Customers at major banks including Barclays, Lloyds, Natwest and Halifax have been handed a major change

Major banks such as HSBC, Lloyds, Barclays, Natwest and Halifax are set to introduce a change that could improve high street access for their account holders and services.

Research by consumer magazine Which? revealed that over 6,000 branches have been closed since 2019, with 24 more closures already announced for 2025. Eight TSB branches, six Barclays, five Lloyds and five Halifax branches are due to close, reports the Express.Which? stated: "NatWest Group, which comprises NatWest, Royal Bank of Scotland and Ulster Bank, has closed 1,360 branches - the most of any banking group.

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Lloyds, Santander, Barclays make 'major' changes for millions this monthSome of these changes will impact current account and credit card holders, while some mortgage customers could also be affected

Lloyds, Santander, Barclays make 'major' changes for millions this monthSome of these changes will impact current account and credit card holders, while some mortgage customers could also be affected

Read more »

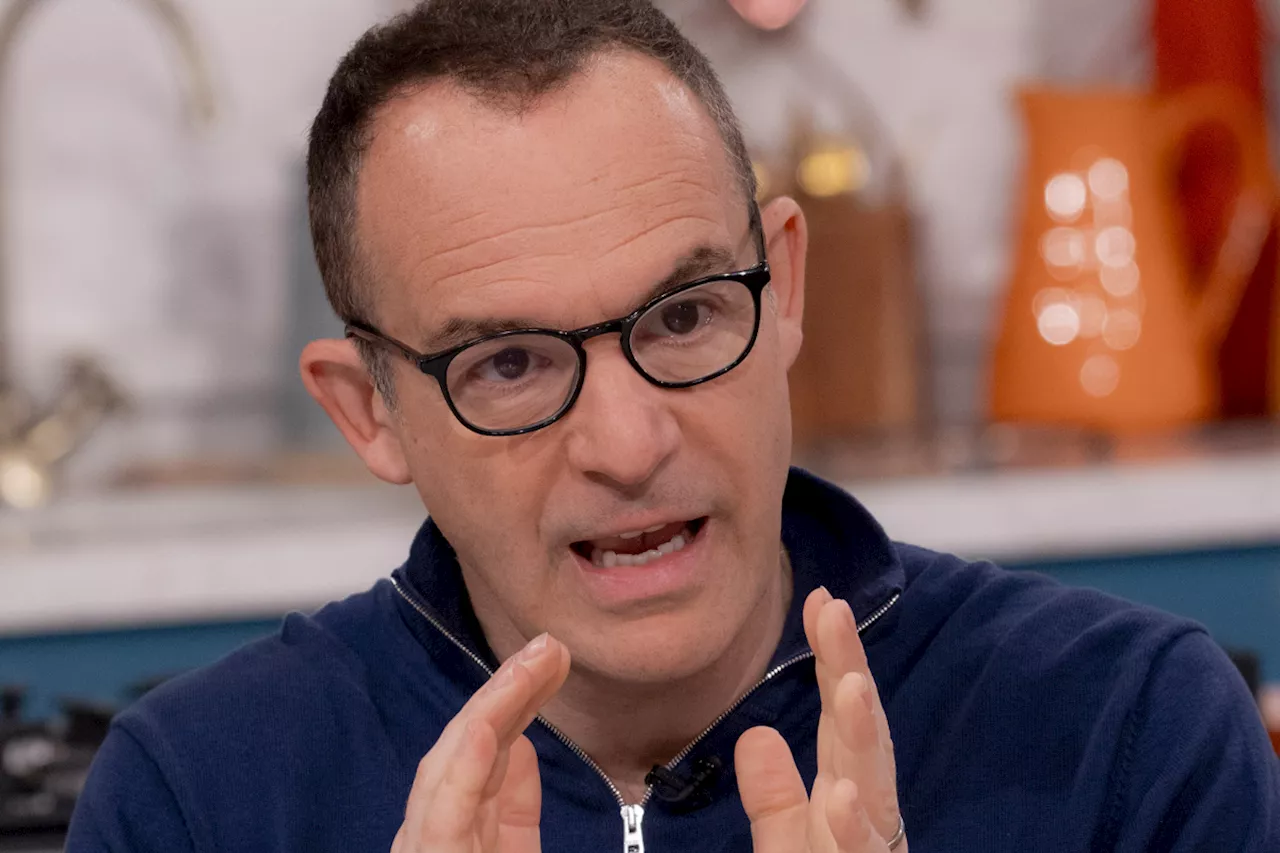

Martin Lewis issues warning to anyone with a Lloyds or Halifax accountThe Lloyds Banking Group, which owns all three brands, says most customers will be charged the same or less after the changes - but others will pay more

Martin Lewis issues warning to anyone with a Lloyds or Halifax accountThe Lloyds Banking Group, which owns all three brands, says most customers will be charged the same or less after the changes - but others will pay more

Read more »

Martin Lewis issues urgent warning to Halifax, Lloyds and Bank of Scotland customersCustomers could be charged more in fees for dipping into their overdraft due to new changes from Halifax, Lloyds and Bank of Scotland

Martin Lewis issues urgent warning to Halifax, Lloyds and Bank of Scotland customersCustomers could be charged more in fees for dipping into their overdraft due to new changes from Halifax, Lloyds and Bank of Scotland

Read more »

Two Lancashire Lloyds Bank and Halifax branches among 45 set to closeThe local branch closures will happen in October 2024

Two Lancashire Lloyds Bank and Halifax branches among 45 set to closeThe local branch closures will happen in October 2024

Read more »

Major bank changes from Barclays and Santander for mortgages and credit cardsCustomers at Barclays, Lloyds, Santander, Natwest, Nationwide and Metro will see changes to credit card and mortgage terms in the next month

Major bank changes from Barclays and Santander for mortgages and credit cardsCustomers at Barclays, Lloyds, Santander, Natwest, Nationwide and Metro will see changes to credit card and mortgage terms in the next month

Read more »

Major supermarket bank with 1.8million customers sold to NatWest – what it means for customers...Prompt: BANK SWITCHING PERKS https://www.thesun.co.

Major supermarket bank with 1.8million customers sold to NatWest – what it means for customers...Prompt: BANK SWITCHING PERKS https://www.thesun.co.

Read more »