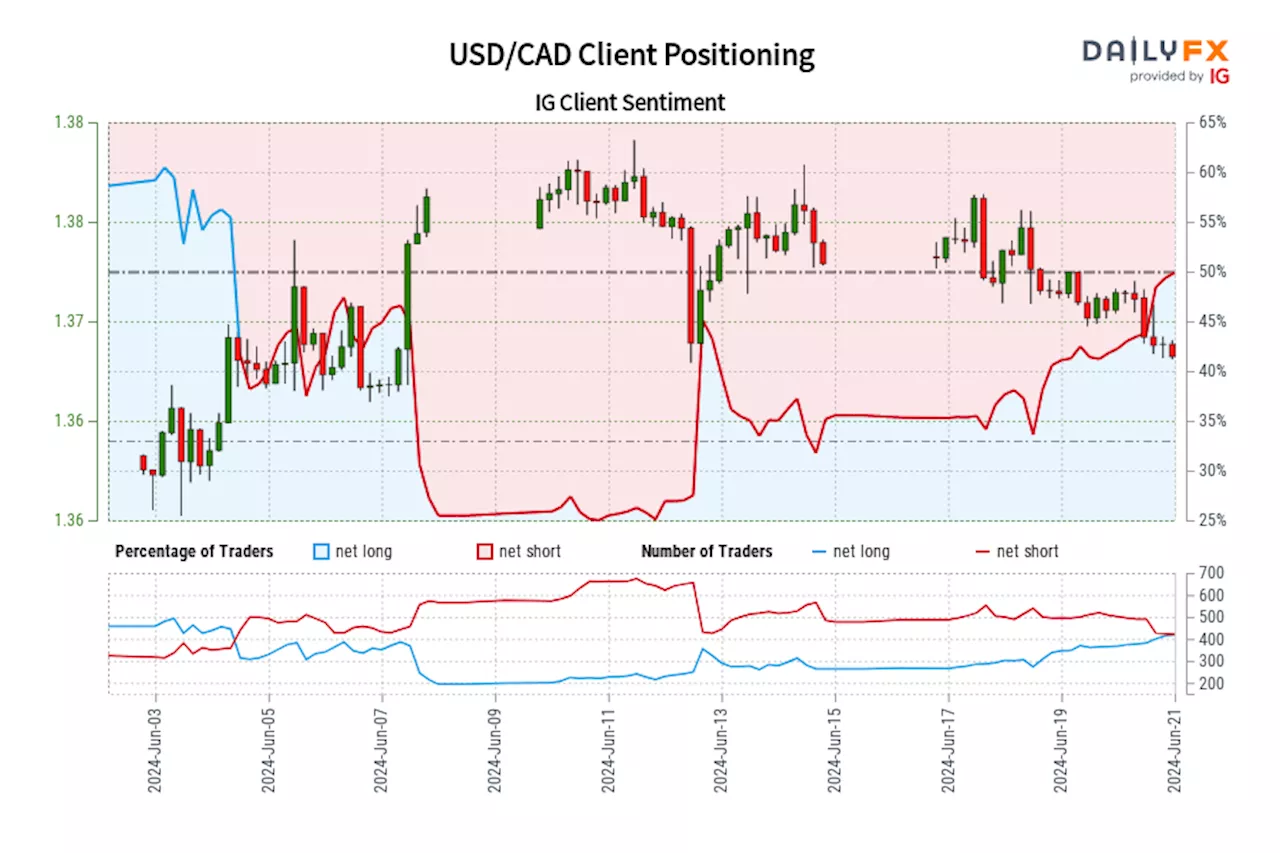

USD/CAD IG Client Sentiment: Our data shows traders are now net-long USD/CAD for the first time since Jun 04, 2024 when USD/CAD traded near 1.37.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/CAD-bearish contrarian trading bias.

USD/CAD IG Client Sentiment: Our data shows traders are now net-long USD/CAD for the first time since Jun 04, 2024 when USD/CAD traded near 1.37.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/CAD-bearish contrarian trading bias.

Read more »

USD/CAD appreciates to near 1.3750 due to lower Oil pricesUSD/CAD continues its winning streak for a third successive session, trading around 1.3760 during the European hours on Tuesday.

USD/CAD appreciates to near 1.3750 due to lower Oil pricesUSD/CAD continues its winning streak for a third successive session, trading around 1.3760 during the European hours on Tuesday.

Read more »

USD/CAD edges lower to near 1.3650 due to improved risk appetite, higher Oil pricesUSD/CAD retreats after two days of gains, trading around 1.3680 during the Asian session on Thursday.

USD/CAD edges lower to near 1.3650 due to improved risk appetite, higher Oil pricesUSD/CAD retreats after two days of gains, trading around 1.3680 during the Asian session on Thursday.

Read more »

USD/CAD Price Analysis: Threatening to break out of triangle price patternUSD/CAD is pushing up against the upper borderline of a large symmetrical triangle price pattern, threatening to break out to the upside.

USD/CAD Price Analysis: Threatening to break out of triangle price patternUSD/CAD is pushing up against the upper borderline of a large symmetrical triangle price pattern, threatening to break out to the upside.

Read more »

USD/CAD Price Analysis: Continues to face pressure near 1.3700The USD/CAD pair drops in an attempt to break decisively above the round-level resistance of 1.3700 in Thursday’s New York session.

USD/CAD Price Analysis: Continues to face pressure near 1.3700The USD/CAD pair drops in an attempt to break decisively above the round-level resistance of 1.3700 in Thursday’s New York session.

Read more »

USD/CAD Price Analysis: Backs down to 50-day SMA after Triangle breakoutUSD/CAD has continued pulling back after decisively breaking out of a Symmetrical Triangle (ST) pattern on the daily chart.

USD/CAD Price Analysis: Backs down to 50-day SMA after Triangle breakoutUSD/CAD has continued pulling back after decisively breaking out of a Symmetrical Triangle (ST) pattern on the daily chart.

Read more »