USD/CAD halts its recent losses, trading around 1.3690 during the Asian session on Friday.

USD/CAD rebounds as investors adopt caution ahead of US PCE on Friday. The decline in the US Treasury yields could limit the advance of the US Dollar. Canada ’s GDP Annualized is expected to expand by 2.2% in the first quarter. US Dollar rebounds ahead of the Federal Reserve's preferred inflation gauge, the Core Personal Consumption Expenditures Price Index, which will be released on Friday. US Gross Domestic Product Annualized growth rate was revised lower to 1.3% from 1.

In Canada, expectations for June rate cuts by the Bank of Canada have waned due to recent data indicating ongoing price pressures. In April, producer prices surged by 1.5% from the previous month, following a 0.9% increase in March, nearly doubling the anticipated 0.8% change. Interest rate futures now show that only 34% of the market is expecting a 25-basis point rate cut at the BoC’s June meeting, down from 46% a week ago.

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

USD/CAD finds interim support near 1.3600 as focus shifts to US core PCE Inflation dataThe USD/CAD pair finds a temporary cushion near the round-level support of 1.3600 in Tuesday’s New York session.

USD/CAD finds interim support near 1.3600 as focus shifts to US core PCE Inflation dataThe USD/CAD pair finds a temporary cushion near the round-level support of 1.3600 in Tuesday’s New York session.

Read more »

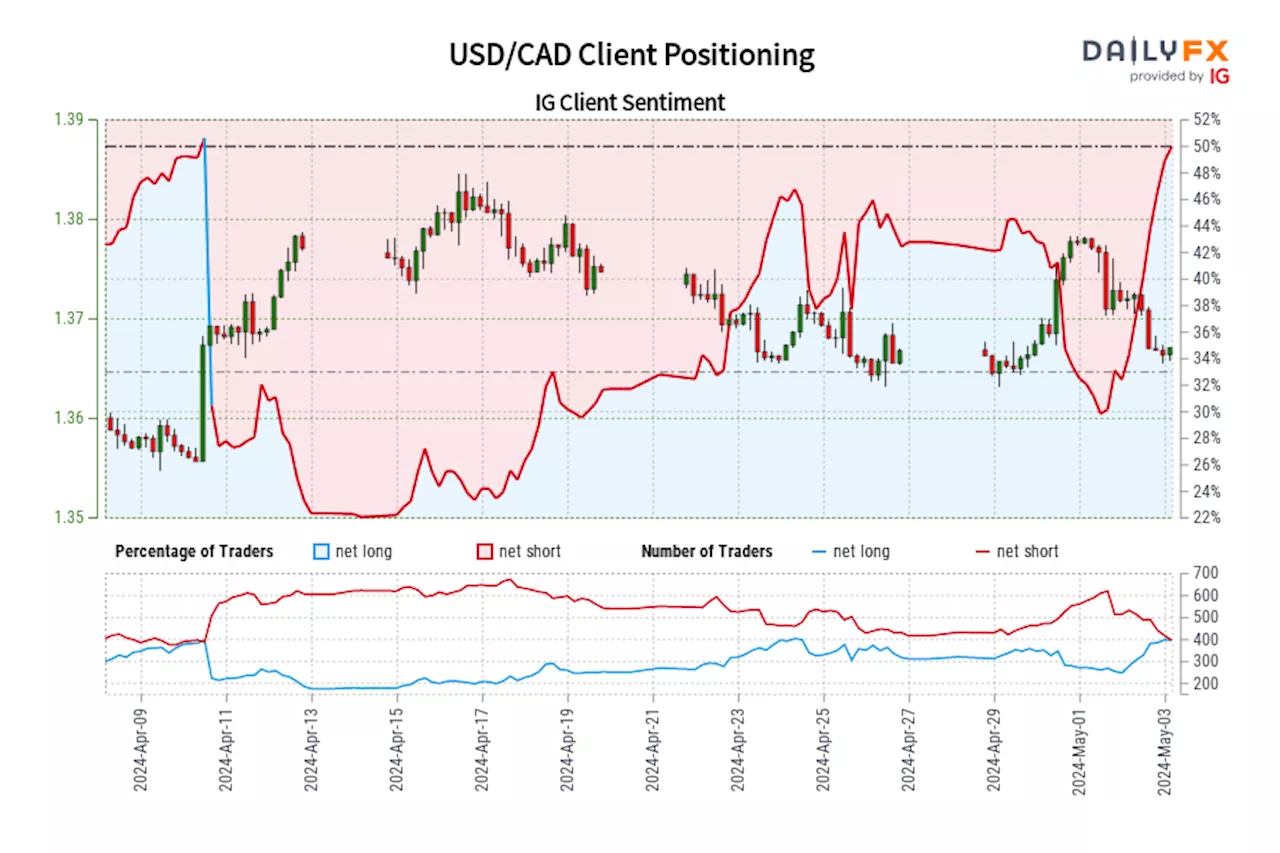

USD/CAD IG Client Sentiment: Our data shows traders are now net-long USD/CAD for the first time since Apr 10, 2024 when USD/CAD traded near 1.37.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/CAD-bearish contrarian trading bias.

USD/CAD IG Client Sentiment: Our data shows traders are now net-long USD/CAD for the first time since Apr 10, 2024 when USD/CAD traded near 1.37.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/CAD-bearish contrarian trading bias.

Read more »

USD/CAD rises to 1.3660 as US Dollar moves higher ahead of FOMC minutesThe USD/CAD pair moves higher to 1.3660 in Wednesday’s American session.

USD/CAD rises to 1.3660 as US Dollar moves higher ahead of FOMC minutesThe USD/CAD pair moves higher to 1.3660 in Wednesday’s American session.

Read more »

USD/CAD Price Analysis: Extends recovery to 1.3640The USD/CAD pair rises further to 1.3640 in Friday’s European session.

USD/CAD Price Analysis: Extends recovery to 1.3640The USD/CAD pair rises further to 1.3640 in Friday’s European session.

Read more »

USD/CAD rises to near 1.3750 due to the hawkish sentiment surrounding FedThe USD/CAD pair continues to advance for the second consecutive session, hovering around 1.3750 during the Asian trading hours on Wednesday.

USD/CAD rises to near 1.3750 due to the hawkish sentiment surrounding FedThe USD/CAD pair continues to advance for the second consecutive session, hovering around 1.3750 during the Asian trading hours on Wednesday.

Read more »

USD/CAD holds above 1.3650 ahead of US PPI dataThe USD/CAD pair trades on a stronger note around 1.3675 during the Asian session on Tuesday.

USD/CAD holds above 1.3650 ahead of US PPI dataThe USD/CAD pair trades on a stronger note around 1.3675 during the Asian session on Tuesday.

Read more »