For those who are concerned about today's news 👇

The Bank of England has raised interest rates further in what will be a blow to some borrowers in Northern Ireland, although others will see no immediate impact.

Helmut Elstner, managing director of The Mortgage Clinic, highlighted how the interest rate rise will impact mortgage borrowers in Northern Ireland, saying that those on fixed rate mortgages will notice no difference to their payments immediately but could see effects if their mortgage deal is due to expire in the coming months.

"Even though interest rates have been increased by the Bank of England, this does not mean that banks will start to offer worse deals for new fixed rate mortgages, because despite the BoE raising interest rates 12 times in a row, over the past six to seven months banks have actually being lowering their rates due to the high rate of competition within the market.

"However I do understand that while this may not seem like a large initial increase, there will be customers feeling the pressure as 12 consecutive small increases to the mortgage payments.

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

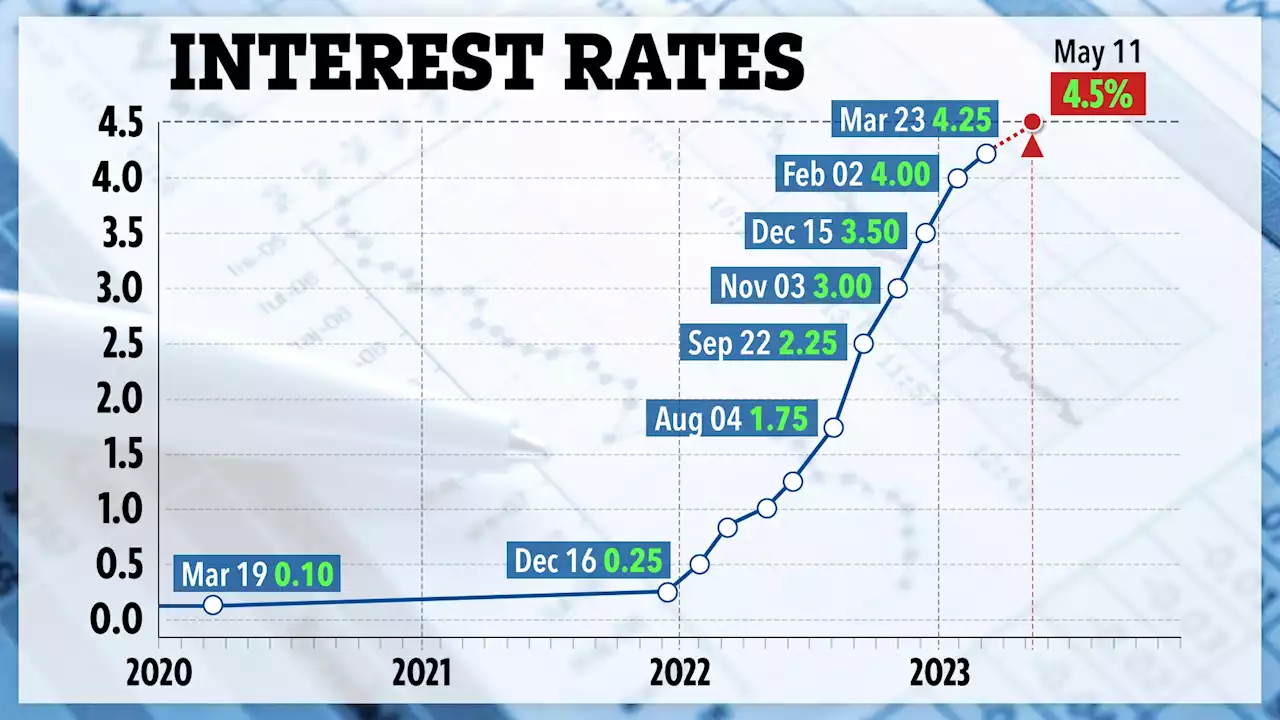

Interest Rates Just Climbed, Again. What Does That Mean For You?The Bank of England just increased it for the 12th time in a row.

Interest Rates Just Climbed, Again. What Does That Mean For You?The Bank of England just increased it for the 12th time in a row.

Read more »

Bank of England hikes interest rates to 4.5% - its highest level since 2008BREAKING: Britain’s interest rates have risen to 4.5%, the Bank of England's highest level since 2008.

Bank of England hikes interest rates to 4.5% - its highest level since 2008BREAKING: Britain’s interest rates have risen to 4.5%, the Bank of England's highest level since 2008.

Read more »

Mortgage warning for millions as Bank of England hikes interest rates AGAINMILLIONS of homeowners will face higher mortgage repayments after the Bank of England hiked interest rates again. The central bank’s base rate has increased from 4.25% to 4.5%. The rate is us…

Mortgage warning for millions as Bank of England hikes interest rates AGAINMILLIONS of homeowners will face higher mortgage repayments after the Bank of England hiked interest rates again. The central bank’s base rate has increased from 4.25% to 4.5%. The rate is us…

Read more »

Interest rates raised to 4.5% by Bank of England - Highest since 2008The Bank of England has raised interest rates to their highest levels in almost 15 years.

Interest rates raised to 4.5% by Bank of England - Highest since 2008The Bank of England has raised interest rates to their highest levels in almost 15 years.

Read more »

‘We will not change Bank of England’s inflation target’ Treasury ministers vowFinancial watchdogs facing benchmarks to keep City competitive amid claims of 'unaccountable' regulators

‘We will not change Bank of England’s inflation target’ Treasury ministers vowFinancial watchdogs facing benchmarks to keep City competitive amid claims of 'unaccountable' regulators

Read more »

What the Bank of England's interest rate announcement this week means for youEconomists are concerned that the Base Rate could rise to the same levels it was at during the 2008 financial crisis

What the Bank of England's interest rate announcement this week means for youEconomists are concerned that the Base Rate could rise to the same levels it was at during the 2008 financial crisis

Read more »